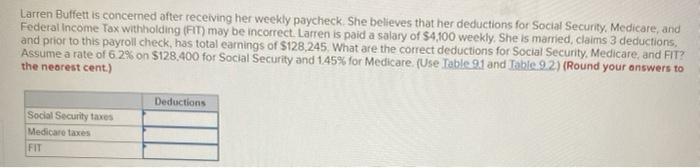

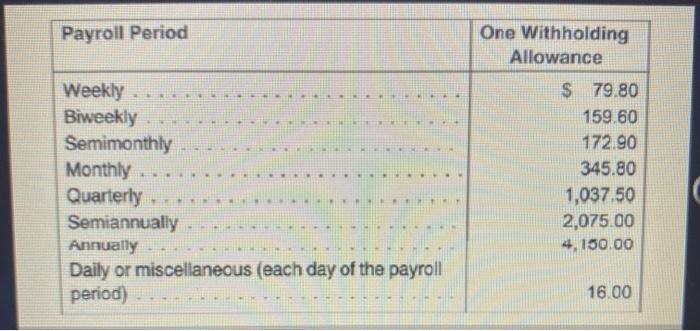

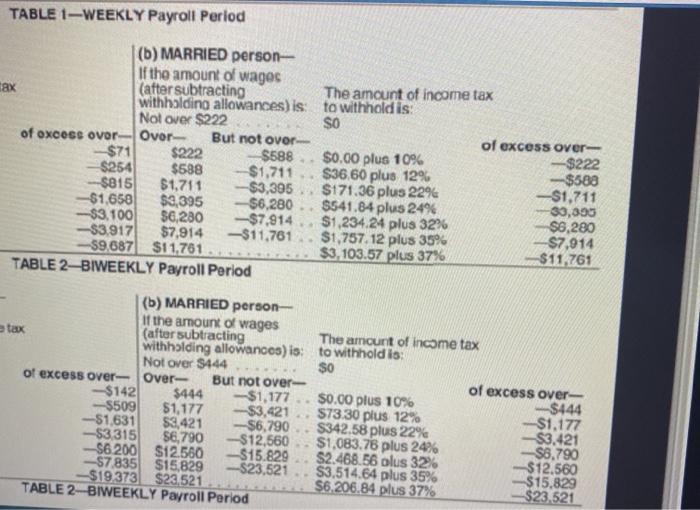

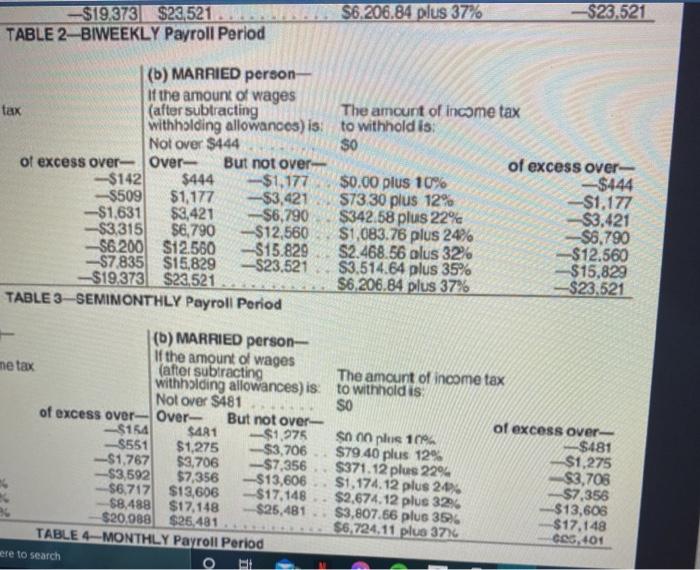

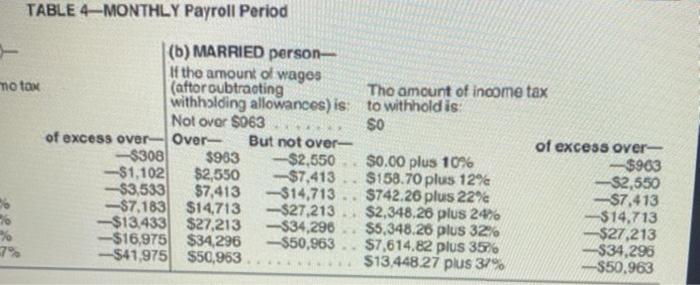

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FT) may be incorrect. Larren is paid a salary of $4,100 weekly. She is married, claims 3 deductions, and prior to this payroll check, has total earnings of S128,245. What are the correct deductions for Social Security Medicare, and FIT? Assume a rate of 62% on $128.400 for Social Security and 145% for Medicare (Use Table 91 and Table 9.2) (Round your answers to the nearest cent.) Deductions Social Security taxes Medicare taxes FIT Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 TABLE 1-WEEKLY Payroll Period (6) MARRIED person- If the amount of wages tax (after subtracting The amount of income tax withholding allowances) is: to withhold is Not over $222 SO of oxcess ovor Over- But not over of excess over- $71 $222 $588 $0.00 plus 10% -$222 $254 $588 $1,711 $36.60 plus 12% -$589 -$815 $1,711 $3,395 $171.36 plus 22% -S1,711 -$1.658 $3,395 $6,280 $541.84 plus 24% -20,000 -$3.100 $6,280 -$7.914.91.234.24 plus 326 $6,280 -$3.917 $7,914 -$11,761 $1,757. 12 plus 35% $7,914 -59.687 $11,761 $3,103.57 plus 37% $11,761 TABLE 2-BIWEEKLY Payroll Period tax (b) MARRIED person If the amount of wages (after subtracting The amount of income tax withholding allowances) is: to withhold is: Not over $444 $0 of excess over-Over- But not over of excess over- - $142 $444 -$1,177 $0.00 plus 10% -$444 -S509 $1,177 -$3,421 573 30 plus 12% -$1,177 -$1,631 $3,421 -$6.790 $342.58 plus 22% -$3.421 -$3,315 56,790 $12,560 $1,083.76 plus 24% -$8,790 S6200 S12.560 $15.829 $2.468.56 olus 32% $12.560 $7835 $15.829 -$23,521 53.514.64 plus 35% $15.829 $19373 $23.521 $6.206.84 plus 37% $23.521 TABLE 2-BIWEEKLY Payroll Period $6.206.84 plus 37% -$23.521 $19.373 $23,521 TABLE 2- BIWEEKLY Payroll Period |(b) MARRIED person- If the amount of wages tax (after subtracting The amount of income tax withholding allowances) is to withhold is: Not over $444 $0 of excess over-Over- But not over of excess over- -$142 $444 $1,177 $0.00 plus 10% -$444 -$509 $1,177 $3,421 S73 30 plus 12% -S1.177 -$1.631 $3,421 $6,790 $342.58 plus 22% S3,421 $3,315 $8,790 -$12,560 $1,083.76 plus 24% $6.790 $6.200 $12.560 -$15.829 S2.468.56 olus 32% S12.560 -S7835 $15,829 -$23,521 $3.514.64 plus 35% $15.829 $19.373 $23,521 S6.206.84 plus 37% -$23.521 TABLE 3-SEMINONTHLY Payroll Period (1) MARRIED person- If the amount of wages me tax (after subtracting The amount of income tax withholding allowances) is to withhold is Nol over $481 SO of excess over-Over- But not over- of excess over- $154 $481 $1,975 SO 60 plus 10% -$481 -S551 $1,275 $3,706 $79.40 plus 12% $1,275 $1,767 $3,706 -$7,356 $371.12 plus 22% $3,706 -S3,592 $7,356 -$13,606 $1,174.12 plus 20% $7,356 $6.717 $13,606 -$17,148 $2.674.12 plus 32% $13,606 $8.488 $17,148 $25,481 $3,807.56 plus 356 $17,148 $20.088 $25,481 $6.724,11 plus 37% GES, 401 TABLE 4 MONTHLY Payroll Period were to search TABLE 4-MONTHLY Payroll Period $0 (b) MARRIED person If the amount of wagos motox (aftoroubtracting The amount of income tax withholding allowances) is to withhold is: Not Over $063 of excess over-Over- But not over- of excess over- -$308 $963 $2,550 $0.00 plus 10% $903 -$1,102 $2,550 -$7,413 $158.70 plus 12% $2,550 -$3.533 $7,413 -$14,713 $742.26 plus 22% -S7,413 -S7,183 $14,713 -$27.213 . $2,348,26 plus 24% $14.713 $13.433 $27.213 -$34.296 $5,348.26 plus 32 -$27,213 $16,975 $34.296 -$50,963 $7,614.82 plus 35%. $34.295 -$41,975 $50,963 $13,448.27 plus 31% -$50.963 so