Answered step by step

Verified Expert Solution

Question

1 Approved Answer

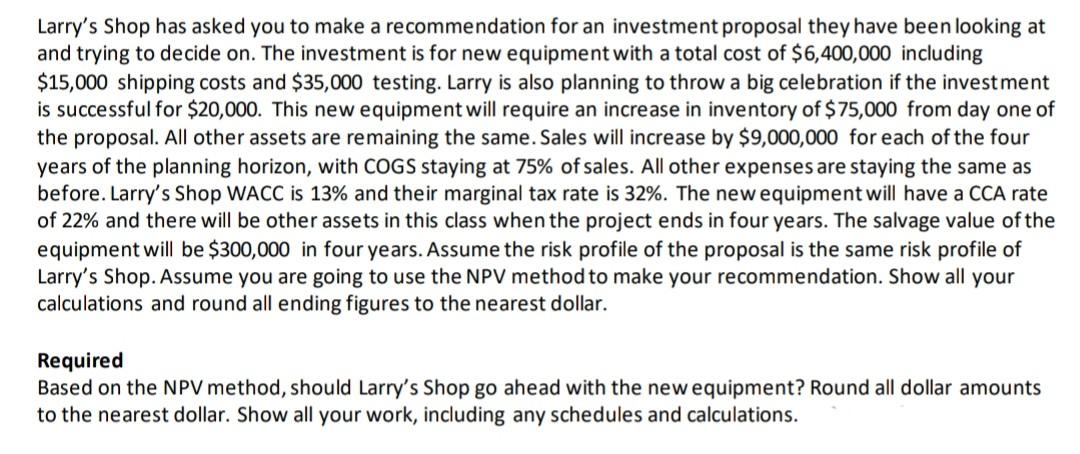

Larry's Shop has asked you to make a recommendation for an investment proposal they have been looking at and trying to decide on. The investment

Larry's Shop has asked you to make a recommendation for an investment proposal they have been looking at and trying to decide on. The investment is for new equipment with a total cost of $6,400,000 including $15,000 shipping costs and $35,000 testing. Larry is also planning to throw a big celebration if the investment is successful for $20,000. This new equipment will require an increase in inventory of $75,000 from day one of the proposal. All other assets are remaining the same. Sales will increase by $9,000,000 for each of the four years of the planning horizon, with COGS staying at 75% of sales. All other expenses are staying the same as before. Larry's Shop WACC is 13% and their marginal tax rate is 32%. The new equipment will have a CCA rate of 22% and there will be other assets in this class when the project ends in four years. The salvage value of the equipment will be $300,000 in four years. Assume the risk profile of the proposal is the same risk profile of Larry's Shop. Assume you are going to use the NPV method to make your recommendation. Show all your calculations and round all ending figures to the nearest dollar. Required Based on the NPV method, should Larry's Shop go ahead with the new equipment? Round all dollar amounts to the nearest dollar. Show all your work, including any schedules and calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started