Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Larry Davis borrows $88,000 at 12 percent interest toward the purchase of a home. His mortgage is for 30 years. Use Appendix D for an

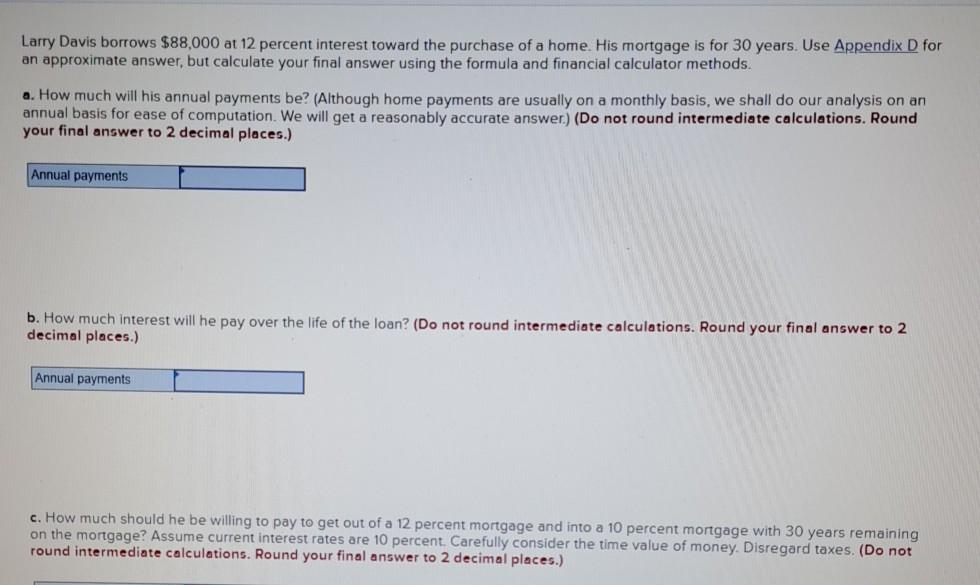

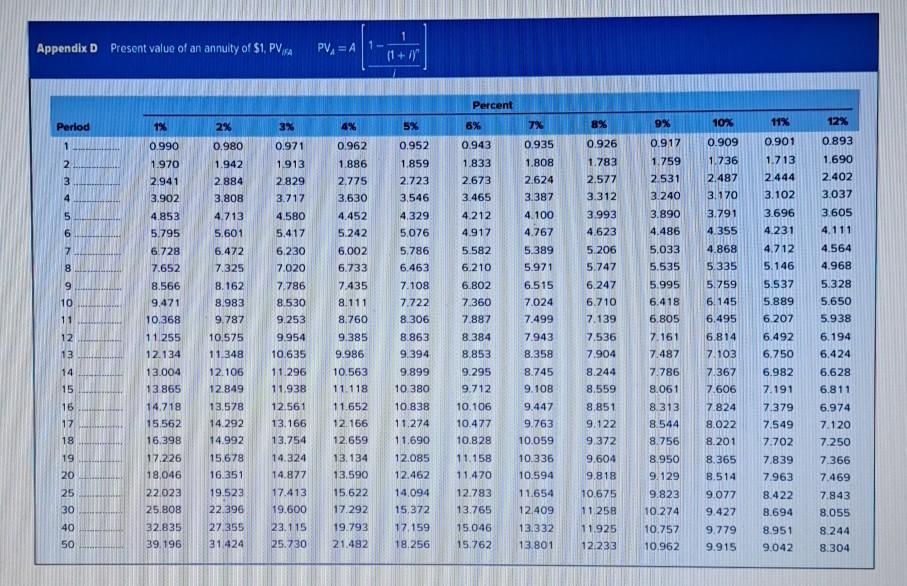

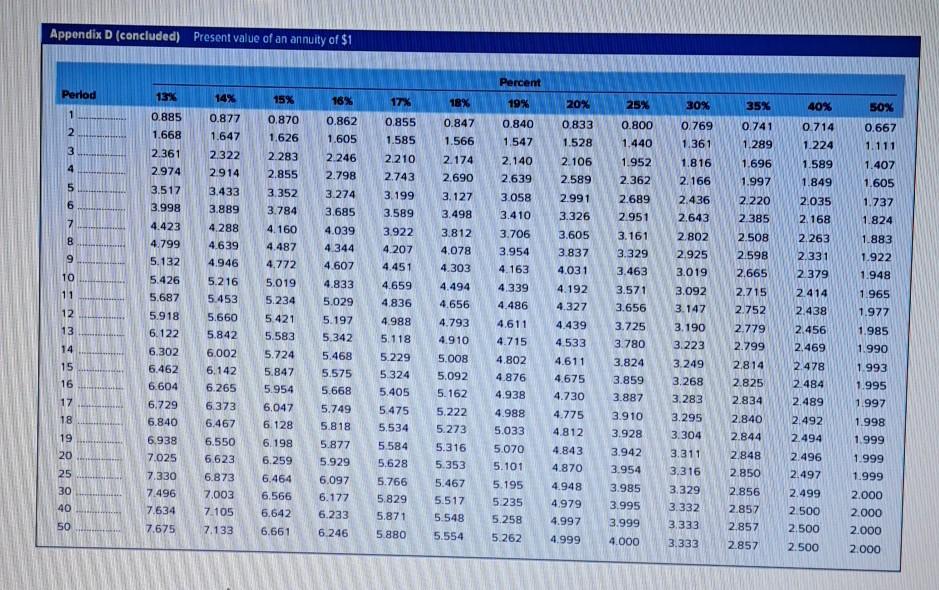

Larry Davis borrows $88,000 at 12 percent interest toward the purchase of a home. His mortgage is for 30 years. Use Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. How much will his annual payments be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer) (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Annual payments b. How much interest will he pay over the life of the loan? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Annual payments c. How much should he be willing to pay to get out of a 12 percent mortgage and into a 10 percent mortgage with 30 years remaining on the mortgage? Assume current interest rates are 10 percent. Carefully consider the time value of money. Disregard taxes. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Appendix D Present value of an annulty of $1. PVA PV = A1- 11+ / Percent Period 1% 2% 11% 12% 3% 4% 5% 7% 6% 8% 9% 10% 0.990 1 0.935 0.909 0.926 2 0.980 1.942 2.884 3.808 0.971 1.913 2.829 3.717 1.970 2.941 3.902 4.853 5.795 0.962 1.886 2.775 3,630 4.452 5.242 0.952 1.859 2.723 3.546 0.943 1.833 2.673 3.465 3 1.808 2.624 3.387 1.736 2.487 3.170 0.901 1.713 2.444 3.102 4 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5 4.212 4.917 4.580 5.417 6.230 3.791 4.355 6 4.713 5.601 6.472 7.325 6.728 4.868 5.335 8 9 7.652 8.566 9.471 10.368 11255 12.134 13.004 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 6.002 6.733 7.435 8.111 8.760 9.385 9.986 5.582 6.210 6.802 7360 7.887 8.162 8.983 9,787 10 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 11 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.93B 12.561 13.166 13.754 14.324 14.877 5.995 6.418 6.805 7.161 7.487 7.786 12 4.329 5,076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14.094 15,372 13 14 15 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6,424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 8.384 8.853 9.295 3.696 4.231 4.712 5.146 5.537 5.889 6 207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 5.759 6.145 6.495 6,814 7.103 7.367 7.606 7824 8.022 8.201 8.745 9.108 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15,678 16.351 19.523 22.396 27 355 31424 16 13 865 14.718 15,562 16.398 17.226 18,046 8,061 8.313 8.544 9.447 9.763 10.059 9.712 10.106 10.477 10.828 11.158 11.470 18 8.559 8.851 9.122 9.372 9.604 9.818 10.563 11.118 11.652 12.156 12.659 13.134 13.590 15.622 17.292 19.793 21.482 8.756 19 8.950 9.129 8.365 8.514 20 25 12.783 13.765 22.023 25.808 32.835 39.196 30 10.336 10.594 11.654 12.409 13.332 13.801 17.413 19.500 23.115 25.730 10.675 11258 11.925 12233 9.823 10.274 10.757 10.962 9.077 9.427 9.779 9.915 40 50 17.159 18.256 15 046 15.762 8.422 8.694 8.951 9.042 8.244 8.304 Appendix D (concluded) Present value of an annuity of $1 Percent Period 13% 15% 18% 17% 18% 19% 25% 30% 40% 50% 1 0.885 2 1.668 2 3 0.862 1.605 0,855 1.585 0.769 1.361 0.714 1.224 0.667 1.111 2.361 1.407 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 2.974 2.246 2.798 3.274 3.685 35% 0.741 1.289 1.696 1.997 2.220 0.840 1.547 2.140 2.639 3.058 3.410 1.589 1.849 1.605 100 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 2.210 2.743 3.199 3.589 3.922 4.207 4.451 3.517 3.998 0.800 1.440 1.952 2.362 2.689 2.951 3.161 3.329 2.035 2.168 2.385 2.508 1.737 1.824 1.883 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 3.706 3.954 4.163 4,339 4.486 2.598 20% 0.833 1.528 2. 106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 2.263 2.331 2.379 2.414 2.438 1.922 1.948 2.665 1.965 1.977 12 13 4.611 4.715 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.330 7.496 7.634 7,675 4.659 4836 4.988 5.118 5.229 5.324 2.715 2.752 2.779 2.799 2.814 1.985 1.990 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 14 15 16 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 6.097 6.177 6.233 6.246 4.802 4.876 4.938 1.993 1.995 2.456 2.469 2.478 2.484 2.489 2.492 2.825 2.834 17 3.463 3.571 3.656 3.725 3.780 3.824 3.859 3.887 3.910 3.928 3.942 3.954 3.985 3.995 3.999 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 5.548 5.554 1.997 4.775 4.988 5.033 18 19 20 1.998 3.190 3.223 3.249 3.268 3.283 3.295 3.304 3.311 3.316 3.329 3.332 3.333 5.405 5.475 5.534 5.584 5.628 5.766 5.829 5.871 2.840 2.844 2.494 5.070 5.101 4.812 4.843 4.870 4.948 4.979 2.848 2.850 2.496 2.497 1.999 1.999 1.999 25 30 40 6.873 7.003 7.105 6.464 6.566 6.642 5.195 5 235 5.258 5.262 2.856 2.857 2.857 2.857 2.499 2.500 2.500 2.500 50 2.000 2.000 2.000 2.000 4.997 4.999 7.133 6.661 5.880 4.000 3.333

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started