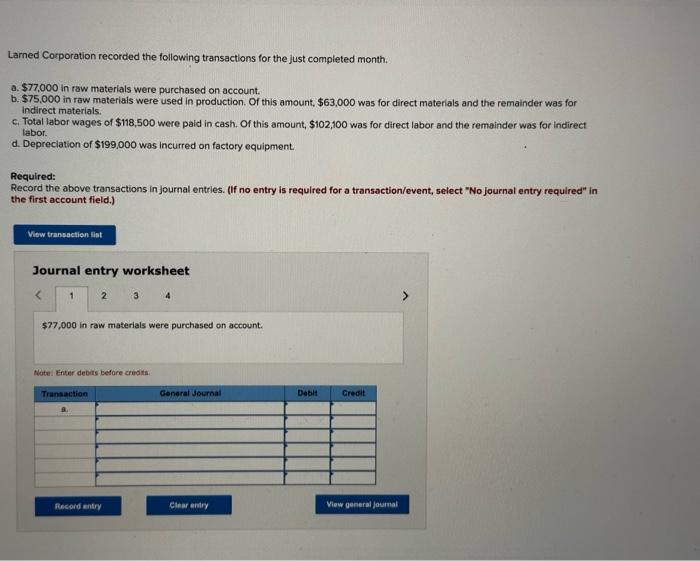

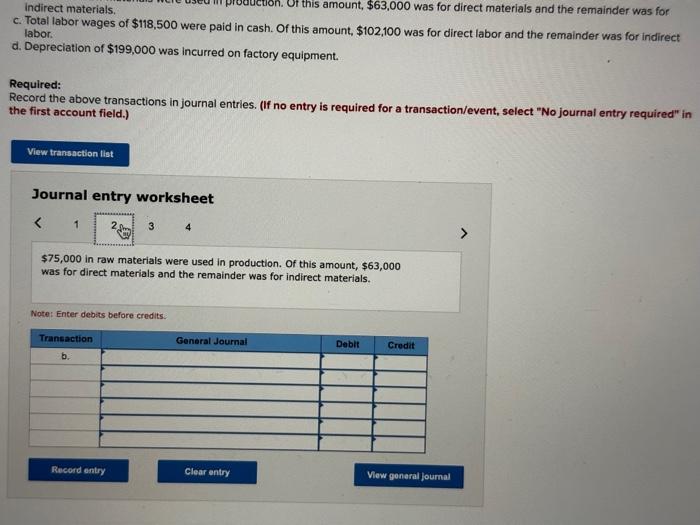

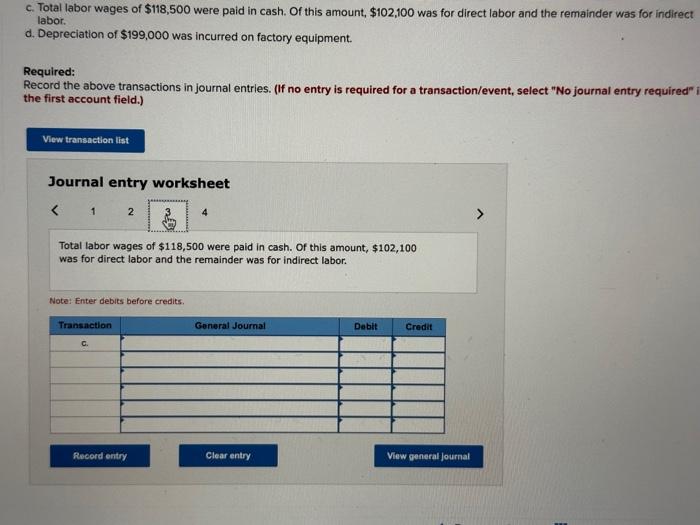

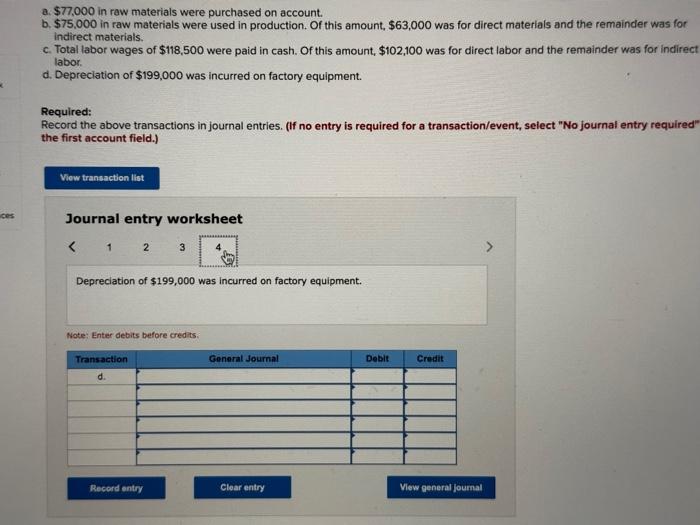

Larned Corporation recorded the following transactions for the just completed month. a. \$77,000 in raw materials were purchased on account. b. $75,000 in raw materials were used in production. Of this amount, $63,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $118,500 were paid in cash. Of this amount, $102,100 was for direct labor and the remainder was for indirect labor. d. Depreciation of $199,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet $77,000 in raw materials were purchased on account. Wote. Enter debits before crenditl. indirect materials. c. Total labor wages of $118,500 were paid in cash. Of this amount, $102,100 was for direct labor and the remainder was for indirect labor. d. Depreciation of $199,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet $75,000 in raw materials were used in production. Of this amount, $63,000 was for direct materials and the remainder was for indirect materials. Note: Enter debits before credits: c. Total labor wages of $118,500 were paid in cash. Of this amount, $102,100 was for direct labor and the remainder was for indirect labor. d. Depreciation of $199,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" the first account field.) Journal entry worksheet Total labor wages of $118,500 were paid in cash. Of this amount, $102,100 was for direct labor and the remainder was for indirect labor. Note: Enter debits before credits. a. $77.000 in raw materials were purchased on account. b. $75.000 in raw materials were used in production. Of this amount, $63,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $118,500 were paid in cash. Of this amount, $102,100 was for direct labor and the remainder was for indirect labor. d. Depreciation of $199,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" the first account field.) Journal entry worksheet Depreciation of $199,000 was incurred on factory equipment. Note: Enter debits before credits