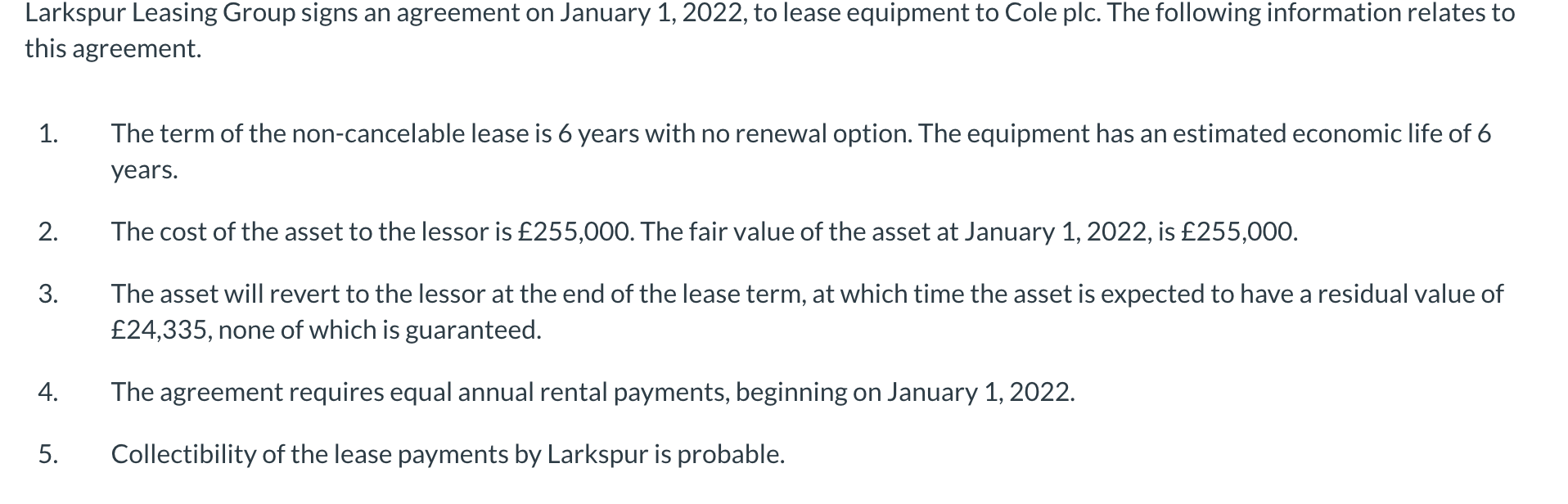

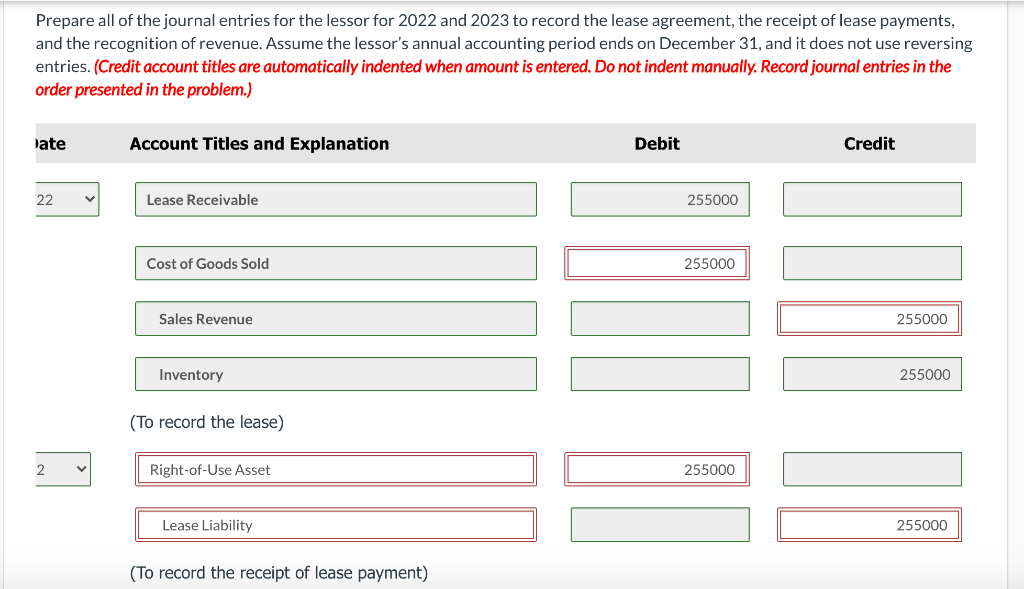

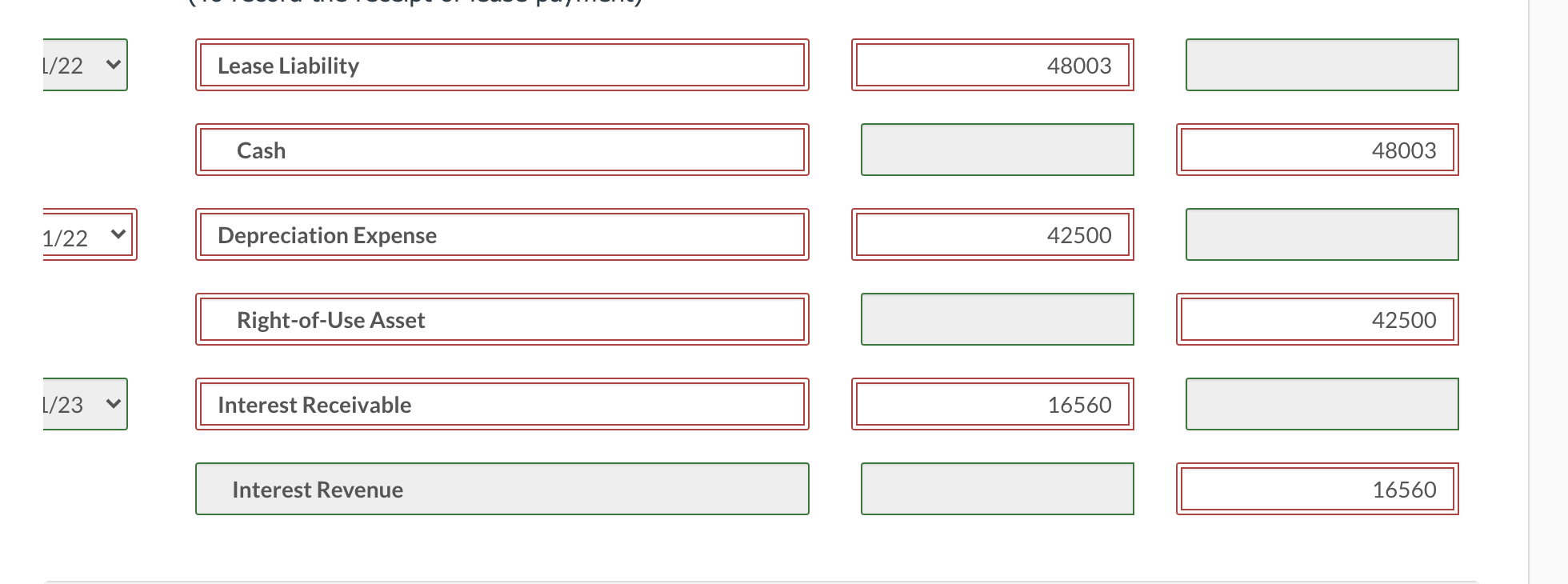

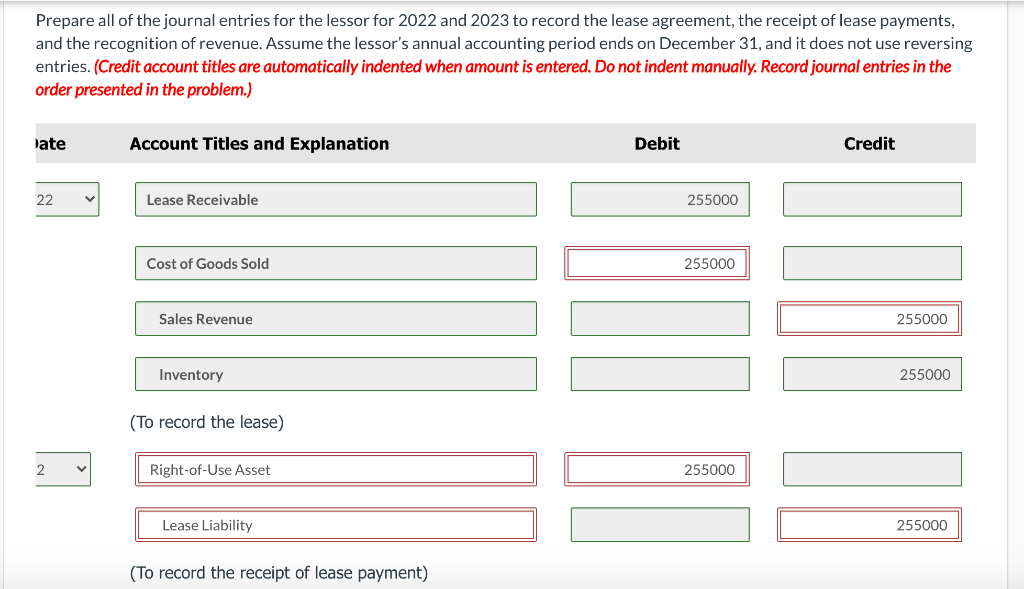

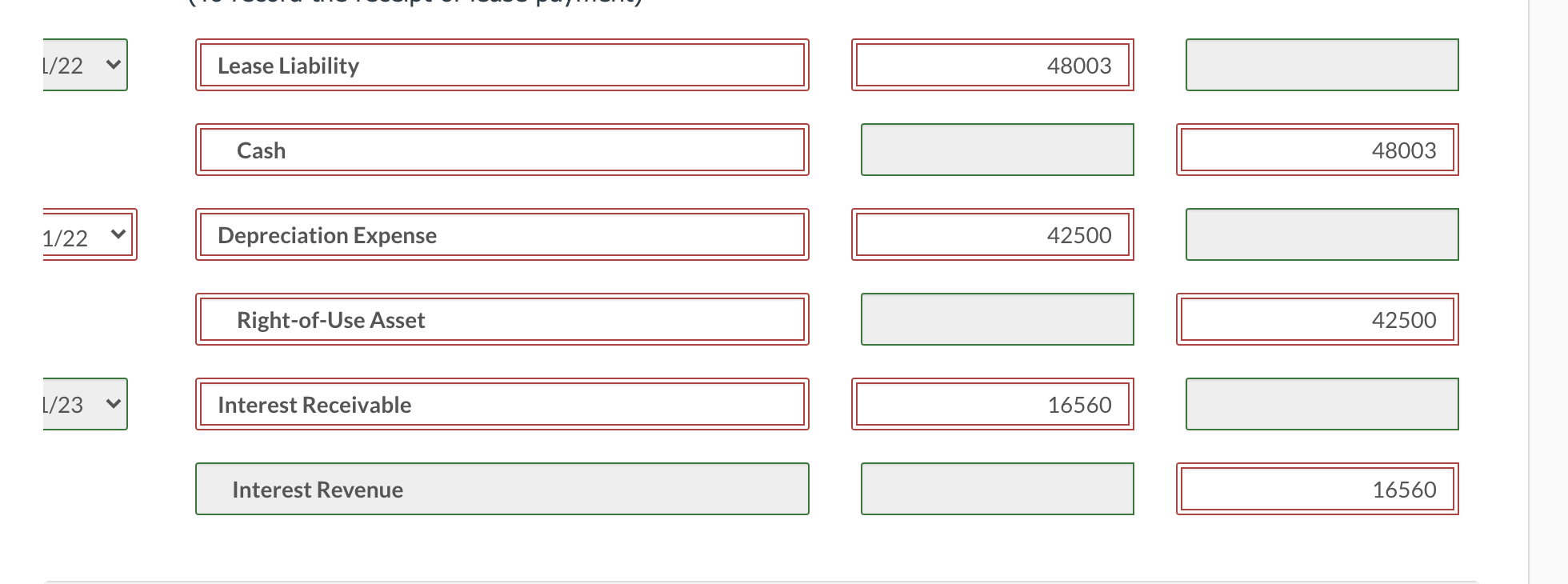

Larkspur Leasing Group signs an agreement on January 1, 2022, to lease equipment to Cole plc. The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. 2. The cost of the asset to the lessor is 255,000. The fair value of the asset at January 1, 2022, is 255,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of 24,335, none of which is guaranteed. 4. The agreement requires equal annual rental payments, beginning on January 1, 2022. 5. Collectibility of the lease payments by Larkspur is probable. Prepare all of the journal entries for the lessor for 2022 and 2023 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) late Account Titles and Explanation Debit Credit 22 Lease Receivable 255000 Cost of Goods Sold 255000 Sales Revenue 255000 Inventory 255000 (To record the lease) Right-of-Use Asset 255000 Lease Liability 255000 (To record the receipt of lease payment) [/22 Lease Liability 48003 Cash 48003 1/22 v Depreciation Expense 42500 Right-of-Use Asset 42500 [/23 > Interest Receivable 16560 Interest Revenue 16560 Larkspur Leasing Group signs an agreement on January 1, 2022, to lease equipment to Cole plc. The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. 2. The cost of the asset to the lessor is 255,000. The fair value of the asset at January 1, 2022, is 255,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of 24,335, none of which is guaranteed. 4. The agreement requires equal annual rental payments, beginning on January 1, 2022. 5. Collectibility of the lease payments by Larkspur is probable. Prepare all of the journal entries for the lessor for 2022 and 2023 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) late Account Titles and Explanation Debit Credit 22 Lease Receivable 255000 Cost of Goods Sold 255000 Sales Revenue 255000 Inventory 255000 (To record the lease) Right-of-Use Asset 255000 Lease Liability 255000 (To record the receipt of lease payment) [/22 Lease Liability 48003 Cash 48003 1/22 v Depreciation Expense 42500 Right-of-Use Asset 42500 [/23 > Interest Receivable 16560 Interest Revenue 16560