Answered step by step

Verified Expert Solution

Question

1 Approved Answer

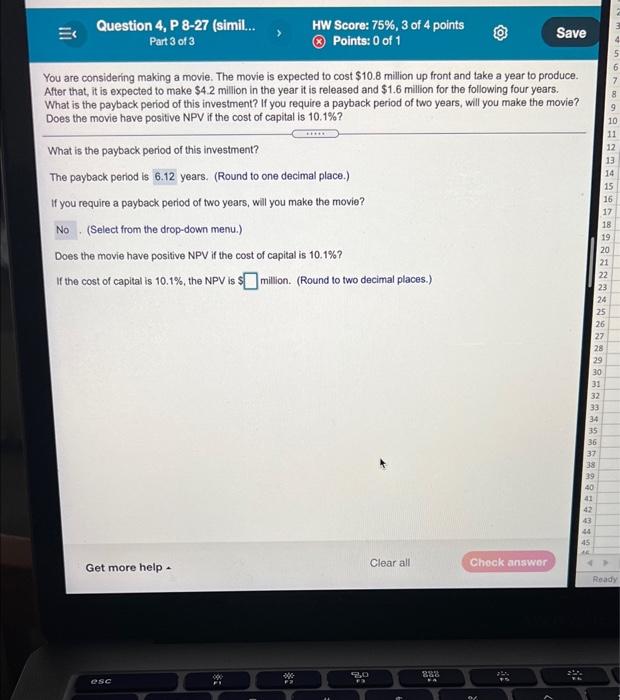

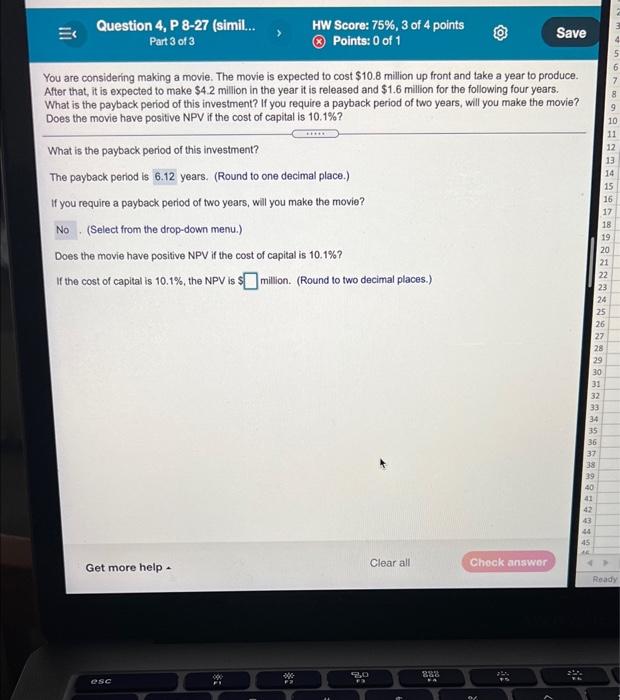

last question Question 4, P 8-27 (simil... Part 3 of 3 HW Score: 75%, 3 of 4 points Points: 0 of 1 Save 4 You

last question

Question 4, P 8-27 (simil... Part 3 of 3 HW Score: 75%, 3 of 4 points Points: 0 of 1 Save 4 You are considering making a movie. The movie is expected to cost $10.8 million up front and take a year to produce. After that, it is expected to make $4.2 million in the year it is released and $1.6 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.1%? What is the payback period of this investment? The payback period is 6.12 years. (Round to one decimal place.) If you require a payback period of two years, will you make the movie? No. (Select from the drop-down menu.) Does the movie have positive NPV if the cost of capital is 10.1%? If the cost of capital is 10.1%, the NPV is $ million. (Round to two decimal places.) 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 Get more help Clear all Check answer Ready 30 888 CSC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started