Question

Langer Inc. is a German company with operations in Germany, Hungary and Poland. You have been given information on the breakdown of revenues and

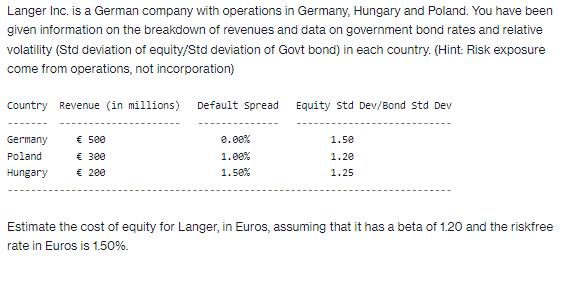

Langer Inc. is a German company with operations in Germany, Hungary and Poland. You have been given information on the breakdown of revenues and data on government bond rates and relative volatility (Std deviation of equity/Std deviation of Govt bond) in each country. (Hint: Risk exposure come from operations, not incorporation) Country Revenue (in millions) Germany Poland Hungary 500 300 200 Default Spread Equity Std Dev/Bond Std Dev 0.00% 1.00% 1.50% 1.50 1.20 1.25 Estimate the cost of equity for Langer, in Euros, assuming that it has a beta of 1.20 and the riskfree rate in Euros is 1.50%.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the cost of equity for Langer Inc we can use the Capital Asset Pricing Model CAPM formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App