Larsen Company makes fertilizer v. a Midwestern state. The company has nearly completed a new plant that will produce twice as much as the

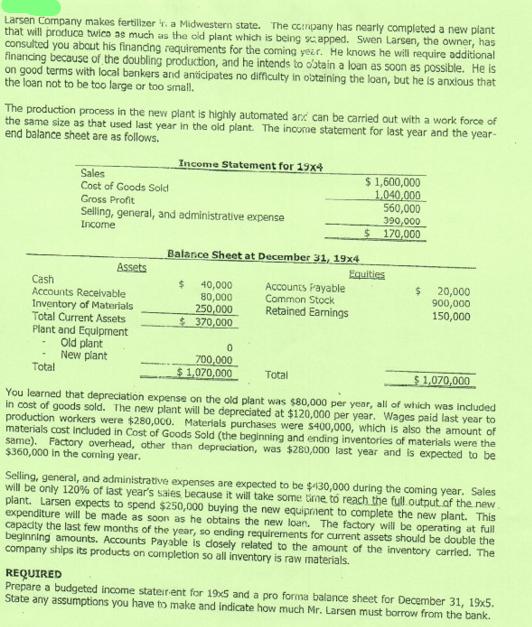

Larsen Company makes fertilizer v. a Midwestern state. The company has nearly completed a new plant that will produce twice as much as the old plant which is being scapped. Swen Larsen, the owner, has consulted you about his financing requirements for the coming year. He knows he will require additional financing because of the doubling production, and he intends to obtain a loan as soon as possible. He is on good terms with local bankers and anticipates no difficulty in obtaining the loan, but he is anxious that the loan not to be too large or too small. The production process in the new plant is highly automated and can be carried out with a work force of the same size as that used last year in the old plant. The income statement for last year and the year- end balance sheet are as follows. Sales Cost of Goods Sold Gross Profit Selling, general, and administrative expense Income Assets Income Statement for 19x4 Cash Accounts Receivable Inventory of Materials Total Current Assets Plant and Equipment Old plant New plant $ Balance Sheet at December 31, 19x4 Accounts Payable Common Stock Retained Earnings $ 40,000 80,000 250,000 $370,000 $ 1,600,000 1,040,000 560,000 390,000 170,000 0 700,000 $1,070,000 Equities $ 20,000 900,000 150,000 Total Total $1,070,000 You learned that depreciation expense on the old plant was $80,000 per year, all of which was included in cost of goods sold. The new plant will be depreciated at $120,000 per year. Wages paid last year to production workers were $280,000. Materials purchases were $400,000, which is also the amount of materials cost included in Cost of Goods Sold (the beginning and ending inventories of materials were the same). Factory overhead, other than depreciation, was $280,000 last year and is expected to be $360,000 in the coming year. Selling, general, and administrative expenses are expected to be $430,000 during the coming year. Sales will be only 120% of last year's sales, because it will take some time to reach the full output of the new plant. Larsen expects to spend $250,000 buying the new equipment to complete the new plant. This expenditure will be made as soon as he obtains the new loan. The factory will be operating at full capacity the last few months of the year, so ending requirements for current assets should be double the beginning amounts. Accounts Payable is closely related to the amount of the inventory carried. The company ships its products on completion so all inventory is raw materials. REQUIRED Prepare a budgeted income stateir-ent for 19x5 and a pro forma balance sheet for December 31, 19x5. State any assumptions you have to make and indicate how much Mr. Larsen must borrow from the bank.

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The image presents the financial statements of Larsen Company for the year 19X4 and includes an income statement and a balance sheet as of December 31 19X4 Additionally there is supplementary informat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started