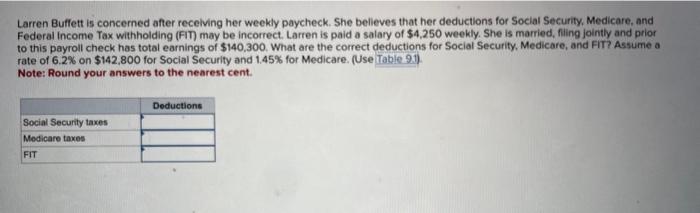

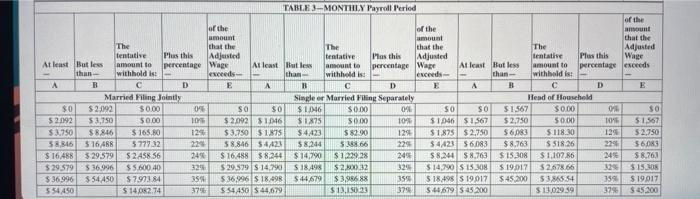

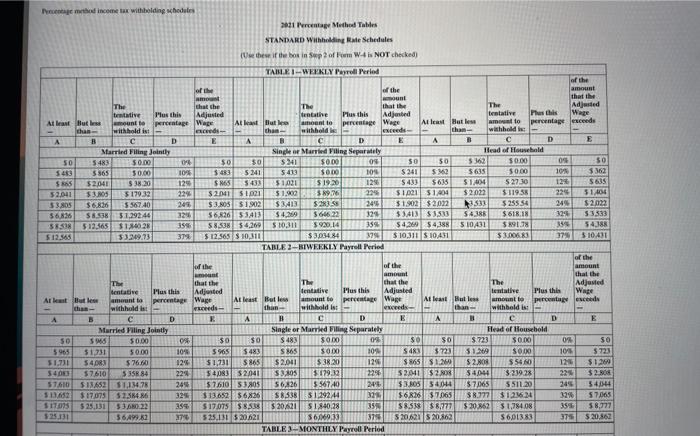

Larren Buffett is concerned after recelving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal income Tax withholding (FT) may be incorrect. Larren is paid a salary of $4,250 weekly. She is married, filing jointly and prior to this payroll check has total earnings of $140,300. What are the correct deductions for Social Security, Medicare, and FIT? Assume a rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. (Use Note: Round your answers to the nearest cent. 2021 Procentae Method Tables STANDA RD Wuhalding Fate Schedules TABL.E 3-MONTII,Y Payndll Period \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{15}{|c|}{ TABL.E 3-MONTIILY Payroll Peried } \\ \hline At least & \begin{tabular}{l} But less \\ than - \end{tabular} & \begin{tabular}{l} The \\ fentative \\ amount to \\ withhold is: \end{tabular} & \begin{tabular}{l} Phos this \\ percentage \end{tabular} & \begin{tabular}{l} of the \\ amount \\ that the \\ Adjeisted \\ Wage \\ execeds- \end{tabular} & A least & \begin{tabular}{l} Hat less \\ than - \end{tabular} & \begin{tabular}{l} The \\ tentative \\ anownt to \\ withhold is: \end{tabular} & \begin{tabular}{l} Mus this \\ percentage \end{tabular} & \begin{tabular}{l} of the \\ amount \\ that the \\ Adjusted \\ Wape \\ excecds- \end{tabular} & A least & \begin{tabular}{l} Hot less \\ than - \end{tabular} & \begin{tabular}{l} The \\ ientative \\ amount to \\ withbold is: \end{tabular} & \begin{tabular}{l} Plus this \\ perceatage \end{tabular} & \begin{tabular}{l} of the \\ ansount \\ that the \\ Adjusted \\ Wage \\ excecds \\ - \end{tabular} \\ \hline A & B & C. & D & E & A & B & C & D & E & A & H & C & D & E. \\ \hline \multicolumn{5}{|c|}{ Married Filing Jointly. } & \multicolumn{5}{|c|}{ Siaple er Married Filing Separately } & \multicolumn{5}{|c|}{ Head of Household } \\ \hline$0 & 52,092 & $000 & 0% & $0 & 50 & $1.046 & $000 & 0% & $0 & $0 & 51567 & 50.00 & & 50 \\ \hline 52092 & 53,750 & 5000 & 10 & $2,092 & 51046 & 51.875 & 5000 & 10% & $1046 & 51567 & $2,750 & 5000 & 10% & 51567 \\ \hline$3,750 & $8846 & $165,60 & 12% & $3.750 & 51875 & $4.423 & 58200 & 127 & 51,875 & $2,750 & 56,083 & 5.118 .30 & 12% & 52,750 \\ \hline 58,346 & 516,488 & 577732 & 22% & 58.846 & 54,423 & 58,244 & 536466 & 22% & $4,423 & $6.083 & $8,763 & $51826 & 22% & 56,063 \\ \hline$16,468 & 5.29579 & 52.45856 & 24x & $16,488 & $8,244 & $14,790 & $122928 & 24% & $8,244 & 58,763 & $15,308 & $1,107,86 & 24% & $8.76.1 \\ \hline$29579 & $36.906 & $5.600.40 & 32% & 529579 & 514,790 & 5.18,498 & 52,20032 & 320 & 514,790 & 515,308 & 519017 & 32.57865 & 32x & 515,308 \\ \hline$36.996 & $54,450 & $797384 & 35% & 5.36,906 & $18,498 & 544.679 & $3,90688 & 35% & 518,498 & $19017 & $45200 & 53,86554 & 35% & $19017 \\ \hline 554,450 & & 514.052 .74 & 37% & $54,450 & 544,679 & & 513,15023 & 370 & 544679 & 525200 & & 513,02959 & 37% & $45200 \\ \hline \end{tabular}