Answered step by step

Verified Expert Solution

Question

1 Approved Answer

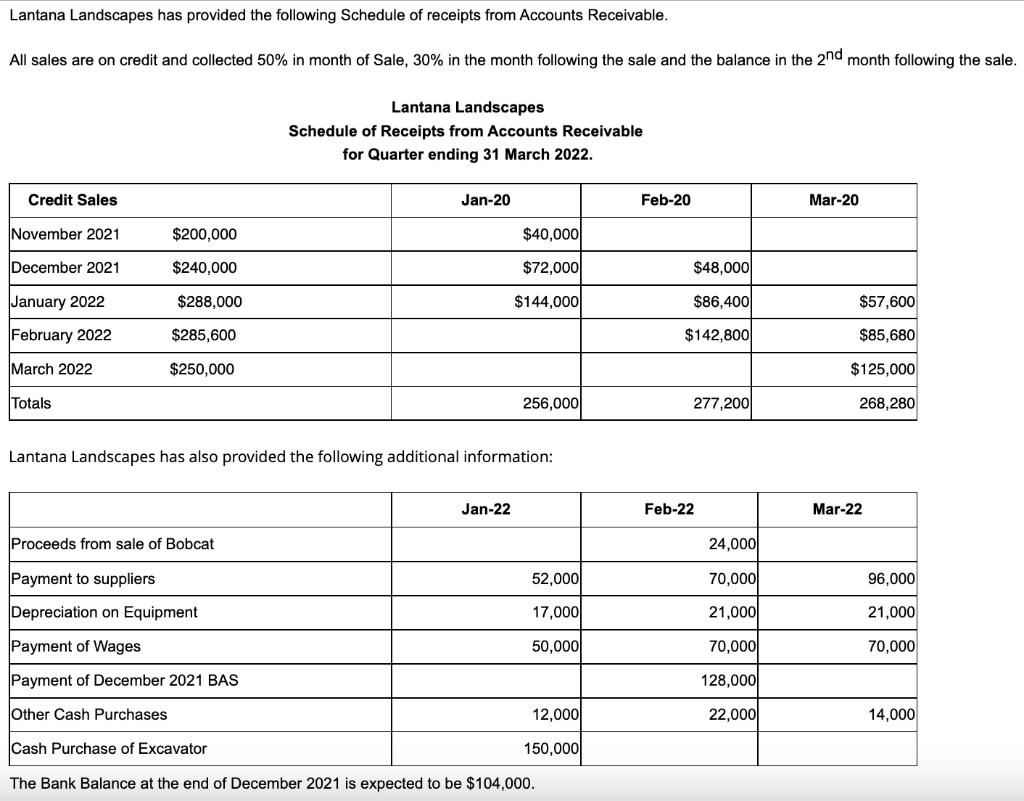

Lantana Landscapes has provided the following Schedule of receipts from Accounts Receivable. All sales are on credit and collected 50% in month of Sale,

Lantana Landscapes has provided the following Schedule of receipts from Accounts Receivable. All sales are on credit and collected 50% in month of Sale, 30% in the month following the sale and the balance in the 2nd month following the sale. Credit Sales November 2021 December 2021 January 2022 February 2022 March 2022 Totals $200,000 $240,000 $288,000 $285,600 $250,000 Lantana Landscapes Schedule of Receipts from Accounts Receivable for Quarter ending 31 March 2022. Jan-20 $40,000 $72,000 $144,000 Jan-22 256,000 Lantana Landscapes has also provided the following additional information: Proceeds from sale of Bobcat Payment to suppliers Depreciation on Equipment. Payment of Wages Payment of December 2021 BAS Other Cash Purchases Cash Purchase of Excavator The Bank Balance at the end of December 2021 is expected to be $104,000. 52,000 17,000 50,000 12,000 150,000 Feb-20 $48,000 $86,400 $142,800 277,200 Feb-22 24,000 70,000 21,000 70,000 128,000 22,000 Mar-20 $57,600 $85,680 $125,000 268,280 Mar-22 96,000 21,000 70,000 14,000 Required: Prepare a cash budget on a monthly basis for Lantana Landscapes for the quarter ending March 2022. (14 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A cash budget is a forecast of revenues and expenditures expected during a given period The purpose of preparing a cash budget is to determine the cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started