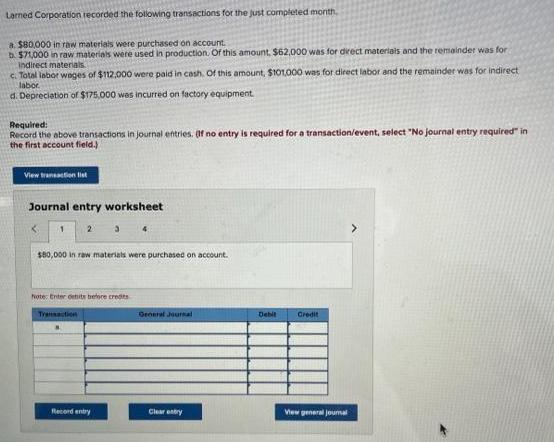

Larned Corporation recorded the following transactions for the just completed month. a $80,000 in raw materials were purchased on account. b. $71,000 in raw

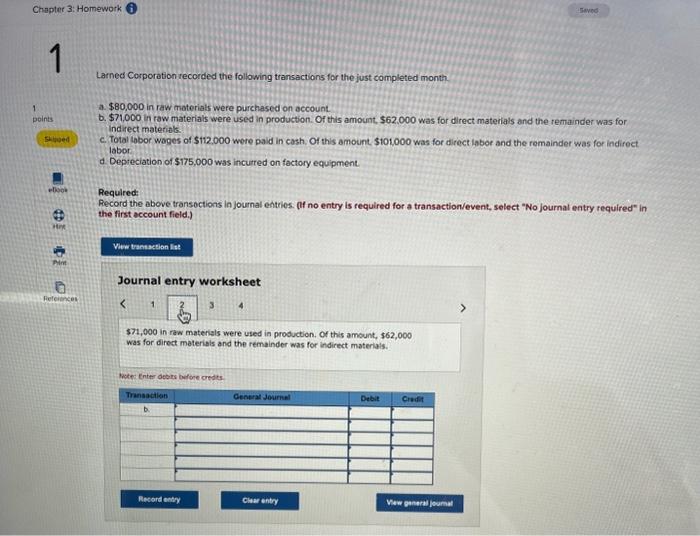

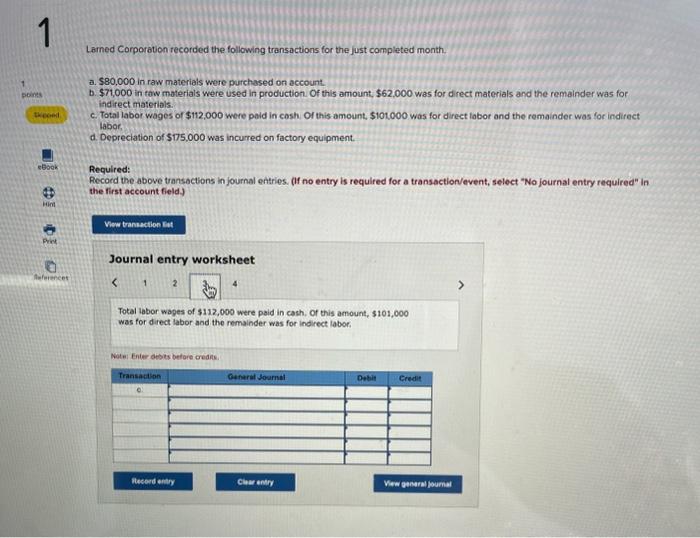

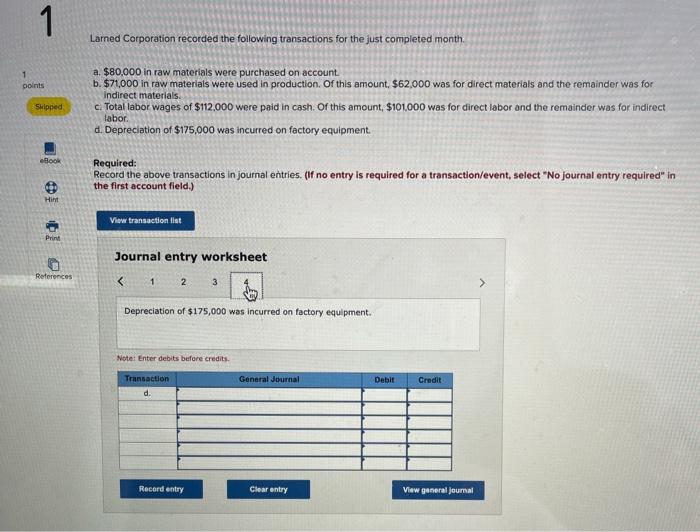

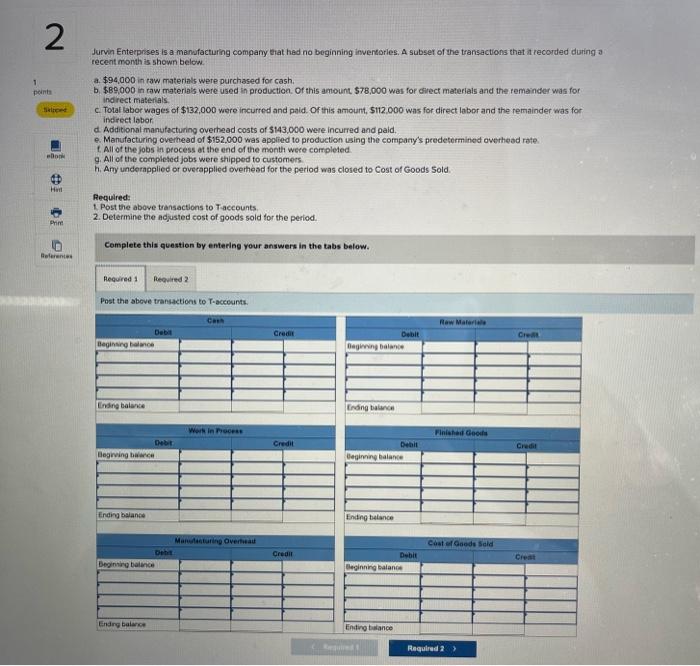

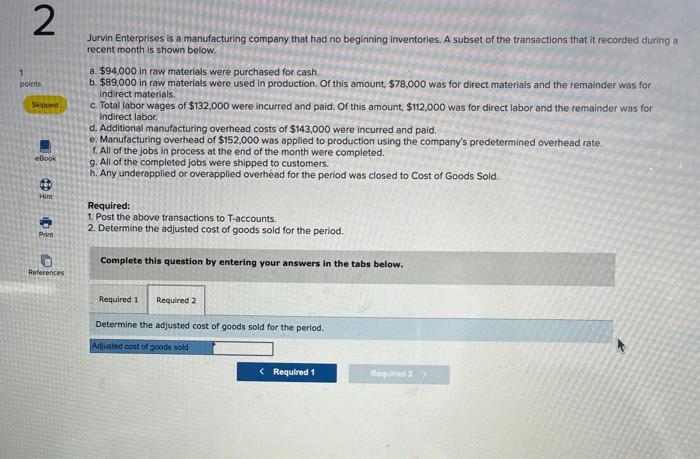

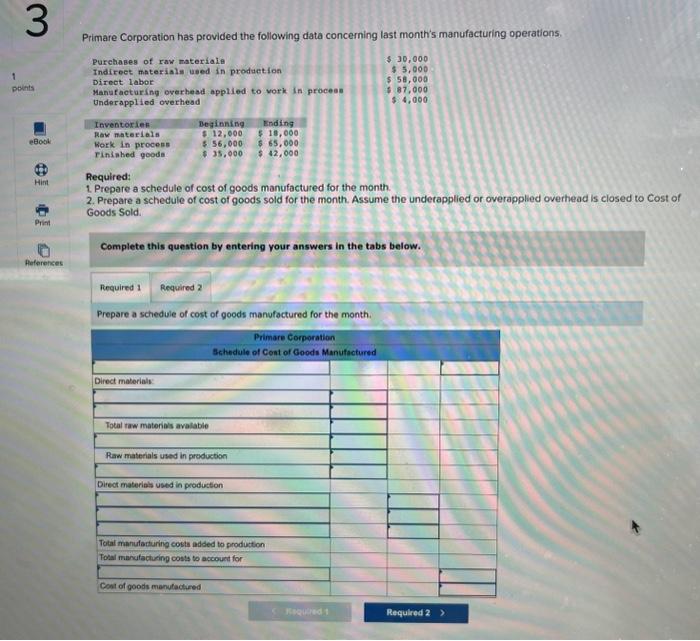

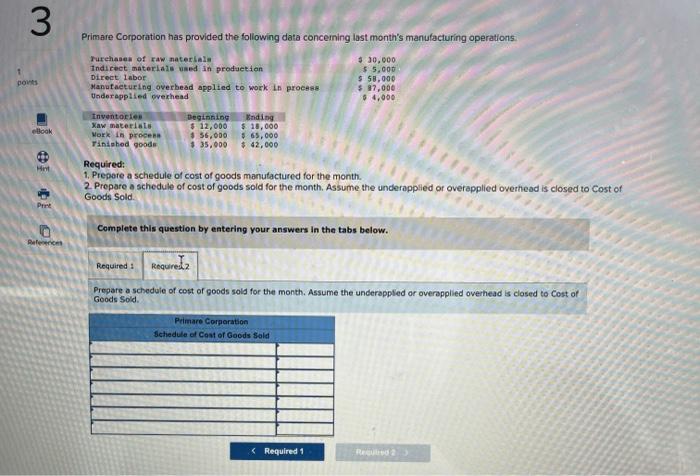

Larned Corporation recorded the following transactions for the just completed month. a $80,000 in raw materials were purchased on account. b. $71,000 in raw materials were used in production. Of this amount, $62,000 was for direct materials and the remainder was for indirect materials c. Total labor wages of $112.000 were paid in cash. Of labor d. Depreciation of $175,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. Of no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 2 3 1 $80,000 in raw materials were purchased on account. Note: Enter detits before credits Transaction N Record entry this amount, $101,000 was for direct labor and the remainder was for indirect General Journal Clear entry Debit Credit View general joumal Chapter 3: Homework 1 points Skboed HIM P References Larned Corporation recorded the following transactions for the just completed month a. $80,000 in raw materials were purchased on account. b. $71,000 in raw materials were used in production. Of this amount, $62,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $112.000 were paid in cash. Of this amount $101,000 was for direct labor and the remainder was for indirect labor d. Depreciation of $175,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 3 $71,000 in raw materials were used in production. Of this amount, $62,000 was for direct materials and the remainder was for indirect materials. Note: Enter debits before credits Transaction b Record entry 4 General Journal Seved Clear entry Debit Credit View general journal 1 points Skood eBook 10 Priet References Larned Corporation recorded the following transactions for the just completed month. a. $80,000 in raw materials were purchased on account. b. $71,000 in raw materials were used in production. Of this amount, $62,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $112.000 were paid in cash. Of this amount, $101.000 was for direct labor and the remainder was for indirect labor d. Depreciation of $175,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction t Journal entry worksheet < 1 2 Total labor wages of $112,000 were paid in cash. Of this amount, $101,000 was for direct labor and the remainder was for indirect labor. Note: Enter debits before credits. Transaction 0 4 Record entry General Journal Clear entry Debit Credit View general journal 1 points Skipped ellook Hint Print References Larned Corporation recorded the following transactions for the just completed month. a. $80,000 in raw materials were purchased on account. b. $71,000 in raw materials were used in production. Of this amount, $62,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $112,000 were paid in cash. Of this amount, $101,000 was for direct labor and the remainder was for indirect labor. d. Depreciation of $175,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 Depreciation of $175,000 was incurred on factory equipment. Note: Enter debits before credits. Transaction d. Record entry General Journal Clear entry Debit Credit View general journal 2 Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. 1 points Saliped ebook 4 Hin Prim References a. $94,000 in raw materials were purchased for cash. b. $89,000 in raw materials were used in production. Of this amount $78,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $132,000 were incurred and paid. Of this amount, $112.000 was for direct labor and the remainder was for indirect labor d. Additional manufacturing overhead costs of $143,000 were incurred and paid. e Manufacturing overhead of $152,000 was applied to production using the company's predetermined overhead rate f. All of the jobs in process at the end of the month were completed. g. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post the above transactions to T-accounts. Beginning balance Ending balance Beginning balance Ending balance Debit Ending balance Debit Debit Beginning balance Cash Work in Process Manufacturing Overhead Credit Credit Credit Beginning balance Ending balance Ending belance Debit Beginning balance Ending balance Debit Required 1 Beginning balance Debit Raw Materials Finished Goods Cost of Goods Sold Required 2 > Credit Credit Creat 2 Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. points Skopped eBook Hint Print References a. $94,000 in raw materials were purchased for cash. b. $89,000 in raw materials were used in production. Of this amount, $78,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for indirect labor. d. Additional manufacturing overhead costs of $143,000 were incurred and paid. e. Manufacturing overhead of $152,000 was applied to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. g. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the adjusted cost of goods sold for the period. Adjusted cost of goods sold < Required 1 Required 2 > 3 1 points eBook Hint Print References Primare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materiale Indirect materials used in production $ 30,000 $5,000 $ 58,000 $87,000 Direct labor $4,000 Manufacturing overhead applied to work in process Underapplied overhead Inventories Raw materials Work in process rinished goods Beginning $ 12,000 Ending $18,000 $56,000 $ 65,000 $35,000 $ 42,000 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Direct materials Required 1 Required 2 Prepare a schedule of cost of goods manufactured for the month. Primare Corporation Schedule of Cost of Goods Manufactured Total raw materials available Raw materials used in production Direct materials used in production Total manufacturing costs added to production Total manufacturing costs to account for Cost of goods manufactured Required 2 > 3 povts eBook Hot Pret References Primare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materials Indirect materials used in production Direct labor Manufacturing overhead applied to work in process Underapplied overhead Inventories Xaw materials Work in proces Finished goods Deginning Ending $ 12,000 $ 18,000 $56,000$ 65,000 $ 35,000 $ 42,000 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold $ 30,000 $ 5,000 $ 58,000 $ 87,000 $ 4,000 Complete this question by entering your answers in the tabs below. Required: Require Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Primare Corporation Schedule of Cost of Goods Sold < Required 1 Required 2 4 Osborn Manufacturing uses a predetermined overhead rate of $18.20 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $218,400 of total manufacturing overhead for an estimated activity level of 12.000 direct labor-hours. The company actually incurred $215,000 of manufacturing overhead and 11,500 direct labor-hours during the period. points +Book Hare Prim D References Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 1. Manufacturing overhead 2. The gross margin would by by 5 1 points eBook Hint Print References The Polaris Company uses a job-order costing system. The following transactions occurred in October. a. Raw materials purchased on account, $210,000. b. Raw materials used in production, $190,000 ($178,000 direct materials and $12,000 indirect materials). c. Accrued direct labor cost of $90,000 and indirect labor cost of $110,000. d. Depreciation recorded on factory equipment, $40,000. e. Other manufacturing overhead costs accrued during October, $70,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $8 per machine-hour. A total of 30,000 machine-hours were used in October, g. Jobs costing $520,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $480,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 25% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $42,000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the transactions given above. (If no entry is required for a transaction/event, select "No journal entry. required in the first account field.) View transaction list Journal entry worksheet < 2 Transaction a. 3 Note: Enter debits before credits. Raw materials purchased on account, $210,000. Record entry 5 General Journal 6 Clear entry 7 8 Debit 9 Credit View general journal 5 1 points Book Hint References The Polaris Company uses a job-order costing system. The following transactions occurred in October: a. Raw materials purchased on account, $210,000, b. Raw materials used in production, $190,000 ($178,000 direct materials and $12,000 indirect materials). c. Accrued direct labor cost of $90,000 and indirect labor cost of $110,000. d. Depreciation recorded on factory equipment, $40,000. e. Other manufacturing overhead costs accrued during October, $70,000 f. The company applies manufacturing overhead cost to production using a predetermined rate of $8 per machine-hour. A total of 30,000 machine-hours were used in October. g. Jobs costing $520,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $480,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 25% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $42,000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare T-accounts for Manufacturing Overhead and Work in Pcess. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $42,000. Manufacturing Overhead Debit Beginning balance Ending balance. Credit Beginning balance Ending balance Debit < Required 1 Work in Process Required 2 Credit 6 1 points eBook MANEKENKA Hint Print References The following data from the just completed year are taken from the accounting records of Mason Company: $524,000 $ 70,000 $118,000 $140,000 $ 63,000 $90,000 $ 80,000 Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventorien Raw materials Work in process Finished goods Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. Ending Beginning $ 7,000 $ 10,000 $ 15,000 $5,000 $ 20,000 $ 35,000 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. Direct materials: Mason Company Schedule of Cost of Goods Manufactured Total raw materials available. Direct materials used in production Total manufacturing costs added to production Total manufacturing costs to account for Cost of goods manufactured Required 1 Required 2 > 6 1 points eBook Hint Print References The following data from the just completed year are taken from the accounting records of Mason Company: $ 524,000 $ 70,000 $ 118,000 $ 140,000 $ 63,000 $90,000 $ 80,000 Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costa Inventories Raw materials Work in process Finished goods Beginning $7,000 $10,000 Ending $ 15,000 $5,000 $ 20,000 $ 35,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Required 3 Mason Company Schedule of Cost of Goods Sold < Required 1 Required 3 > Chapter 3: Homework 1 j 6 af # 10 10 H P Me Sw The following data from the just completed year are taken from the accounting records of Mason Company al But later 324,000 $70,000 210,000 140,000 4:43,000 190,000 $40,000 ial purchases pen ellig Aditive expenses antarturl when applied to work in process Austacturing overhead costa Inventories Rav materiale Werk in pro Fished good beginning 1,000 30,000 20,000 Required 1 Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials 2. Prepare a schedule of cost of goods sold Assume that the company's underapplied or overappled overhead is closed to cost of Goods Sold 3. Prepare an income statement Kegel1 Required 2 Ending Complete this question by entering your answers in the tabs below. 15.000 $3.000 25,000 Prepare an income statement Read 3 Selling and adverse Compr malement Required 2 < Prev Gurm Next >

Step by Step Solution

3.46 Rating (162 Votes )

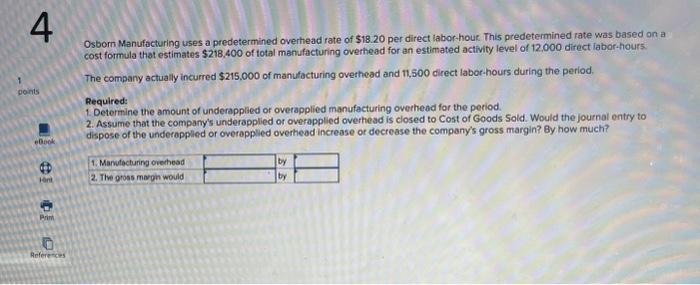

There are 3 Steps involved in it

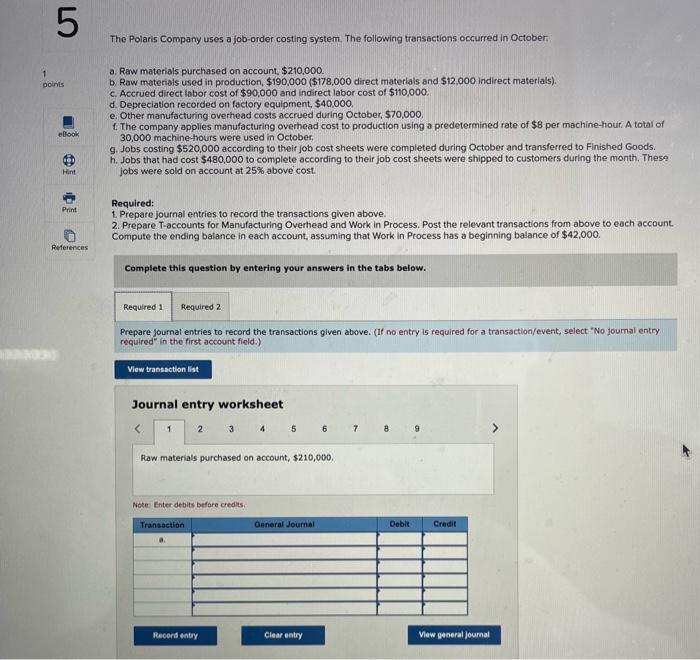

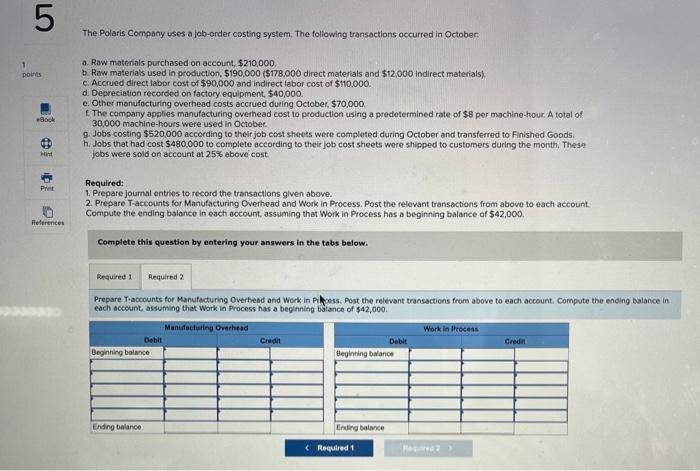

Step: 1

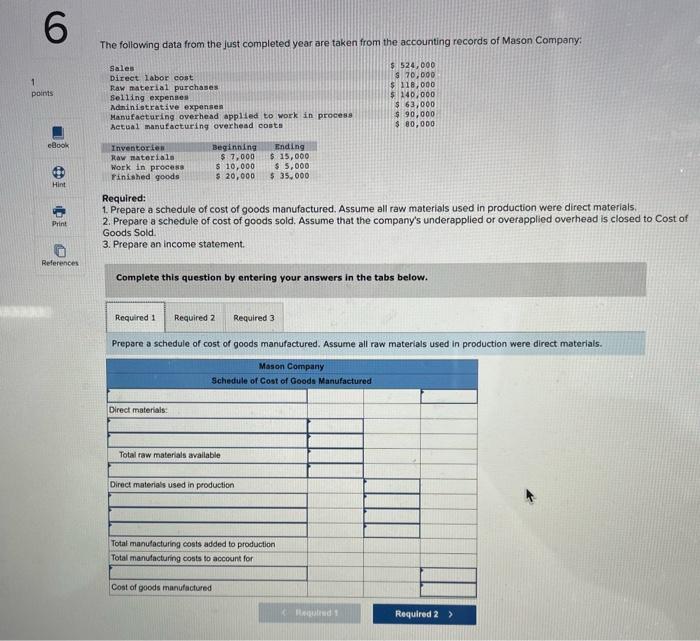

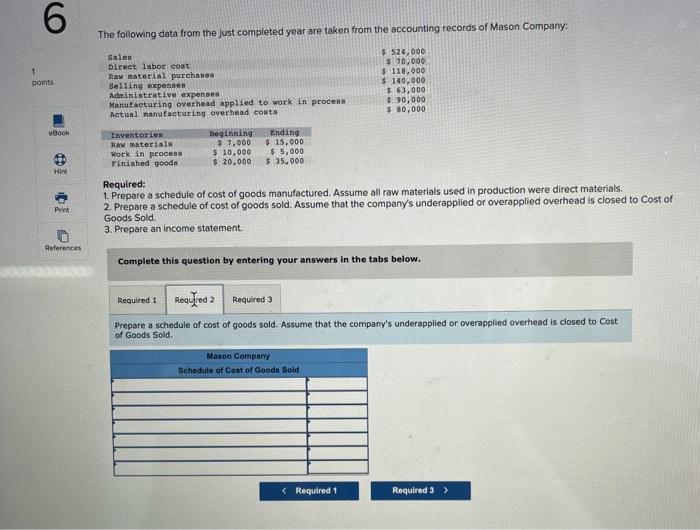

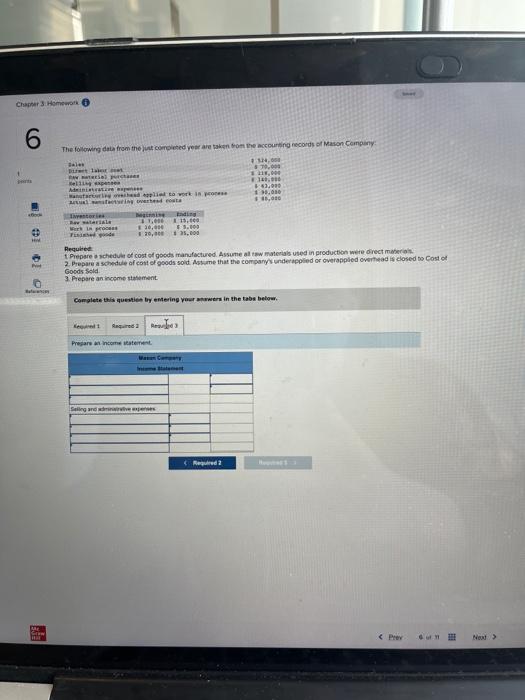

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started