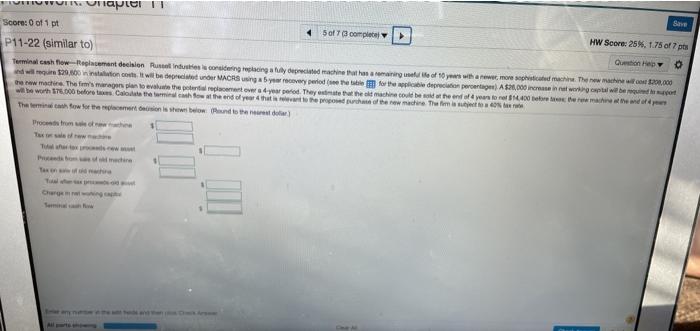

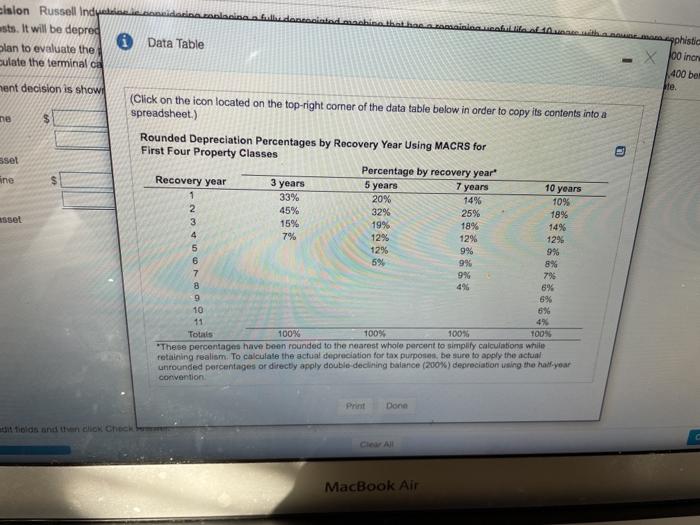

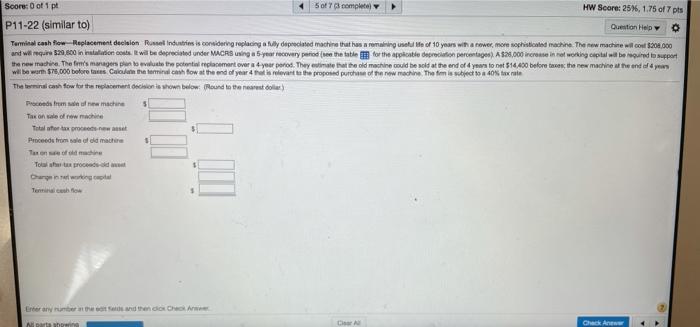

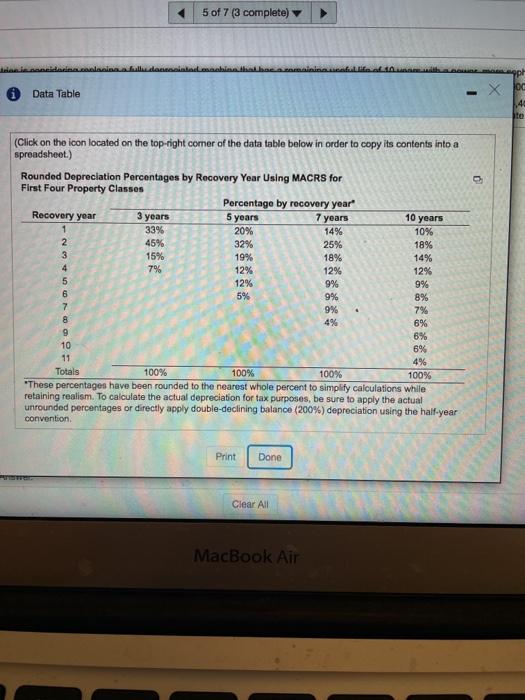

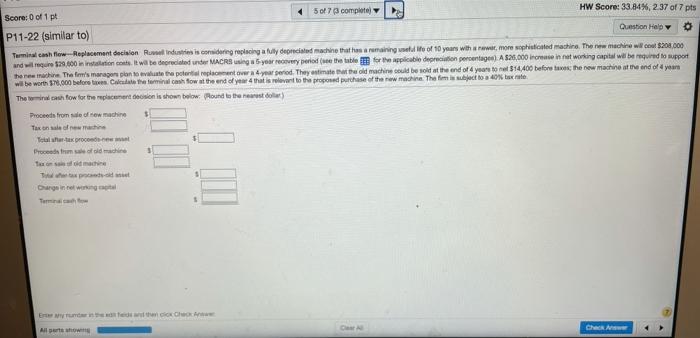

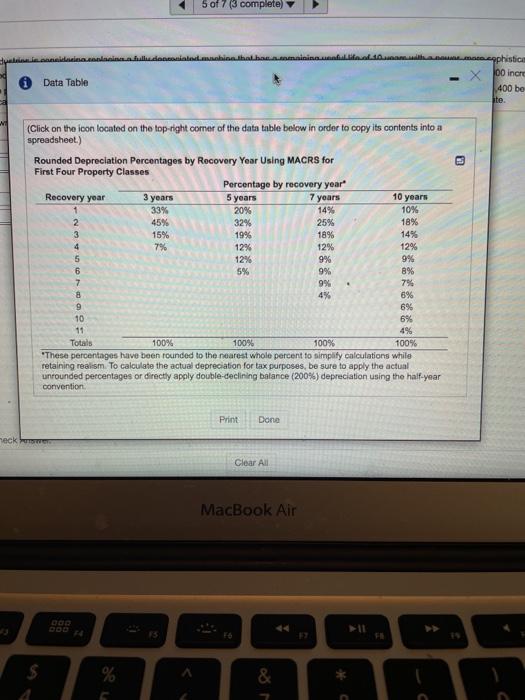

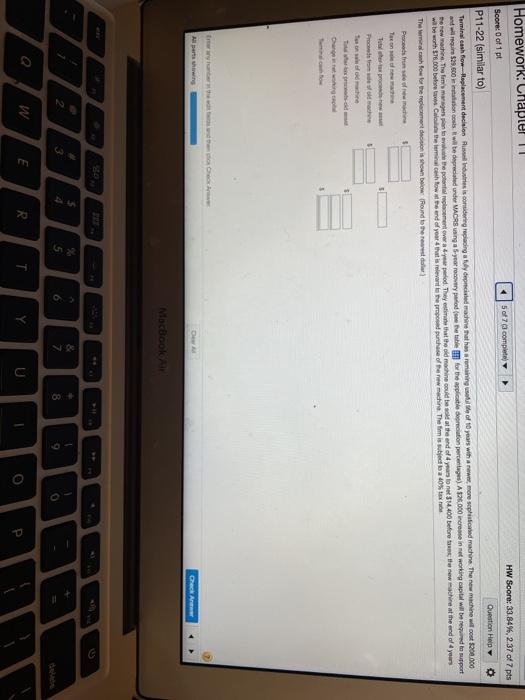

lapel Save Score: 0 of 1 pt 45 of complete HW Score: 25%, 1.75 of 7 po P11-22 (similar to) Terminal cash flow-glacement decision industries scoring in deprecated methasone of 10 years with more cated machine. The new .00 de $2.500 ton. It wil begren MACRS ingay very period for the curreret AS26,000 sehat we plebem the www machine. The firm's muragars plan to evaluate the problemet water period. They set the machine could be at the end of years toner. Der er mannend will be waith 17.00 before all the more the end of what we had the new are the form The terminoworth mention is the below and to the data mashine that has ision Russell Indah asts. It will be depre 0 Data Table plan to evaluate the culate the terminal ca mphistic X 0 inch 400 ber He ment decision is shown ne sset ine 5 years asset (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 7 years 10 years 1 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 129 5 12% 9% 9% 6 5% 9% 8% 7 9% 796 8 696 9 6% 10 6% 11 4% Totais 100% 100% 100% TOON "These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double declining balance (200%) depreciation using the half year convention Done it finds and to Check MacBook Air Question Help Score: 0 of 1 pt 5 of completely HW Score: 25%, 1.75 of 7 pts P11-22 (similar to) Terminal cash flow Replacement decision Russel Industries is considering replacing a ruly deprecated machine that has a remaining unetul le of 10 years with a newer, more sophisticated machine. The new machine wil.com 5208.000 and we are 520.800 in natulations will be depreciated under MACRS uning a 5-year recovery period on the table for the applicatie depreciation percentages). A$28,000 increase in networking capital beregned to support the new machina. Trofors manager in toate the potential replacement over at your poros. They entrate that the old machine could be sold at the end of 4 years to net 514 400 bolore teen, the new machine at the endda will be worn $75,000 bolores Chich fow at the end of years olevate the proposed purchase of the new machine. The firm is object to 40%. The show for the replacement on hown below: Round to the rest of Proceeds from new machine Tax on sale of new machine Total for tax pret Proceeds from sale of a mother 3 Tool to proceso Charge wrong Tech Erbrand then Nigar C Check Aw 5 of 7 (3 complete) cool * Data Table 4E to (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 8 4% 6% 9 8% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention 7% Print Done Clear All MacBook Air Score: 0 of 1 pt 5 of 7 completo) HW Score: 33.84% 237 of 7 pts P11-22 (similar to) Question Help O Terminal cash flow --Replacement decision industries is coming replacing a fully deprecated machine that has a running wife of 10 years wth rawat, more posted machine. The new machine wilco 20,000 and wil gure $29.600 in installation cost wa be decided under MACRS in your recovery period the table for the applicable depreciation percentage). A $25,000 increase in not working capital will be required to support the new machine The fe's margen plan to evaluate the poter replacement a year period. They estimate that the old machine could be sold at the end of 4 years to net 14.400 before to the new machine at the end of year will be worth 170.000 before the terminal canh tow at the end of year that is relevant to the proposed phase of the raw machine. The firm subject to a 40% texte The show for the replacement son is shown below found to the newestor) Proceeds from sofrowmachine Taxonoma Torta proce Proceeds from o of old machine 3 Tamachine Dagine wengi All town Chew 5 of 7 (3 complete) Data Table werphistice Xbo inere 400 be ite. - NE 10 years (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been founded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention . Print Done meck Clear All MacBook Air DOB $ & Homework! Chapter HW Score: 33.84%. 2.37 of 7 pts 5 of 73 complete Score: 0 of 1 pt P11-22 (similar to) Question Help Terminal cash flow-Fleplacement decision Rines is considering replacing a fully decoracine that has remaining setter of 10 years with a new, more sophisticated machine. The new machine will cost $200.000 and wil gure 529,600 inosis. It will be depreciated under MACRS inga 5-year recovery period the title for the applicatie depreciation percentages). A $26.000 increase in networking capital will be required to support De rewrath The image to the poll replacement way period. They that the old machine could be sold at the end of stone $4.400 before the machine at the end of 4 years will be worth 1.000 b Clothelial cashow the end of your that is relevant to the propond purchase of the machine. The firm is subject to a 40% The serial for the medicamente is shown below found to the solar Process of the Toto proceso Teh D Check An MacBook 3 5 7 8 9 W E R. Y