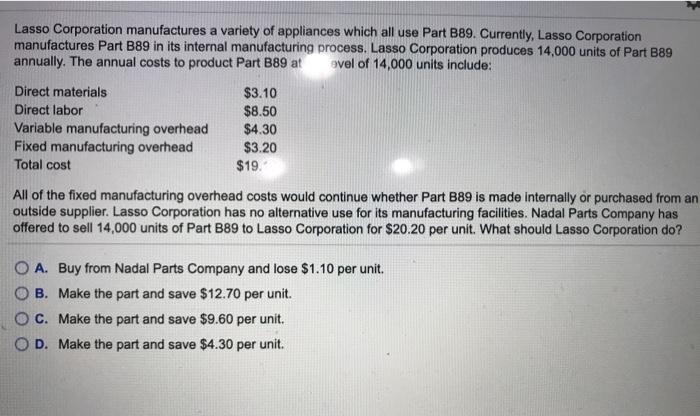

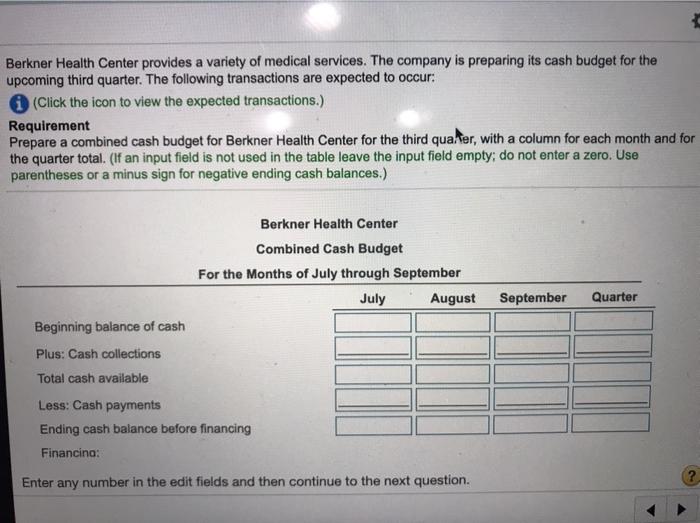

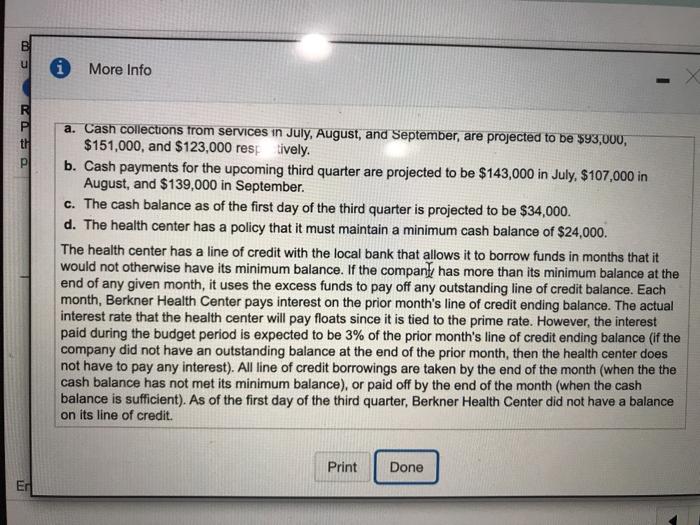

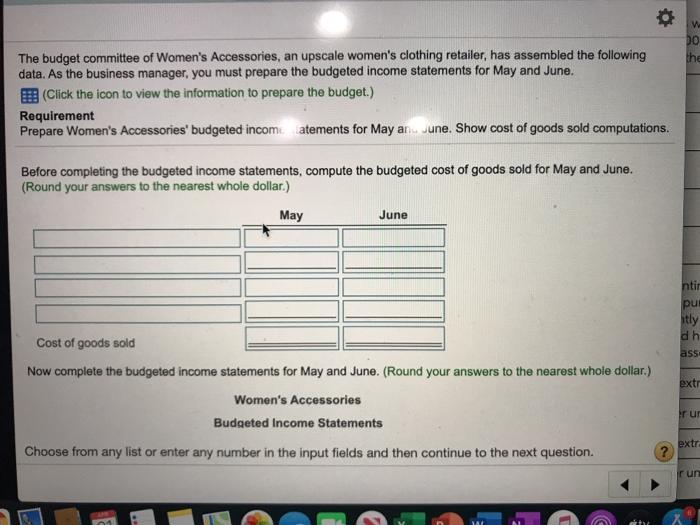

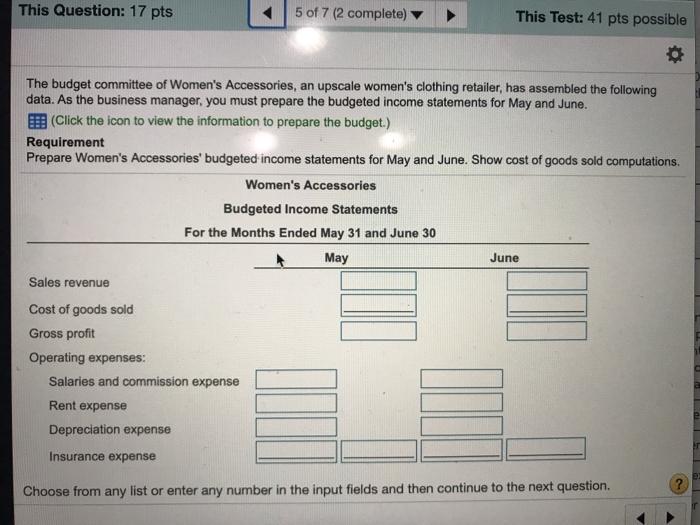

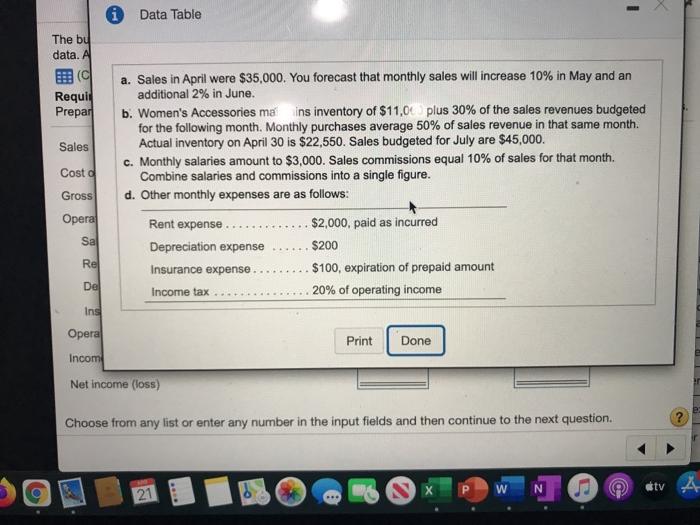

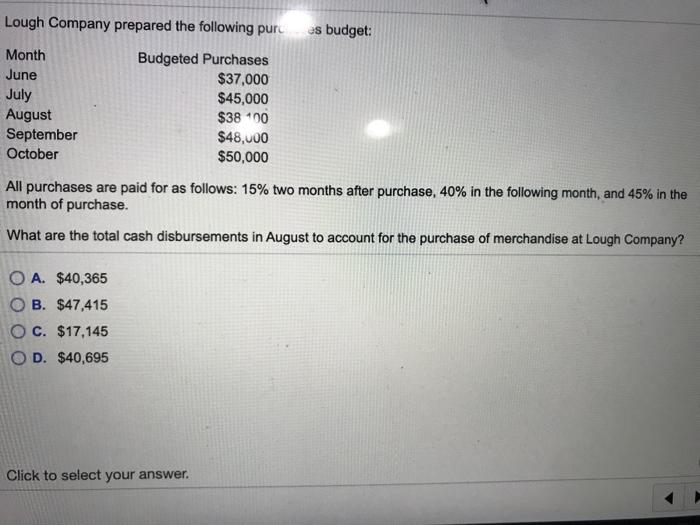

Lasso Corporation manufactures a variety of appliances which all use Part 889. Currently, Lasso Corporation manufactures Part 389 in its internal manufacturing process. Lasso Corporation produces 14,000 units of Part 889 annually. The annual costs to product Part 389 at evel of 14,000 units include: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost $3.10 $8.50 $4.30 $3.20 $19. All of the fixed manufacturing overhead costs would continue whether Part 889 is made internally or purchased from an outside supplier. Lasso Corporation has no alternative use for its manufacturing facilities. Nadal Parts Company has offered to sell 14,000 units of Part 389 to Lasso Corporation for $20.20 per unit. What should Lasso Corporation do? O A. Buy from Nadal Parts Company and lose $1.10 per unit. B. Make the part and save $12.70 per unit. C. Make the part and save $9.60 per unit. OD. Make the part and save $4.30 per unit. Berkner Health Center provides a variety of medical services. The company is preparing its cash budget for the upcoming third quarter. The following transactions are expected to occur: (Click the icon to view the expected transactions.) Requirement Prepare a combined cash budget for Berkner Health Center for the third quaker, with a column for each month and for the quarter total. (If an input field is not used in the table leave the input field empty; do not enter a zero. Use parentheses or a minus sign for negative ending cash balances.) September Quarter Berkner Health Center Combined Cash Budget For the Months of July through September July August Beginning balance of cash Plus: Cash collections Total cash available Less: Cash payments Ending cash balance before financing Financina: Enter any number in the edit fields and then continue to the next question. (? u More Info R th P a. Cash collections from services in July, August, and September, are projected to be $93,000, $151,000, and $123,000 resptively. b. Cash payments for the upcoming third quarter are projected to be $143,000 in July, $107.000 in August, and $139,000 in September. c. The cash balance as of the first day of the third quarter is projected to be $34,000. d. The health center has a policy that it must maintain a minimum cash balance of $24,000. The health center has a line of credit with the local bank that allows it to borrow funds in months that it would not otherwise have its minimum balance. If the company has more than its minimum balance at the end of any given month, it uses the excess funds to pay off any outstanding line of credit balance. Each month, Berkner Health Center pays interest on the prior month's line of credit ending balance. The actual interest rate that the health center will pay floats since it is tied to the prime rate. However, the interest paid during the budget period is expected to be 3% of the prior month's line of credit ending balance (if the company did not have an outstanding balance at the end of the prior month, then the health center does not have to pay any interest). All line of credit borrowings are taken by the end of the month (when the the cash balance has not met its minimum balance), or paid off by the end of the month (when the cash balance is sufficient). As of the first day of the third quarter, Berkner Health Center did not have a balance on its line of credit. Print Done DO the The budget committee of Women's Accessories, an upscale women's clothing retailer, has assembled the following data. As the business manager, you must prepare the budgeted income statements for May and June. (Click the icon to view the information to prepare the budget.) Requirement Prepare Women's Accessories' budgeted incomatements for May an une. Show cost of goods sold computations. Before completing the budgeted income statements, compute the budgeted cost of goods sold for May and June. (Round your answers to the nearest whole dollar) May June ntir pu htly dh ass extr Cost of goods sold Now complete the budgeted income statements for May and June. (Round your answers to the nearest whole dollar.) Women's Accessories Budgeted Income Statements Choose from any list or enter any number in the input fields and then continue to the next question. rur extr run This Question: 17 pts 5 of 7 (2 complete) This Test: 41 pts possible The budget committee of Women's Accessories, an upscale women's clothing retailer, has assembled the following data. As the business manager, you must prepare the budgeted income statements for May and June. (Click the icon to view the information to prepare the budget.) Requirement Prepare Women's Accessories' budgeted income statements for May and June. Show cost of goods sold computations. Women's Accessories Budgeted Income Statements For the Months Ended May 31 and June 30 May June Sales revenue Cost of goods sold Gross profit Operating expenses: Salaries and commission expense Rent expense Depreciation expense Insurance expense Choose from any list or enter any number in the input fields and then continue to the next question. i Data Table The bu data. A Requit Prepar Sales Costo a. Sales in April were $35,000. You forecast that monthly sales will increase 10% in May and an additional 2% in June. b. Women's Accessories ma ins inventory of $11,00 plus 30% of the sales revenues budgeted for the following month. Monthly purchases average 50% of sales revenue in that same month. Actual inventory on April 30 is $22,550. Sales budgeted for July are $45,000. c. Monthly salaries amount to $3,000. Sales commissions equal 10% of sales for that month. Combine salaries and commissions into a single figure. d. Other monthly expenses are as follows: Rent expense ........ $2,000, paid as incurred Depreciation expense $200 Insurance expense. $100, expiration of prepaid amount Income tax 20% of operating income Gross Opera Sa Re De Ins Opera Print Done Incom Net income (loss) Choose from any list or enter any number in the input fields and then continue to the next question. P W N ty E NX o 21 Lough Company prepared the following puru es budget: Month Budgeted Purchases June $37,000 July $45,000 August $38 100 September $48,000 October $50,000 All purchases are paid for as follows: 15% two months after purchase, 40% in the following month, and 45% in the month of purchase. What are the total cash disbursements in August to account for the purchase of merchandise at Lough Company? O A. $40,365 OB. $47,415 O c. $17,145 D. $40,695 Click to select your