Answered step by step

Verified Expert Solution

Question

1 Approved Answer

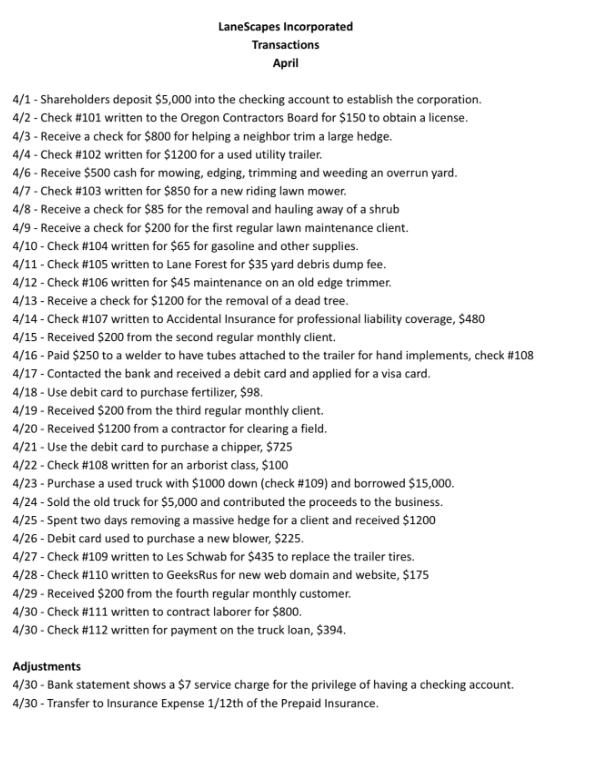

LaneScapes Incorporated Transactions April 4/1 - Shareholders deposit $5,000 into the checking account to establish the corporation. 4/2 - Check # 101 written to

LaneScapes Incorporated Transactions April 4/1 - Shareholders deposit $5,000 into the checking account to establish the corporation. 4/2 - Check # 101 written to the Oregon Contractors Board for $150 to obtain a license. 4/3 - Receive a check for $800 for helping a neighbor trim a large hedge. 4/4 - Check #102 written for $1200 for a used utility trailer. 4/6 - Receive $500 cash for mowing, edging, trimming and weeding an overrun yard. 4/7 - Check #103 written for $850 for a new riding lawn mower. 4/8 - Receive a check for $85 for the removal and hauling away of a shrub 4/9 - Receive a check for $200 for the first regular lawn maintenance client. 4/10 - Check #104 written for $65 for gasoline and other supplies. 4/11 - Check #105 written to Lane Forest for $35 yard debris dump fee. 4/12 - Check #106 written for $45 maintenance on an old edge trimmer. 4/13 - Receive a check for $1200 for the removal of a dead tree. 4/14 - Check #107 written to Accidental Insurance for professional liability coverage, $480 4/15 - Received $200 from the second regular monthly client. 4/16 - Paid $250 to a welder to have tubes attached to the trailer for hand implements, check #108 4/17 - Contacted the bank and received a debit card and applied for a visa card. 4/18 - Use debit card to purchase fertilizer, $98. 4/19 - Received $200 from the third regular monthly client. 4/20 - Received $1200 from a contractor for clearing a field. 4/21 - Use the debit card to purchase a chipper, $725 4/22 - Check # 108 written for an arborist class, $100 4/23-Purchase a used truck with $1000 down (check #109) and borrowed $15,000. 4/24 - Sold the old truck for $5,000 and contributed the proceeds to the business. 4/25 - Spent two days removing a massive hedge for a client and received $1200 4/26 - Debit card used to purchase a new blower, $225. 4/27 - Check # 109 written to Les Schwab for $435 to replace the trailer tires. 4/28 - Check #110 written to GeeksRus for new web domain and website, $175 4/29 - Received $200 from the fourth regular monthly customer. 4/30 - Check # 111 written to contract laborer for $800. 4/30 - Check # 112 written for payment on the truck loan, $394. Adjustments 4/30 - Bank statement shows a $7 service charge for the privilege of having a checking account. 4/30 - Transfer to Insurance Expense 1/12th of the Prepaid Insurance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started