Answered step by step

Verified Expert Solution

Question

1 Approved Answer

last one please help Question 5 Peter Ltd is a holding company that owns and controls a number of companies. The Board of Directors is

last one please help

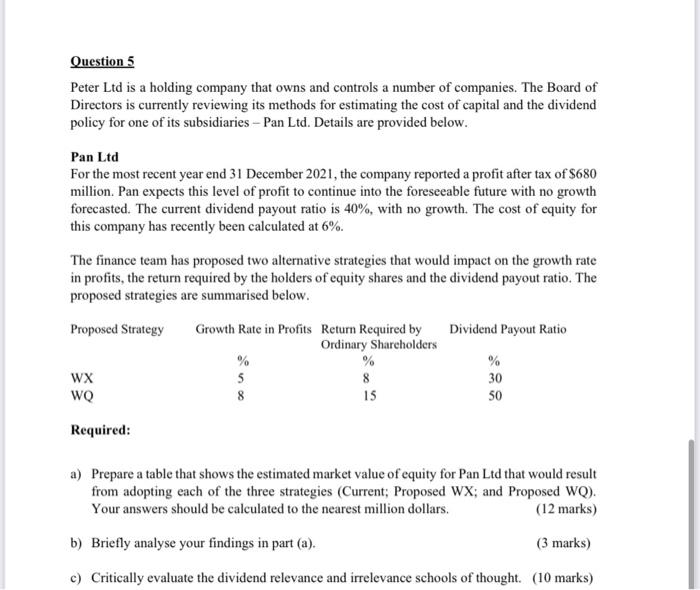

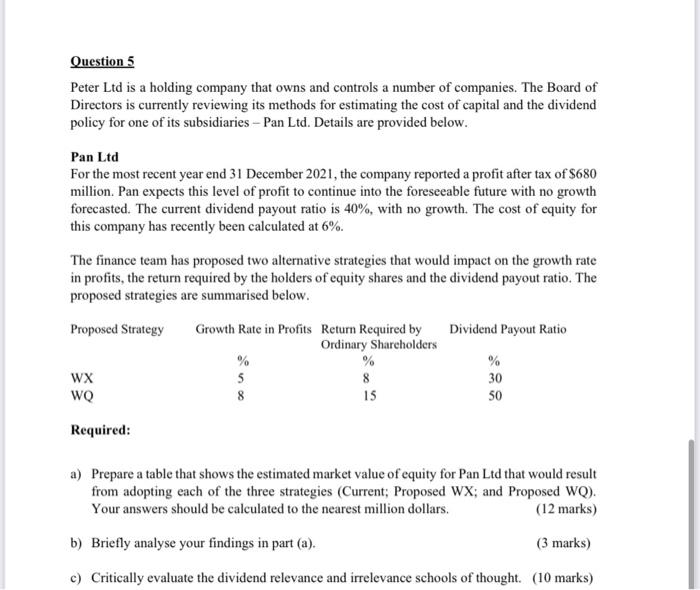

Question 5 Peter Ltd is a holding company that owns and controls a number of companies. The Board of Directors is currently reviewing its methods for estimating the cost of capital and the dividend policy for one of its subsidiaries - Pan Ltd. Details are provided below. Pan Ltd For the most recent year end 31 December 2021, the company reported a profit after tax of $680 million. Pan expects this level of profit to continue into the foreseeable future with no growth forecasted. The current dividend payout ratio is 40%, with no growth. The cost of equity for this company has recently been calculated at 6%. The finance team has proposed two alternative strategies that would impact on the growth rate in profits, the return required by the holders of equity shares and the dividend payout ratio. The proposed strategies are summarised below. Proposed Strategy Dividend Payout Ratio Growth Rate in Profits Return Required by Ordinary Shareholders % % 5 8 8 15 WX WQ % 30 50 Required: a) Prepare a table that shows the estimated market value of equity for Pan Ltd that would result from adopting each of the three strategies (Current: Proposed WX; and Proposed WO). Your answers should be calculated to the nearest million dollars. (12 marks) b) Briefly analyse your findings in part (a). (3 marks) c) Critically evaluate the dividend relevance and irrelevance schools of thought. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started