Answered step by step

Verified Expert Solution

Question

1 Approved Answer

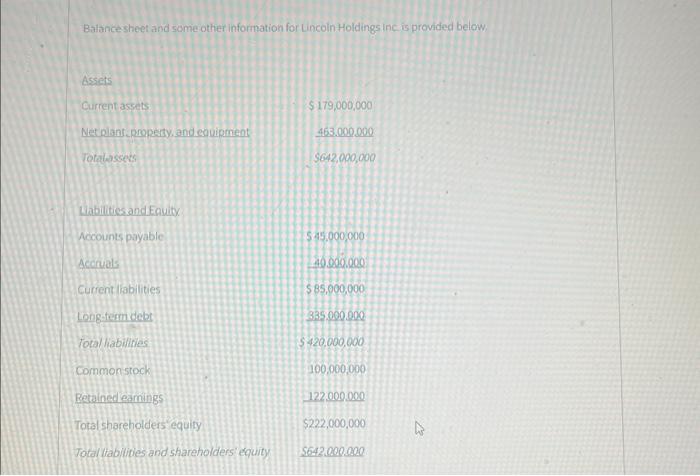

last 3 digits is 676 Balancesheet and some other information for Lincoln Holdings inc is provided belcw - Lncolin Hoidings' noncallable $1,000 par value, 20

last 3 digits is 676

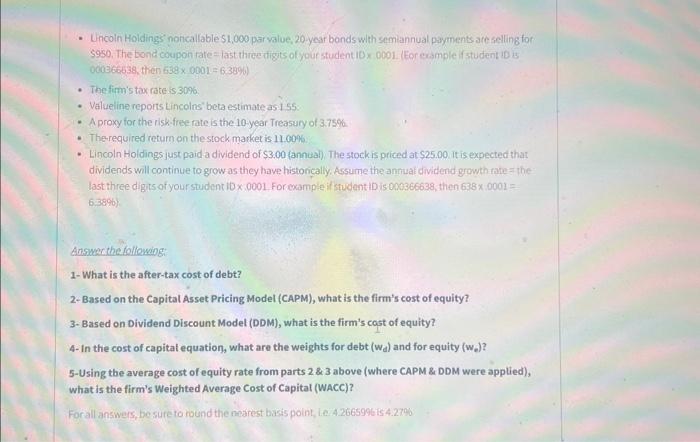

Balancesheet and some other information for Lincoln Holdings inc is provided belcw - Lncolin Hoidings' noncallable $1,000 par value, 20 year bonds with semiannual payments ate selling for 5950. The bond coupon rate= last threedigts ofyoue studentiox 0001. (For example if student io is 060366538, then 658.0001=6339% - The firm's tax rate is 309 . - Valueline reports Lincolns' beta estimate as is5. - A proxy for the rish. frae rate is the 10-year Treasury of 3.75% - Therequired retum on thestock market is 11.00% - Lincoln Holdings just paid a dividend of $3.00 (annuai). The stockis priced at $25.00. it is expected that dividends will continue to grow as they have historically. Assume the antual dividend growthrne = the last three digts of your student i0 x 0001. Forexample if studentiD is 000366638 , then 63800001= 63896) Answarthe following 1- What is the after-tax cost of debt? 2-Based on the Capital Asset Pricing Model (CAPM), what is the firm's cost of equity? 3- Based on Dividend Discount Model (DDM), what is the firm's cast of equity? 4- In the cost of capital equation, what are the weights for debt ( wd) and for equity (we) ? 5-Using the average cost of equity rate from parts 2&3 above (where CAPM \& DDM were applied), what is the firm's Weighted Average Cost of Capital (WACC)? Forall answers, be sure to round the nearest basis point, i.e 4.2665996 is 4.2796

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started