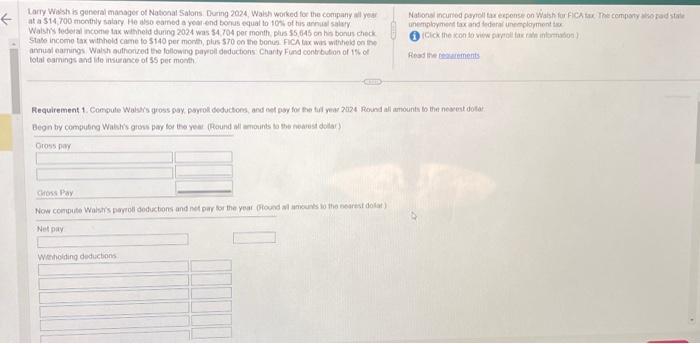

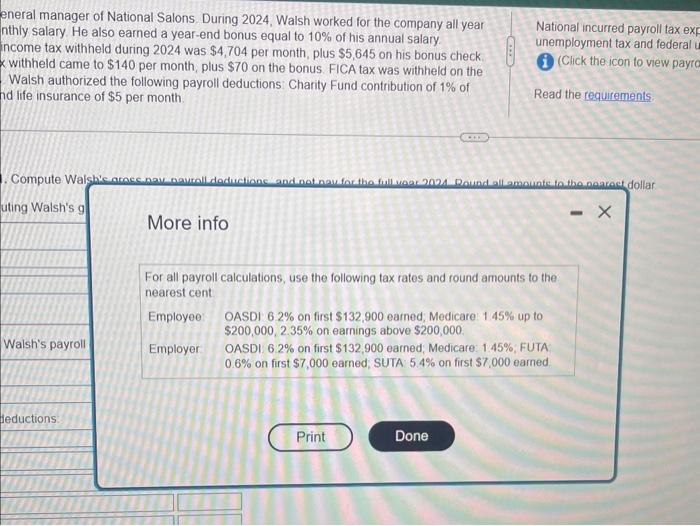

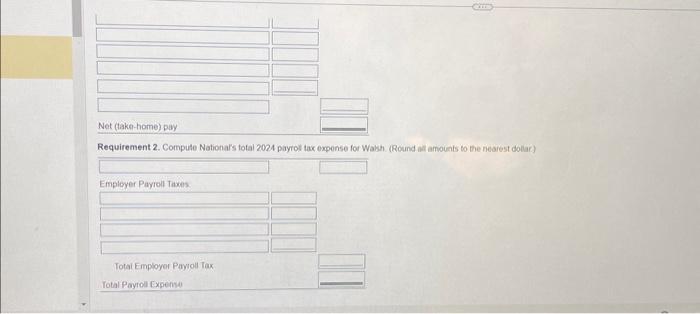

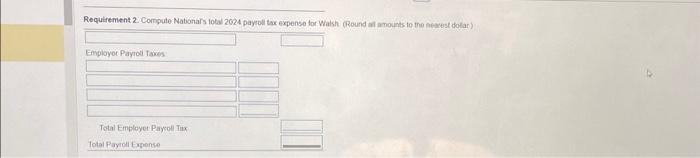

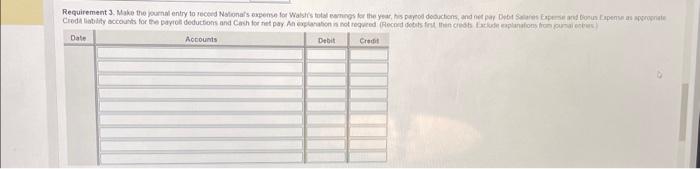

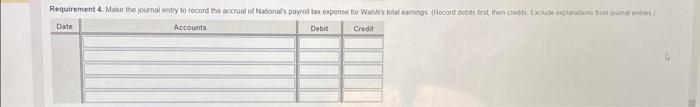

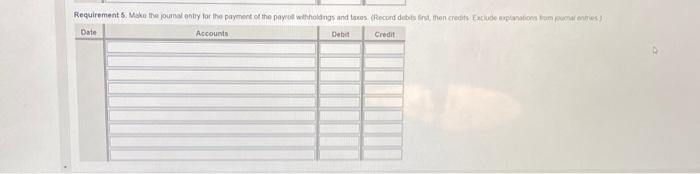

Larry Wish is general manoger of Notional Sabns. Durng 2024, Wakh worked for the company al yoar at a $14,700 monthly salary He asso pamed a your end borus equal to 160 of his arnial salary Walshs tederal incone lax withelid durng 2024 was 54.704 per month. plos $5,645 on hs bonus check State income tax withheld came to $140 per morth, plus 570 co the benus. Fich tax wis wittriek on tere annusl oarnings Walsh guthorized the following payedi deductions Charty Find contrbuton of 1 of of total eamings and ife insurance of 35 per month inempleyment tex and tederas unemploment ise (i) icick the scon bo vew paycol facrah intoriabios) Phost he tewerements Begn by compueng Waishs gress pay for the year (Round al anounts io the neaves dolar) eneral manager of National Salons. During 2024, Walsh worked for the company all year nthly salary. He also earned a year-end bonus equal to 10% of his annual salary. income tax withheld during 2024 was $4,704 per month, plus $5,645 on his bonus check x withheld came to $140 per month, plus $70 on the bonus. FICA tax was withheld on the Walsh authorized the following payroll deductions: Charity Fund contribution of 1% of dife insurance of $5 per month. National incurred payroll tax exp unemployment tax and federal (1) (Click the icon to view payro Read the requirements More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Employee OASDI 62% on first $132,900 earned; Medicare. 1.45% up to $200,000,2.35% on earnings above $200,000 Employer OASDI 6.2% on first $132,900 earned, Medicare: 1.45%, FUTA 0.6% on first $7,000 earned, SUTA 5.4% on first $7,000 earned Net (take-home) pay Requirement 2. Compule Notionals total 2024 payrol tax expense for Wabh. (Round all amounts to the nearest dollar) Empleyer Payrol Taxes Totai Employer Payoul Tax Total Payrod Expense Requirement 2 . Conpute Nationars 10ta 2024 payoli thx expense for Wakh (Round al mounts to the Acevest dolar) \begin{tabular}{l|l|l|l|l|} \hline Date & Accounts & Debie Credit \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Larry Wish is general manoger of Notional Sabns. Durng 2024, Wakh worked for the company al yoar at a $14,700 monthly salary He asso pamed a your end borus equal to 160 of his arnial salary Walshs tederal incone lax withelid durng 2024 was 54.704 per month. plos $5,645 on hs bonus check State income tax withheld came to $140 per morth, plus 570 co the benus. Fich tax wis wittriek on tere annusl oarnings Walsh guthorized the following payedi deductions Charty Find contrbuton of 1 of of total eamings and ife insurance of 35 per month inempleyment tex and tederas unemploment ise (i) icick the scon bo vew paycol facrah intoriabios) Phost he tewerements Begn by compueng Waishs gress pay for the year (Round al anounts io the neaves dolar) eneral manager of National Salons. During 2024, Walsh worked for the company all year nthly salary. He also earned a year-end bonus equal to 10% of his annual salary. income tax withheld during 2024 was $4,704 per month, plus $5,645 on his bonus check x withheld came to $140 per month, plus $70 on the bonus. FICA tax was withheld on the Walsh authorized the following payroll deductions: Charity Fund contribution of 1% of dife insurance of $5 per month. National incurred payroll tax exp unemployment tax and federal (1) (Click the icon to view payro Read the requirements More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Employee OASDI 62% on first $132,900 earned; Medicare. 1.45% up to $200,000,2.35% on earnings above $200,000 Employer OASDI 6.2% on first $132,900 earned, Medicare: 1.45%, FUTA 0.6% on first $7,000 earned, SUTA 5.4% on first $7,000 earned Net (take-home) pay Requirement 2. Compule Notionals total 2024 payrol tax expense for Wabh. (Round all amounts to the nearest dollar) Empleyer Payrol Taxes Totai Employer Payoul Tax Total Payrod Expense Requirement 2 . Conpute Nationars 10ta 2024 payoli thx expense for Wakh (Round al mounts to the Acevest dolar) \begin{tabular}{l|l|l|l|l|} \hline Date & Accounts & Debie Credit \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular}