Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last year, Harrington Inc. had sales of $325,000 and net income of $19,000; its year-end assets were $250,000. The firm's total debt to total assets

Last year, Harrington Inc. had sales of $325,000 and net income of $19,000; its year-end assets were $250,000. The firm's total debt to total assets ratio was 45.0%. What is the ROE?

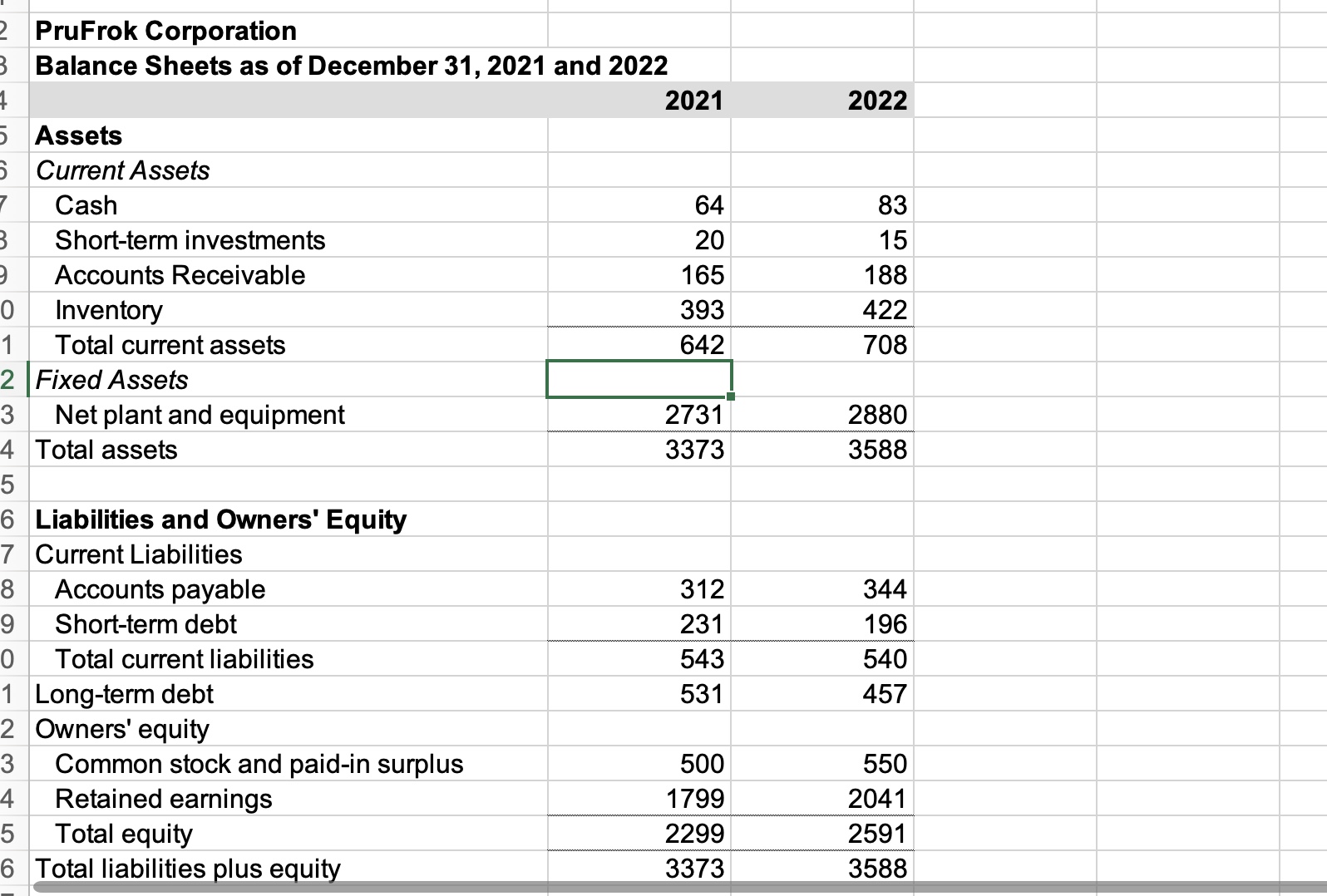

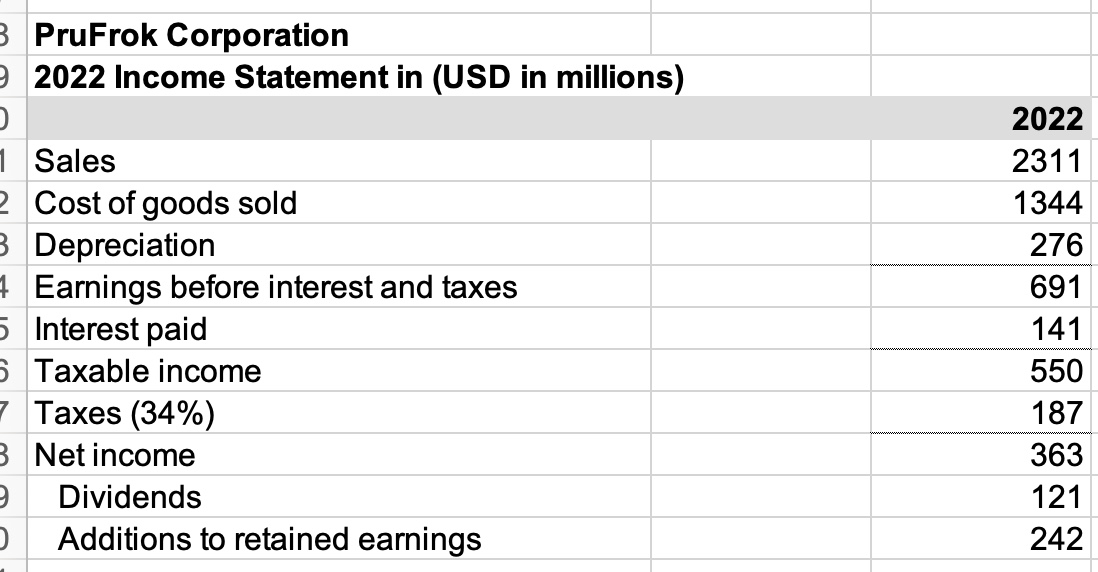

PruFrok Corporation Balance Sheets as of December 31, 2021 and 2022 \begin{tabular}{|c|c|c|} \hline & 2021 & 2022 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Current Assets } \\ \hline Cash & 64 & 83 \\ \hline Short-term investments & 20 & 15 \\ \hline Accounts Receivable & 165 & 188 \\ \hline Inventory & 393 & 422 \\ \hline Total current assets & 642 & 708 \\ \hline \multicolumn{3}{|l|}{ Fixed Assets } \\ \hline Net plant and equipment & 2731 & 2880 \\ \hline Total assets & 3373 & 3588 \\ \hline \multicolumn{3}{|l|}{ Liabilities and Owners' Equity } \\ \hline \multicolumn{3}{|l|}{ Current Liabilities } \\ \hline Accounts payable & 312 & 344 \\ \hline Short-term debt & 231 & 196 \\ \hline Total current liabilities & 543 & 540 \\ \hline Long-term debt & 531 & 457 \\ \hline \multicolumn{3}{|l|}{ Owners' equity } \\ \hline Common stock and paid-in surplus & 500 & 550 \\ \hline Retained earnings & 1799 & 2041 \\ \hline Total equity & 2299 & 2591 \\ \hline Total liabilities plus equity & 3373 & 3588 \\ \hline \end{tabular} PruFrok Corporation 2022 Income Statement in (USD in millions) \begin{tabular}{|l|r|r|} \hline & 2022 \\ \hline Sales & 2311 \\ \hline Cost of goods sold & 1344 \\ \hline Depreciation & 276 \\ \hline Earnings before interest and taxes & 691 \\ \hline Interest paid & 141 \\ \hline Taxable income & 550 \\ \hline Taxes (34\%) & 187 \\ \hline Net income & 363 \\ \hline Dividends & 121 \\ \hline Additions to retained earnings & 242 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started