Question

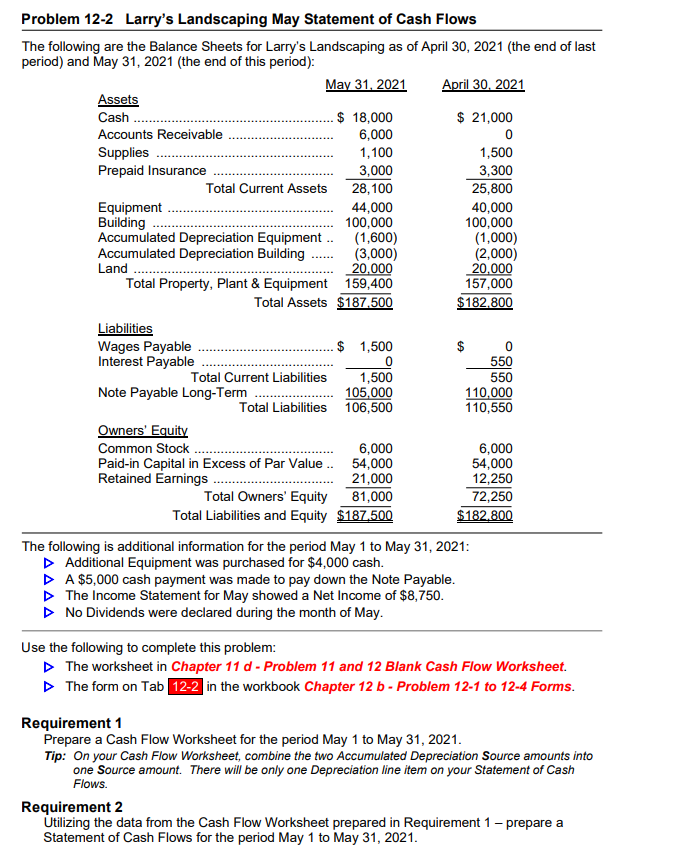

Larrys Landscaping May Statement of Cash Flows The following are the Balance Sheets for Larrys Landscaping as of April 30, 2021 (the end of last

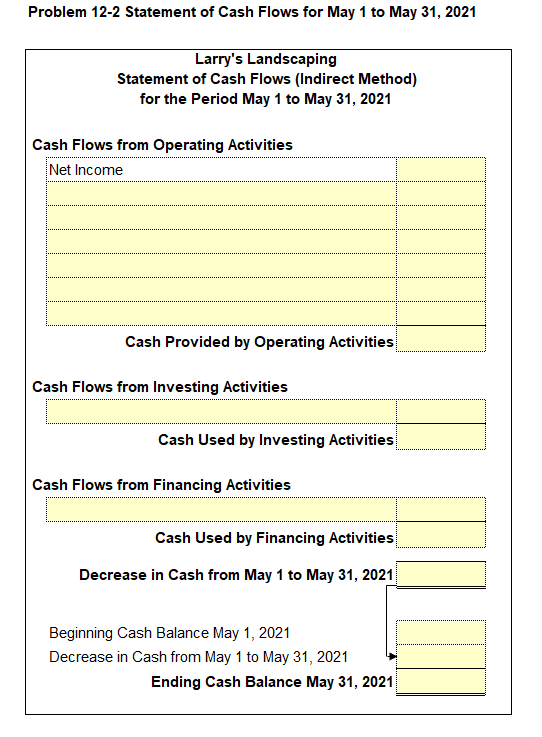

Larrys Landscaping May Statement of Cash Flows The following are the Balance Sheets for Larrys Landscaping as of April 30, 2021 (the end of last period) and May 31, 2021 (the end of this period): May 31, 2021 April 30, 2021 Assets Cash ..................................................... $ 18,000 $ 21,000 Accounts Receivable ............................ 6,000 0 Supplies ............................................... 1,100 1,500 Prepaid Insurance ................................ 3,000 3,300 Total Current Assets 28,100 25,800 Equipment ............................................ 44,000 40,000 Building ................................................ 100,000 100,000 Accumulated Depreciation Equipment .. (1,600) (1,000) Accumulated Depreciation Building ...... (3,000) (2,000) Land ..................................................... 20,000 20,000 Total Property, Plant & Equipment 159,400 157,000 Total Assets $187,500 $182,800 Liabilities Wages Payable .................................... $ 1,500 $ 0 Interest Payable ................................... 0 550 Total Current Liabilities 1,500 550 Note Payable Long-Term ..................... 105,000 110,000 Total Liabilities 106,500 110,550 Owners Equity Common Stock ..................................... 6,000 6,000 Paid-in Capital in Excess of Par Value .. 54,000 54,000 Retained Earnings ................................ 21,000 12,250 Total Owners Equity 81,000 72,250 Total Liabilities and Equity $187,500 $182,800 The following is additional information for the period May 1 to May 31, 2021: Additional Equipment was purchased for $4,000 cash. A $5,000 cash payment was made to pay down the Note Payable. The Income Statement for May showed a Net Income of $8,750. No Dividends were declared during the month of May. Use the following to complete this problem: The worksheet in Chapter 11 d - Problem 11 and 12 Blank Cash Flow Worksheet. The form on Tab .12-2. in the workbook Chapter 12 b - Problem 12-1 to 12-4 Forms. Requirement 1 Prepare a Cash Flow Worksheet for the period May 1 to May 31, 2021. Tip: On your Cash Flow Worksheet, combine the two Accumulated Depreciation Source amounts into one Source amount. There will be only one Depreciation line item on your Statement of Cash Flows. Requirement 2 Utilizing the data from the Cash Flow Worksheet prepared in Requirement 1 prepare a Statement of Cash Flows for the period May 1 to May 31, 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started