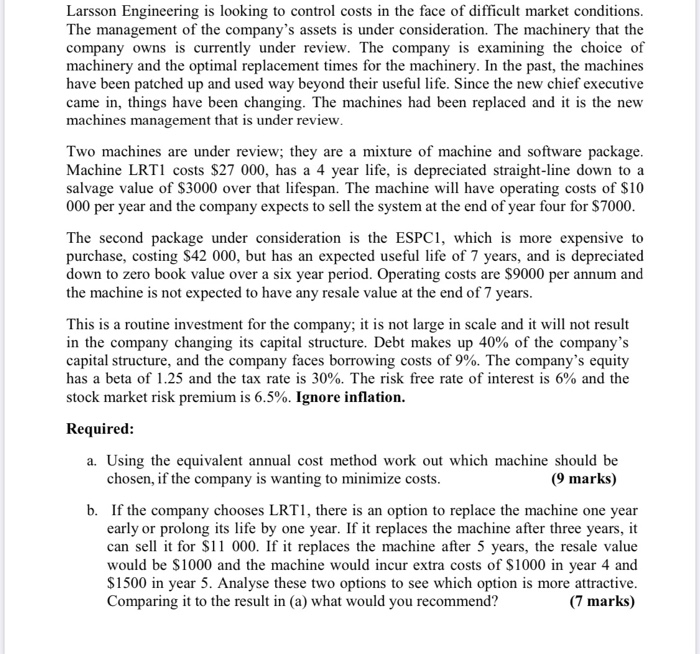

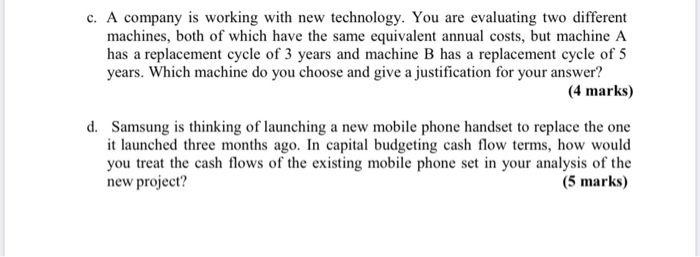

Larsson Engineering is looking to control costs in the face of difficult market conditions. The management of the company's assets is under consideration. The machinery that the company owns is currently under review. The company is examining the choice of machinery and the optimal replacement times for the machinery. In the past, the machines have been patched up and used way beyond their useful life. Since the new chief executive came in, things have been changing. The machines had been replaced and it is the new machines management that is under review. Two machines are under review; they are a mixture of machine and software package. Machine LRT1 costs $27 000, has a 4 year life, is depreciated straight-line down to a salvage value of $3000 over that lifespan. The machine will have operating costs of $10 000 per year and the company expects to sell the system at the end of year four for $7000. The second package under consideration is the ESPC, which is more expensive to purchase, costing $42 000, but has an expected useful life of 7 years, and is depreciated down to zero book value over a six year period. Operating costs are $9000 per annum and the machine is not expected to have any resale value at the end of 7 years. This is a routine investment for the company; it is not large in scale and it will not result in the company changing its capital structure. Debt makes up 40% of the company's capital structure, and the company faces borrowing costs of 9%. The company's equity has a beta of 1.25 and the tax rate is 30%. The risk free rate of interest is 6% and the stock market risk premium is 6.5%. Ignore inflation. Required: a. Using the equivalent annual cost method work out which machine should be chosen, if the company is wanting to minimize costs. (9 marks) b. If the company chooses LRT1, there is an option to replace the machine one year early or prolong its life by one year. If it replaces the machine after three years, it can sell it for $11 000. If it replaces the machine after 5 years, the resale value would be $1000 and the machine would incur extra costs of $1000 in year 4 and $1500 in year 5. Analyse these two options to see which option is more attractive. Comparing it to the result in (a) what would you recommend? (7 marks) c. A company is working with new technology. You are evaluating two different machines, both of which have the same equivalent annual costs, but machine A has a replacement cycle of 3 years and machine B has a replacement cycle of 5 years. Which machine do you choose and give a justification for your answer? (4 marks) d. Samsung is thinking of launching a new mobile phone handset to replace the one it launched three months ago. In capital budgeting cash flow terms, how would you treat the cash flows of the existing mobile phone set in your analysis of the new project