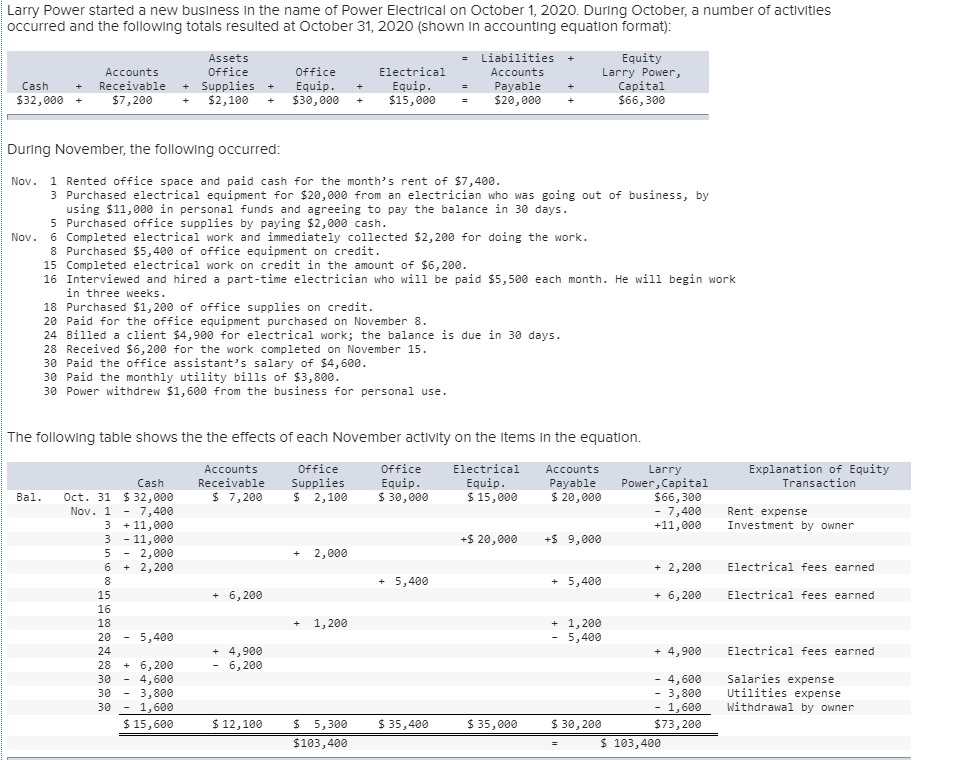

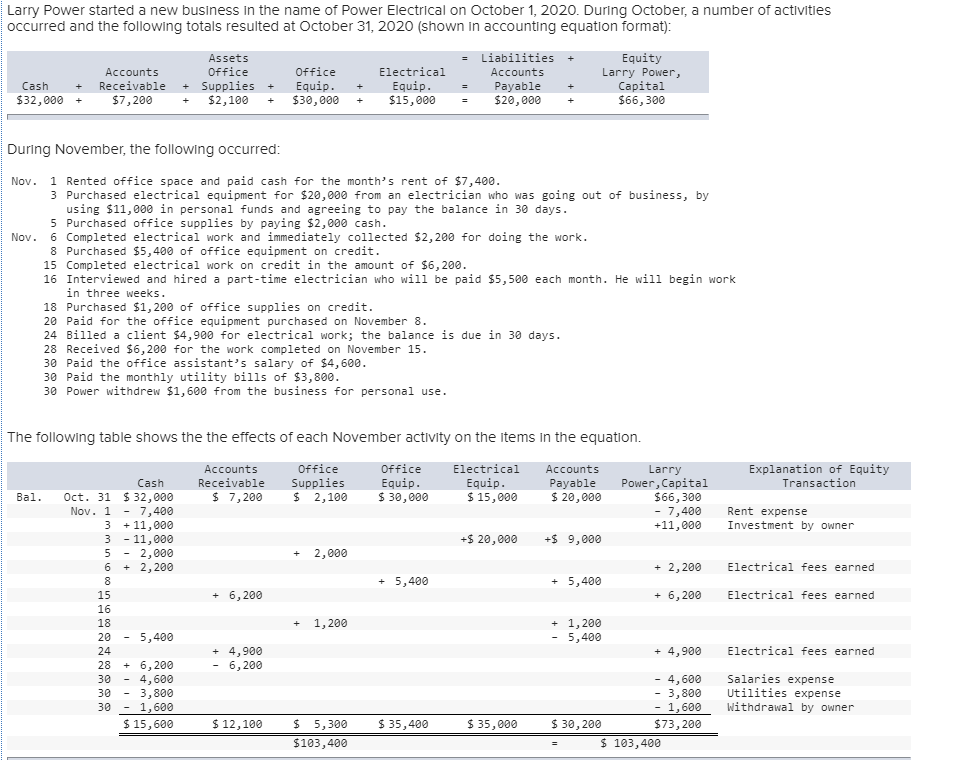

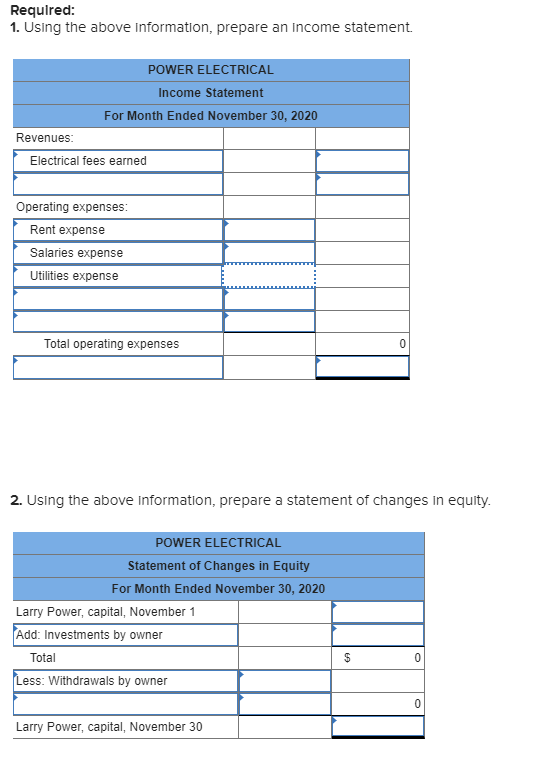

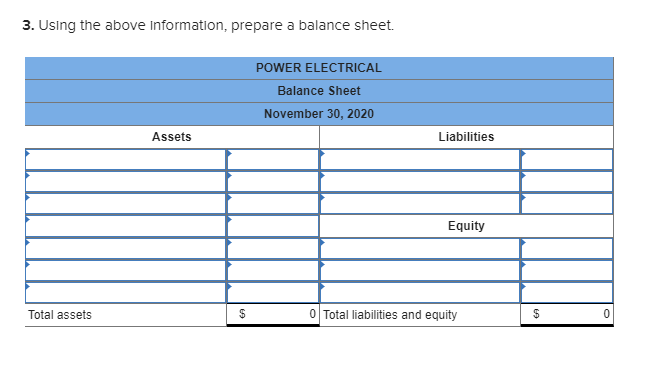

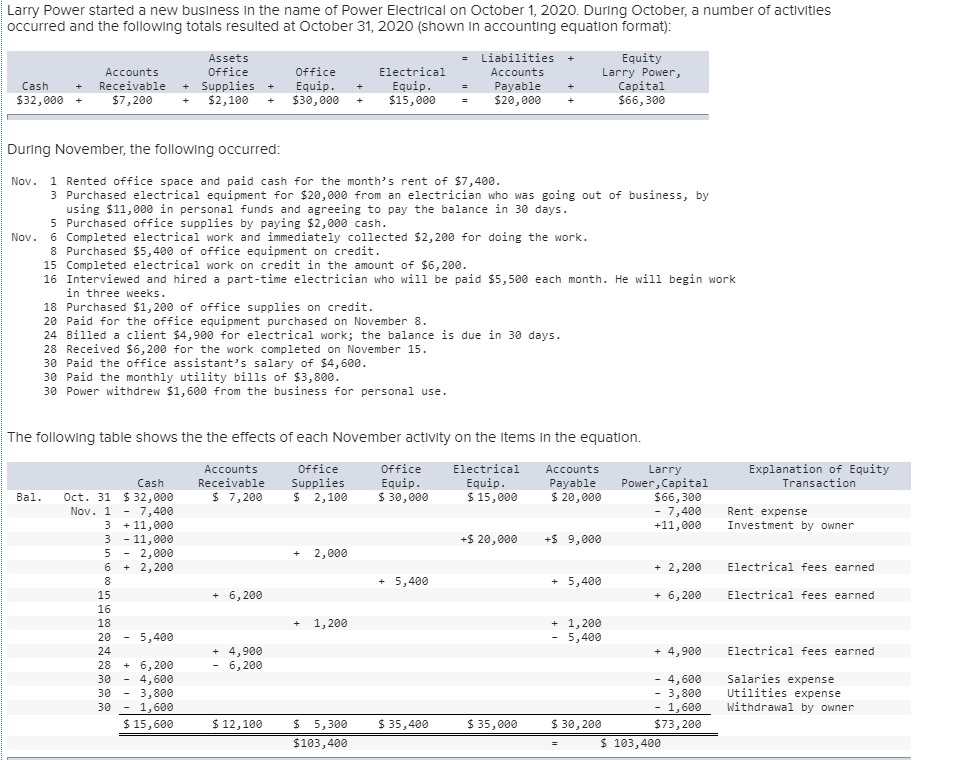

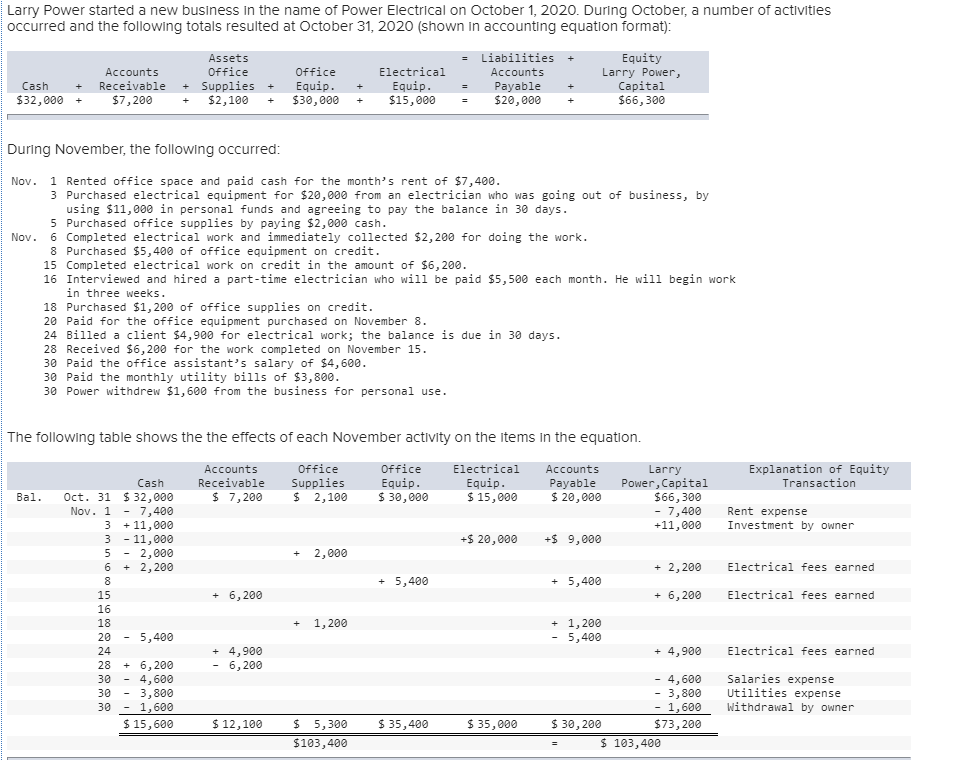

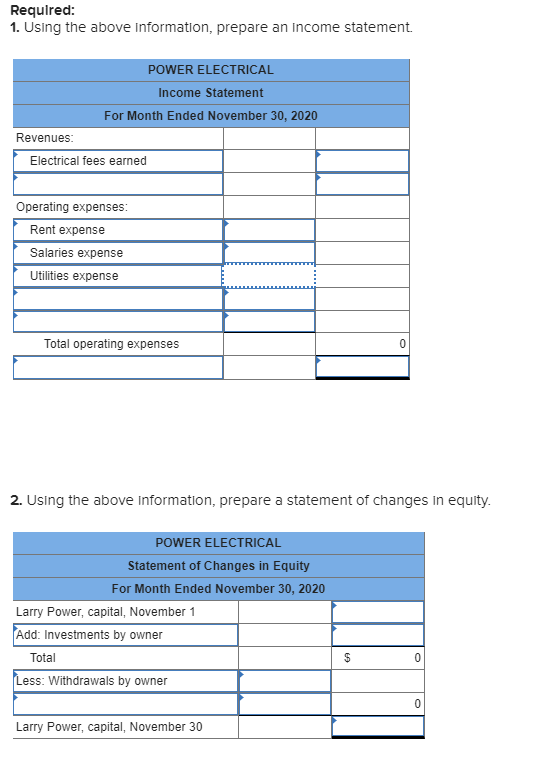

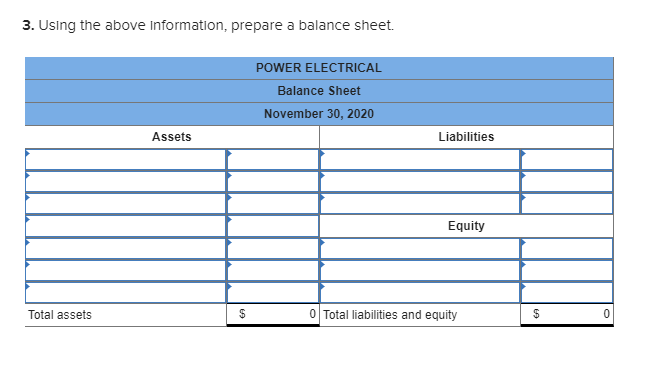

Larry Power started a new business in the name of Power Electrical on October 1, 2020. During October, a number of activities occurred and the following totals resulted at October 31, 2020 (shown in accounting equation format): Assets = Liabilities + Equity Accounts Office Office Electrical Accounts Larry Power, Cash Receivable + Supplies + Equip. Equip. Payable Capital $32,000 + $7,200 $2,100 $30,000 $15,000 $20,000 $66,300 + + + + During November, the following occurred: Nov. 1 Rented office space and paid cash for the month's rent of $7,400. 3 Purchased electrical equipment for $20,000 from an electrician who was going out of business, by using $11,000 in personal funds and agreeing to pay the balance in 30 days. 5 Purchased office supplies by paying $2,000 cash. Nov. 6 Completed electrical work and immediately collected $2,200 for doing the work. 8 Purchased $5,400 of office equipment on credit. 15 Completed electrical work on credit in the amount of $6,200. 16 Interviewed and hired a part-time electrician who will be paid $5,500 each month. He will begin work in three weeks. 18 Purchased $1,200 of office supplies on credit. 20 Paid for the office equipment purchased on November 8. 24 Billed a client $4,900 for electrical work; the balance is due in 30 days. 28 Received $6,200 for the work completed on November 15. 30 Paid the office assistant's salary of $4,600. 30 Paid the monthly utility bills of $3,800. 30 Power withdrew $1,600 from the business for personal use. The following table shows the the effects of each November activity on the items in the equation. Accounts Receivable $ 7,200 Office Supplies $ 2,100 Office Equip. $ 30,000 Electrical Equip. $ 15,000 Accounts Payable $ 20,000 Explanation of Equity Transaction Bal. Larry Power, Capital $66,300 - 7,400 +11,000 Rent expense Investment by owner +$ 20,000 +$ 9,000 + 2,000 + 2,200 Electrical fees earned + 5,400 + 5,400 + 6,200 + 6,200 Electrical fees earned Cash Oct. 31 $ 32,000 Nov. 1 - 7,400 3 + 11,000 3 - 11,000 5 - 2,000 6 + 2,200 8 15 16 18 20 - 5,400 24 28 + 6,200 30 - 4,600 30 - 3,800 30 - 1,600 $ 15,600 + 1,200 + 1,200 - 5,400 + 4,900 Electrical fees earned + 4,900 6,200 - 4,600 3,800 - 1,600 $ 30,200 $73,200 $ 103,400 Salaries expense Utilities expense Withdrawal by owner $ 12,100 $ 35,400 $ 35,000 $ 5,300 $103,400 Larry Power started a new business in the name of Power Electrical on October 1, 2020. During October, a number of activities occurred and the following totals resulted at October 31, 2020 (shown in accounting equation format): Assets = Liabilities + Equity Accounts Office Office Electrical Accounts Larry Power, Cash Receivable + Supplies + Equip. Equip. Payable Capital $32,000 + $7,200 $2,100 $30,000 $15,000 $20,000 $66,300 + + + + During November, the following occurred: Nov. 1 Rented office space and paid cash for the month's rent of $7,400. 3 Purchased electrical equipment for $20,000 from an electrician who was going out of business, by using $11,000 in personal funds and agreeing to pay the balance in 30 days. 5 Purchased office supplies by paying $2,000 cash. Nov. 6 Completed electrical work and immediately collected $2,200 for doing the work. 8 Purchased $5,400 of office equipment on credit. 15 Completed electrical work on credit in the amount of $6,200. 16 Interviewed and hired a part-time electrician who will be paid $5,500 each month. He will begin work in three weeks. 18 Purchased $1,200 of office supplies on credit. 20 Paid for the office equipment purchased on November 8. 24 Billed a client $4,900 for electrical work; the balance is due in 30 days. 28 Received $6,200 for the work completed on November 15. 30 Paid the office assistant's salary of $4,600. 30 Paid the monthly utility bills of $3,800. 30 Power withdrew $1,600 from the business for personal use. The following table shows the the effects of each November activity on the items in the equation. Accounts Receivable $ 7,200 Office Supplies $ 2,100 Office Equip. $ 30,000 Electrical Equip. $ 15,000 Accounts Payable $ 20,000 Explanation of Equity Transaction Bal. Larry Power, Capital $66,300 - 7,400 +11,000 Rent expense Investment by owner +$ 20,000 +$ 9,000 + 2,000 + 2,200 Electrical fees earned + 5,400 + 5,400 + 6,200 + 6,200 Electrical fees earned Cash Oct. 31 $ 32,000 Nov. 1 - 7,400 3 + 11,000 3 - 11,000 5 - 2,000 6 + 2,200 8 15 16 18 20 - 5,400 24 28 + 6,200 30 - 4,600 30 - 3,800 30 - 1,600 $ 15,600 + 1,200 + 1,200 - 5,400 + 4,900 Electrical fees earned + 4,900 6,200 - 4,600 3,800 - 1,600 $ 30,200 $73,200 $ 103,400 Salaries expense Utilities expense Withdrawal by owner $ 12,100 $ 35,400 $ 35,000 $ 5,300 $103,400 Required: 1. Using the above information, prepare an income statement POWER ELECTRICAL Income Statement For Month Ended November 30, 2020 Revenues: Electrical fees earned Operating expenses: Rent expense Salaries expense Utilities expense Total operating expenses 0 2. Using the above information, prepare a statement of changes in equity. POWER ELECTRICAL Statement of Changes in Equity For Month Ended November 30, 2020 Larry Power, capital, November 1 Add: Investments by owner Total Less: Withdrawals by owner $ 0 0 Larry Power, capital, November 30 3. Using the above information, prepare a balance sheet. POWER ELECTRICAL Balance Sheet November 30, 2020 Assets Liabilities Equity Total assets $ 0 Total liabilities and equity $