Answered step by step

Verified Expert Solution

Question

1 Approved Answer

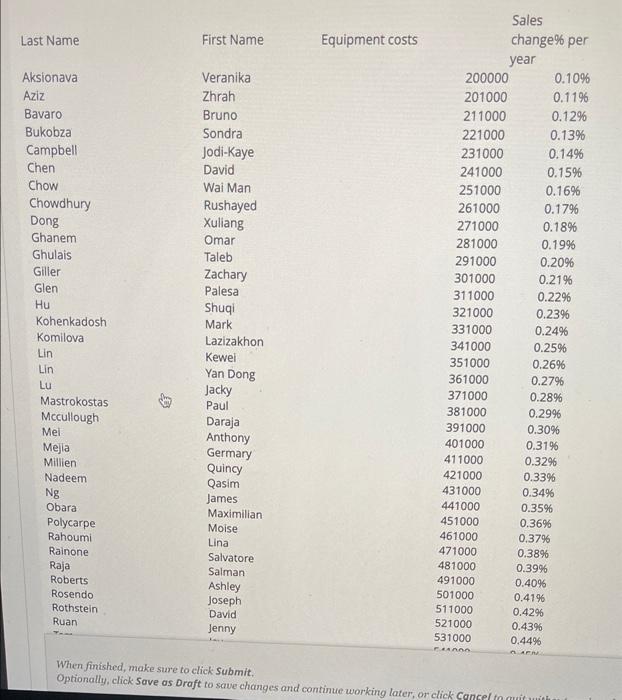

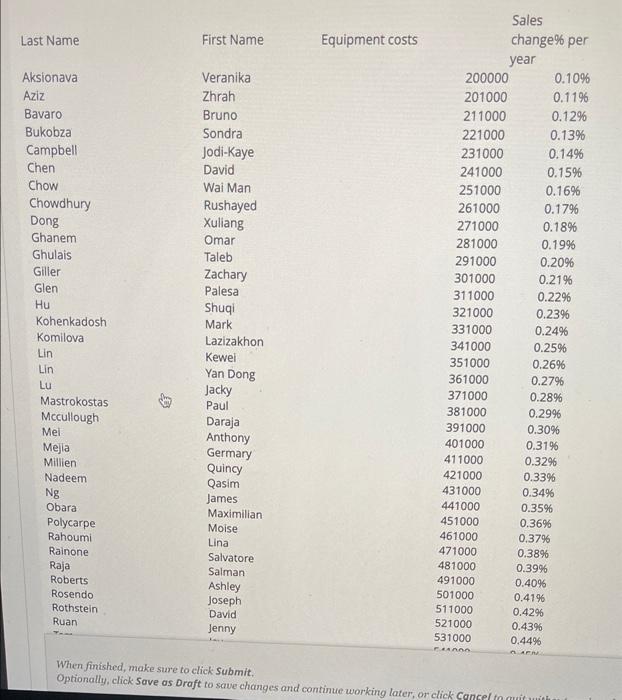

Last Name First Name Equipment costs Aksionava Aziz Bavaro Bukobza Campbell Chen Chow Chowdhury Dong Ghanem Ghulais Giller Glen Hu Kohenkadosh Komilova Lin Lin Lu

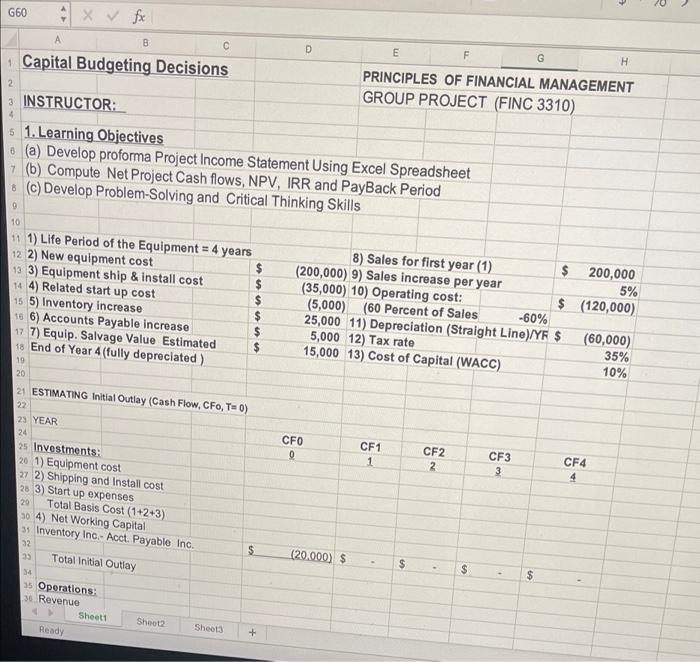

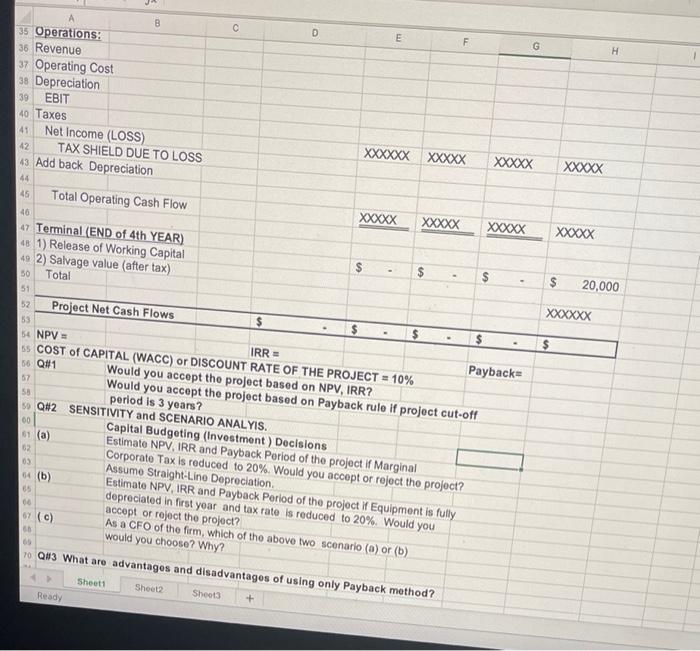

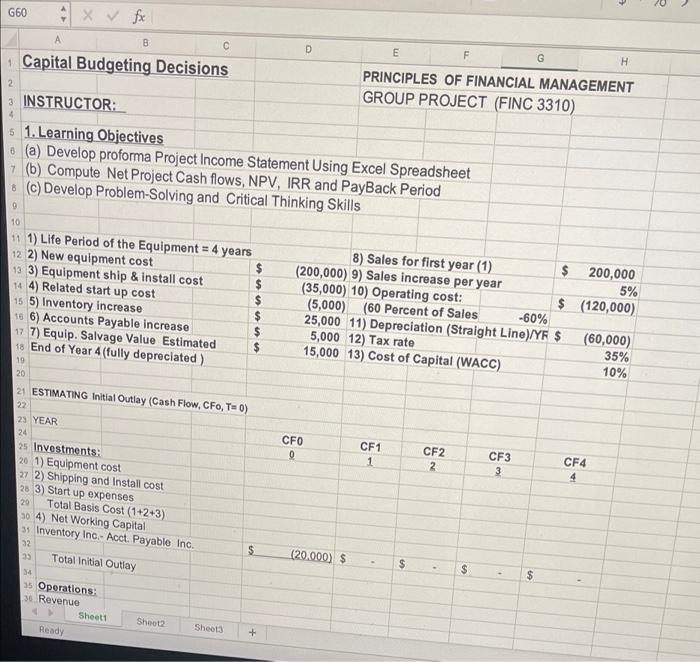

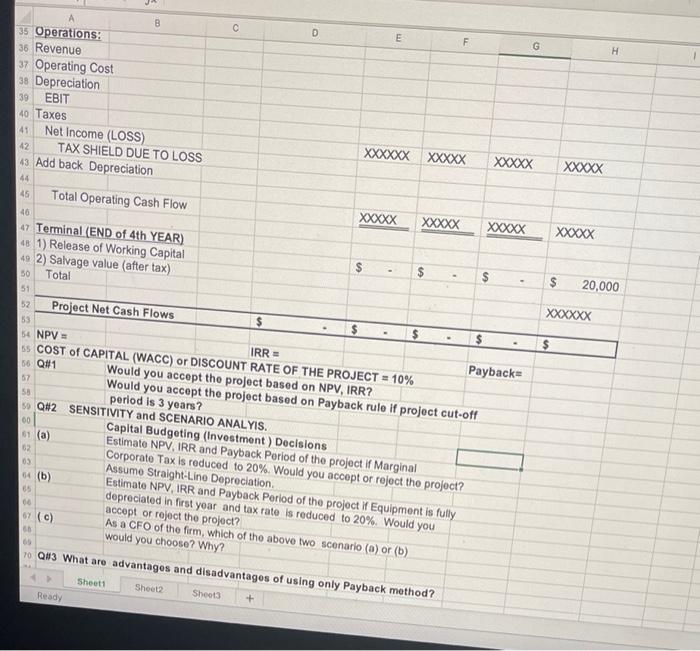

Last Name First Name Equipment costs Aksionava Aziz Bavaro Bukobza Campbell Chen Chow Chowdhury Dong Ghanem Ghulais Giller Glen Hu Kohenkadosh Komilova Lin Lin Lu Mastrokostas Mccullough Mei Mejia Millien Nadeem Ng Obara Polycarpe Rahoumi Rainone Raja Roberts Rosendo Rothstein Ruan Veranika Zhrah Bruno Sondra Jodi-Kaye David Wai Man Rushayed Xuliang Omar Taleb Zachary Palesa Shugi Mark Lazizakhon Kewei Yan Dong Jacky Paul Daraja Anthony Germary Quincy Qasim James Maximilian Moise Lina Salvatore Salman Ashley Joseph David Jenny Sales change% per year 200000 0.10% 201000 0.1196 211000 0.12% 221000 0.13% 231000 0.14% 241000 0.15% 251000 0.16% 261000 0.1796 271000 0.18% 281000 0.1996 291000 0.20% 301000 0.21% 311000 0.2296 321000 0.2396 331000 0.24% 341000 0.25% 351000 0.2696 361000 0.2796 371000 0.28% 381000 0.2996 391000 0.30% 401000 0.3196 411000 0.3296 421000 0.33% 431000 0.34% 441000 0.35% 451000 0.3696 461000 0.37% 471000 0.38% 481000 0.39% 491000 0.4096 501000 0.41% 511000 0.42% 521000 0.4396 531000 0.4496 ANA AR When finished, make sure to click Submit. Optionally, click Save as Draft to save changes and continue working later, or click Cancel to amit with 20 G60 X fx A C D E F Capital Budgeting Decisions H 2 PRINCIPLES OF FINANCIAL MANAGEMENT GROUP PROJECT (FINC 3310) 3 INSTRUCTOR: 4 51. Learning Objectives (a) Develop proforma Project Income Statement Using Excel Spreadsheet 7 (6) Compute Net Project Cash flows, NPV, IRR and PayBack Period 8C) Develop Problem Solving and Critical Thinking Skills 9 10 11 1) Life Period of the Equipment = 4 years 12 2) New equipment cost $ 123) Equipment ship & Install cost $ 14 4) Related start up cost $ 15 5) Inventory increase $ 16 6) Accounts Payable increase $ 17 7) Equip. Salvage Value Estimated $ 18 End of Year 4 (fully depreciated) 8) Sales for first year (1) $ 200,000 (200,000) 9) Sales increase per year 5% (35,000) 10) Operating cost: $ (120,000) (5,000) (60 Percent of Sales -60% 25,000 11) Depreciation (Straight Line)/YF $ (60,000) 5,000 12) Tax rate 35% 15,000 13) Cost of Capital (WACC) 10% 19 20 21 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) 22 23 YEAR 24 CFO 0 CF1 1 CF2 2 CF3 3 CF4 4 20 25 Investments: 201) Equipment cost 27 2) Shipping and Install cost 28 3) Start up expenses Total Basis Cost (1+2+3) 30 4) Net Working Capital > Inventory Inc.- Acct. Payable Inc. 32 33 Total Initial Outlay 34 35 Operations 36 Revenue Sheet Sheet2 Sheets Ready $ (20.000) $ $ $ $ $ + B c D E F G H 35 Operations: 36 Revenue 37 Operating cost 38 Depreciation 39 EBIT 40 Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS 43 Add back Depreciation 41 42 XXXXXXXXXXX XXXXX 44 45 Total Operating Cash Flow 46 XXXXX XXXXX XXXXX 47 Terminal (END of 4th YEAR) 1) Release of Working Capital 422) Salvage value (after tax) 50 Total $ $ $ $ 20,000 51 52 XXXXXX 58 00 Project Net Cash Flows 53 54 NPV = IRR = Payback 5 COST OF CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% 56 Q#1 Would you accept the project based on NPV, IRR? 57 Would you accept the project based on Payback rule if project cut-off period is 3 years? - Q#2 SENSITIVITY and SCENARIO ANALYIS. Capital Budgeting (Investment ) Decisions 61 (a) Estimate NPV IRR and Payback period of the project if Marginal 62 Corporate Tax is reduced to 20%. Would you accept or reject tho project? Assumo Straight-Line Depreciation 4 (b) Estimate NPV, IRR and Payback Period of the project if Equipment is fully deprecated in first year and tax rate is reduced to 20%. Would you accept or reject the project? 67 (C) As a CFO of the firm, which of the above two scenario () or (b) would you choose? Why? 03 00 66 69 70 Q#3 What are advantages and disadvantages of using only Payback method? Sheet1 Sheet2 Sheets Ready +

Last Name First Name Equipment costs Aksionava Aziz Bavaro Bukobza Campbell Chen Chow Chowdhury Dong Ghanem Ghulais Giller Glen Hu Kohenkadosh Komilova Lin Lin Lu Mastrokostas Mccullough Mei Mejia Millien Nadeem Ng Obara Polycarpe Rahoumi Rainone Raja Roberts Rosendo Rothstein Ruan Veranika Zhrah Bruno Sondra Jodi-Kaye David Wai Man Rushayed Xuliang Omar Taleb Zachary Palesa Shugi Mark Lazizakhon Kewei Yan Dong Jacky Paul Daraja Anthony Germary Quincy Qasim James Maximilian Moise Lina Salvatore Salman Ashley Joseph David Jenny Sales change% per year 200000 0.10% 201000 0.1196 211000 0.12% 221000 0.13% 231000 0.14% 241000 0.15% 251000 0.16% 261000 0.1796 271000 0.18% 281000 0.1996 291000 0.20% 301000 0.21% 311000 0.2296 321000 0.2396 331000 0.24% 341000 0.25% 351000 0.2696 361000 0.2796 371000 0.28% 381000 0.2996 391000 0.30% 401000 0.3196 411000 0.3296 421000 0.33% 431000 0.34% 441000 0.35% 451000 0.3696 461000 0.37% 471000 0.38% 481000 0.39% 491000 0.4096 501000 0.41% 511000 0.42% 521000 0.4396 531000 0.4496 ANA AR When finished, make sure to click Submit. Optionally, click Save as Draft to save changes and continue working later, or click Cancel to amit with 20 G60 X fx A C D E F Capital Budgeting Decisions H 2 PRINCIPLES OF FINANCIAL MANAGEMENT GROUP PROJECT (FINC 3310) 3 INSTRUCTOR: 4 51. Learning Objectives (a) Develop proforma Project Income Statement Using Excel Spreadsheet 7 (6) Compute Net Project Cash flows, NPV, IRR and PayBack Period 8C) Develop Problem Solving and Critical Thinking Skills 9 10 11 1) Life Period of the Equipment = 4 years 12 2) New equipment cost $ 123) Equipment ship & Install cost $ 14 4) Related start up cost $ 15 5) Inventory increase $ 16 6) Accounts Payable increase $ 17 7) Equip. Salvage Value Estimated $ 18 End of Year 4 (fully depreciated) 8) Sales for first year (1) $ 200,000 (200,000) 9) Sales increase per year 5% (35,000) 10) Operating cost: $ (120,000) (5,000) (60 Percent of Sales -60% 25,000 11) Depreciation (Straight Line)/YF $ (60,000) 5,000 12) Tax rate 35% 15,000 13) Cost of Capital (WACC) 10% 19 20 21 ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) 22 23 YEAR 24 CFO 0 CF1 1 CF2 2 CF3 3 CF4 4 20 25 Investments: 201) Equipment cost 27 2) Shipping and Install cost 28 3) Start up expenses Total Basis Cost (1+2+3) 30 4) Net Working Capital > Inventory Inc.- Acct. Payable Inc. 32 33 Total Initial Outlay 34 35 Operations 36 Revenue Sheet Sheet2 Sheets Ready $ (20.000) $ $ $ $ $ + B c D E F G H 35 Operations: 36 Revenue 37 Operating cost 38 Depreciation 39 EBIT 40 Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS 43 Add back Depreciation 41 42 XXXXXXXXXXX XXXXX 44 45 Total Operating Cash Flow 46 XXXXX XXXXX XXXXX 47 Terminal (END of 4th YEAR) 1) Release of Working Capital 422) Salvage value (after tax) 50 Total $ $ $ $ 20,000 51 52 XXXXXX 58 00 Project Net Cash Flows 53 54 NPV = IRR = Payback 5 COST OF CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% 56 Q#1 Would you accept the project based on NPV, IRR? 57 Would you accept the project based on Payback rule if project cut-off period is 3 years? - Q#2 SENSITIVITY and SCENARIO ANALYIS. Capital Budgeting (Investment ) Decisions 61 (a) Estimate NPV IRR and Payback period of the project if Marginal 62 Corporate Tax is reduced to 20%. Would you accept or reject tho project? Assumo Straight-Line Depreciation 4 (b) Estimate NPV, IRR and Payback Period of the project if Equipment is fully deprecated in first year and tax rate is reduced to 20%. Would you accept or reject the project? 67 (C) As a CFO of the firm, which of the above two scenario () or (b) would you choose? Why? 03 00 66 69 70 Q#3 What are advantages and disadvantages of using only Payback method? Sheet1 Sheet2 Sheets Ready +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started