Question

Larry and Michael, equal partners, form the Accurate Air Partnership. During the year, Accurate had the following revenue, expenses, gains, losses, and distributions: -Cost of

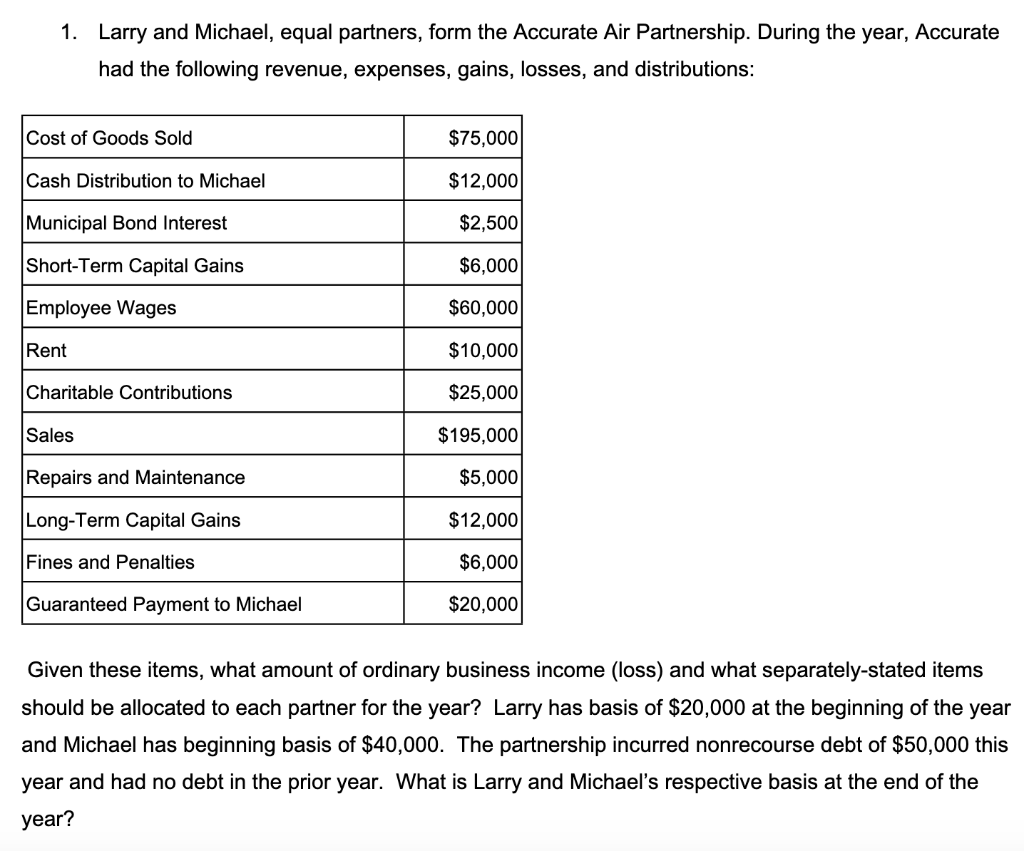

Larry and Michael, equal partners, form the Accurate Air Partnership. During the year, Accurate had the following revenue, expenses, gains, losses, and distributions:

-Cost of Goods Sold $75,000

-Cash Distribution to Michael $12,000

-Municipal Bond Interest $2,500

-Short-Term Capital Gains $6,000

-Employee Wages $60,000

-Rent $10,000

-Charitable Contributions $25,000

-Sales $195,000

-Repairs and Maintenance $5,000

-Long-Term Capital Gains $12,000

-Fines and Penalties $6,000

-Guaranteed Payment to Michael $20,000

**

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year? Larry has basis of $20,000 at the beginning of the year and Michael has beginning basis of $40,000. The partnership incurred nonrecourse debt of $50,000 this year and had no debt in the prior year. What is Larry and Michaels respective basis at the end of the year? 2. Anna is a one-third partner in the ANNA partnership (calendar year-end). Anna decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1: Basis FMV Cash $170,000 $170,000 Accounts receivable -0- 240,000 Stock investment 80,000 120,000 Land 300,000 360,000 Total $550,000 $890,000

1. Larry and Michael, equal partners, form the Accurate Air Partnership. During the year, Accurate had the following revenue, expenses, gains, losses, and distributions: Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year? Larry has basis of $20,000 at the beginning of the year and Michael has beginning basis of $40,000. The partnership incurred nonrecourse debt of $50,000 this year and had no debt in the prior year. What is Larry and Michael's respective basis at the end of the year? 1. Larry and Michael, equal partners, form the Accurate Air Partnership. During the year, Accurate had the following revenue, expenses, gains, losses, and distributions: Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year? Larry has basis of $20,000 at the beginning of the year and Michael has beginning basis of $40,000. The partnership incurred nonrecourse debt of $50,000 this year and had no debt in the prior year. What is Larry and Michael's respective basis at the end of the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started