Question

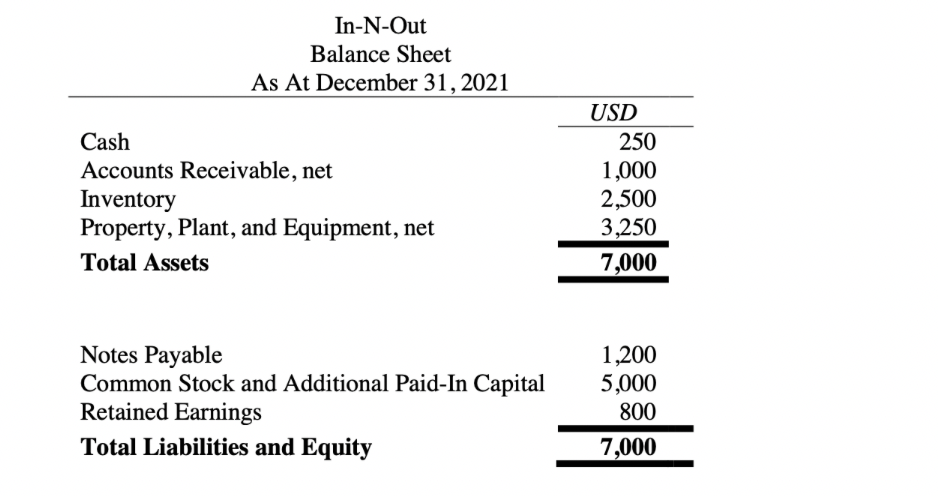

Last summer, Anonymous worked as an accounting intern at In-N-Out. Anonymous will begin work with the company's balance sheet as at December 31, 2021. During

Last summer, Anonymous worked as an accounting intern at In-N-Out. Anonymous will begin work with the company's balance sheet as at December 31, 2021.

During the year 2022, the following transactions occurred: On January 2, 2022, In-N-Out sold 15 tumblers on account to Podcast Corp for $20 per tumbler. The terms of the contract were FOB destination and 5/15, n/45. The cost of each tumbler to In-N-Out was $12. The tumblers left In-N-Out facility on January 3 and arrived at Podcast Corp's facility on January 4. Podcast Corp returned 3 tumblers to In-N-Out on January 6. The returned tumblers were shipped and delivered on January 6. On January 13, Podcast Corp made a cash payment to In-N-Out for all the outstanding balance on account for the inventory purchased on January 2, 2022. Both In-N-Out and Podcast Corp use the perpetual method to account for inventory.

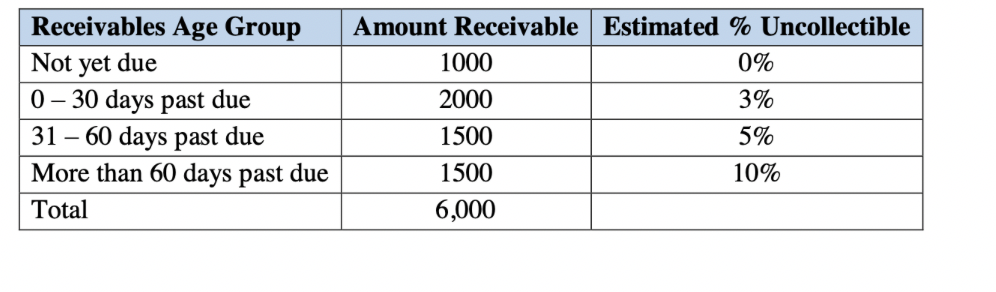

During the year ending December 31, 2022, In-N-Out made other credit sales for $6,000. The total cost of these other sales to In-N-Out was $2,000. The beginning account receivable (i.e. the amount on the December 31, 2021 balance sheet) is already net of the beginning balance on allowance for doubtful accounts which had a credit balance of $200. During the year ending December 31, 2022, In-N-Out received $1,000 worth of checks from its accounts receivables. The balance on accounts receivable as at December 31, 2022 was a debit of $6,000 with the following aging schedule:

December 31, 2022 was a debit of $6,000 with the following aging schedule:

In-N-Out pre-reconciliation cash account balance (prior to receiving the bank statement) for December 31, 2022 was equal to $3,530. The bank statement on December 31, 2022 yields a cash account balance equal to $1,310. In-N-Out gathers the following information to prepare the bank reconciliation for December 31, 2022.

Outstanding checks are equal to $870. On December 11, 2022, In-N-Out incorrectly recorded a receipt on its accounts receivable of $2,280. The bank statement shows the correct receipt of $228. Deposits in transit are equal to $475. The bank statement yields one NSF check of $250. Interest received of $15 is reported on the bank statement Service charge of $70 is reported on the bank statement An automatic payment (i.e. autopay) of $200 to JPM Bank for notes payable owed by In-N-Out is reported on the bank statement.

The property, plant, and equipment balance of $3,250 on the balance sheet relates to an equipment purchased on July 1, 2019. In-N-Out purchased this equipment for $6,000 with a loan from JPM Bank. In-N-Out estimated the useful life of the equipment to be 5 years with an estimated salvage value of $500. The company uses the straight-line method of depreciation. On December 31, 2022, In-N-Out expects the equipment to generate $2,000 of future cash flows. On December 31, 2022, the fair market value of the equipment is $1,900.

Required: A. Prepare In-N-Out's income statement for the year ended December 31, 2022 B. Prepare In-N-Out's balance sheet as at December 31, 2022

In-N-Out Balance Sheet As At December 31, 2021 \begin{tabular}{lr} \hline & USD \\ \cline { 2 } Cash & 250 \\ Accounts Receivable, net & 1,000 \\ Inventory & 2,500 \\ Property, Plant, and Equipment, net & 3,250 \\ Total Assets & 7,000 \\ \hline \end{tabular} \begin{tabular}{lr} Notes Payable & 1,200 \\ Common Stock and Additional Paid-In Capital & 5,000 \\ Retained Earnings & 800 \\ Total Liabilities and Equity & 7,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline Receivables Age Group & Amount Receivable & Estimated \% Uncollectible \\ \hline Not yet due & 1000 & 0% \\ \hline 030 days past due & 2000 & 3% \\ \hline 3160 days past due & 1500 & 5% \\ \hline More than 60 days past due & 1500 & 10% \\ \hline Total & 6,000 & \\ \hline \end{tabular} In-N-Out Balance Sheet As At December 31, 2021 \begin{tabular}{lr} \hline & USD \\ \cline { 2 } Cash & 250 \\ Accounts Receivable, net & 1,000 \\ Inventory & 2,500 \\ Property, Plant, and Equipment, net & 3,250 \\ Total Assets & 7,000 \\ \hline \end{tabular} \begin{tabular}{lr} Notes Payable & 1,200 \\ Common Stock and Additional Paid-In Capital & 5,000 \\ Retained Earnings & 800 \\ Total Liabilities and Equity & 7,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline Receivables Age Group & Amount Receivable & Estimated \% Uncollectible \\ \hline Not yet due & 1000 & 0% \\ \hline 030 days past due & 2000 & 3% \\ \hline 3160 days past due & 1500 & 5% \\ \hline More than 60 days past due & 1500 & 10% \\ \hline Total & 6,000 & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started