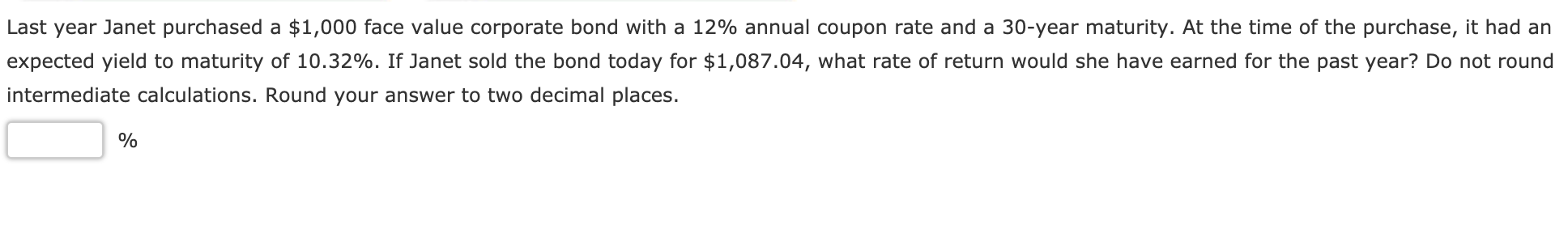

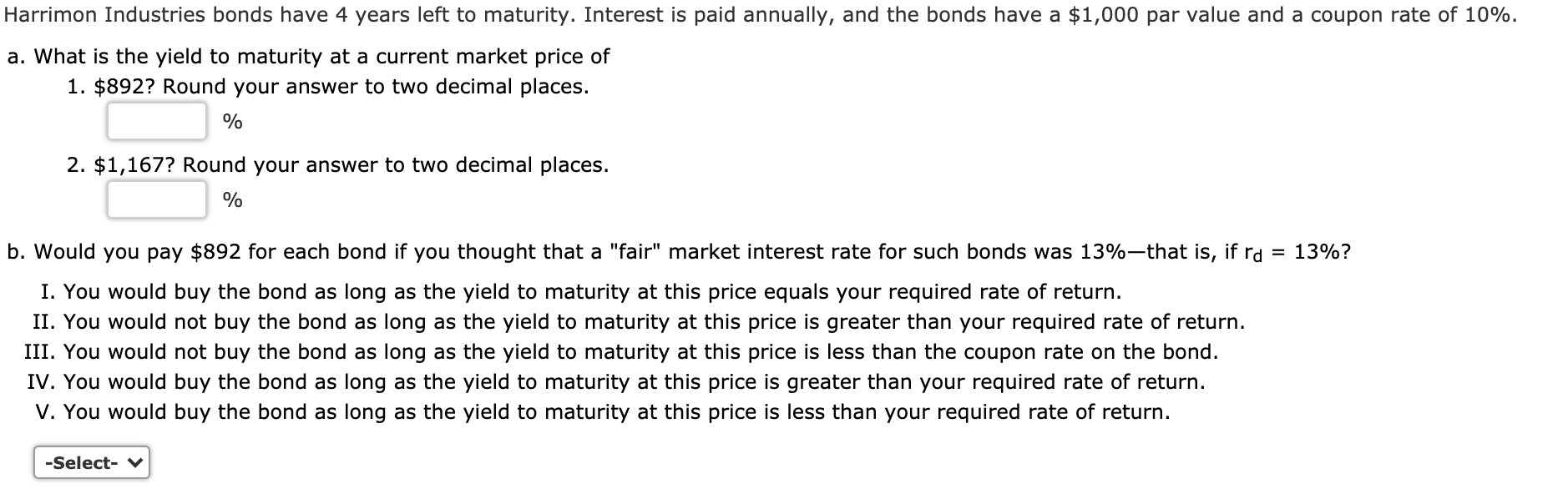

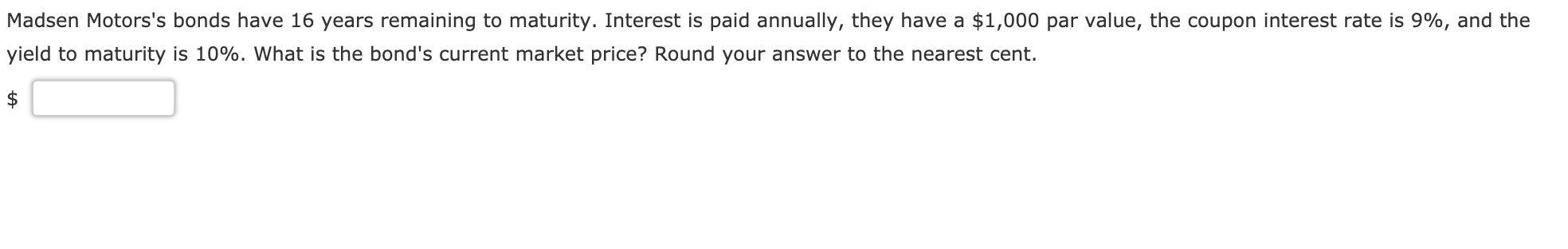

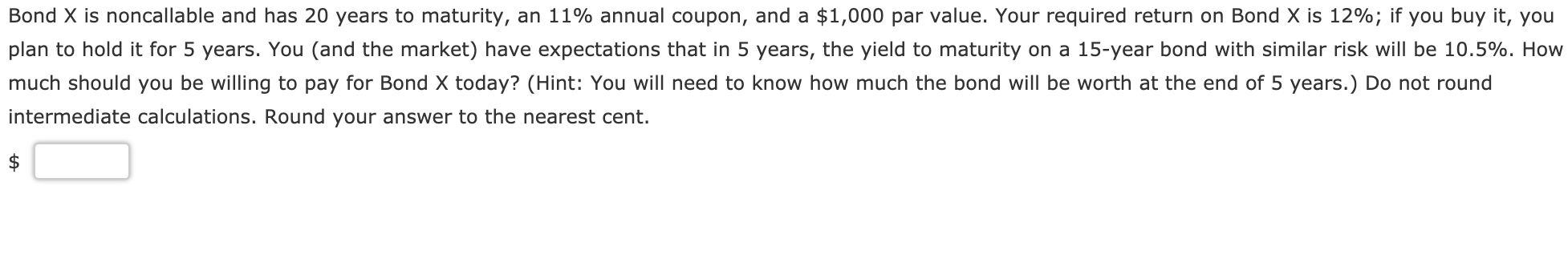

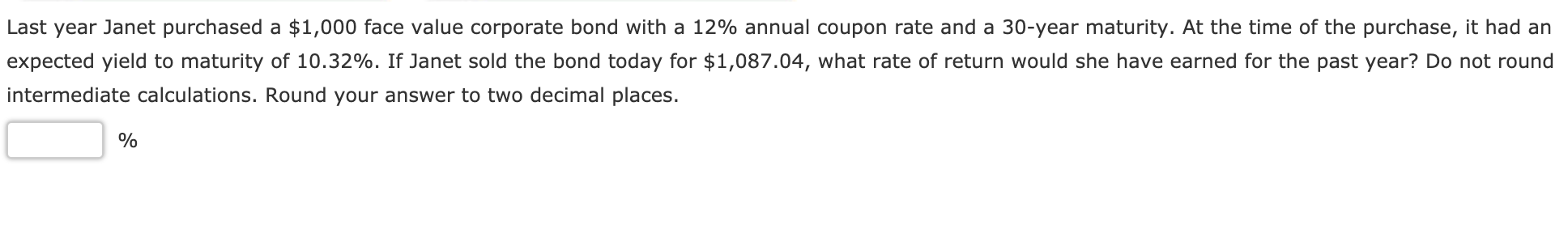

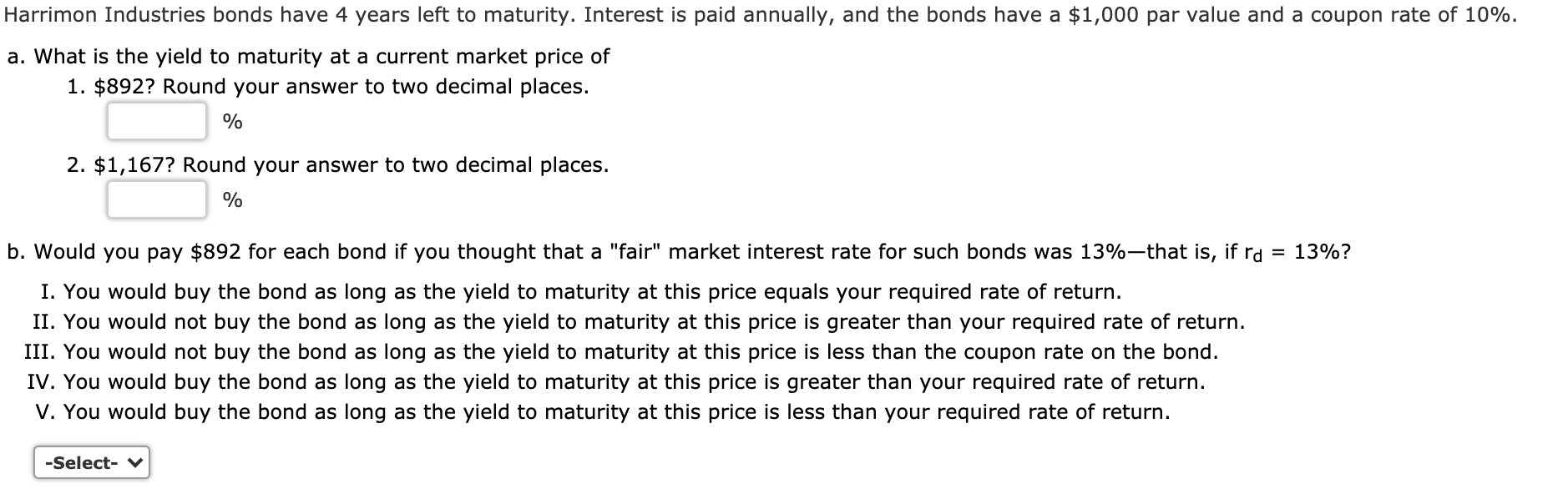

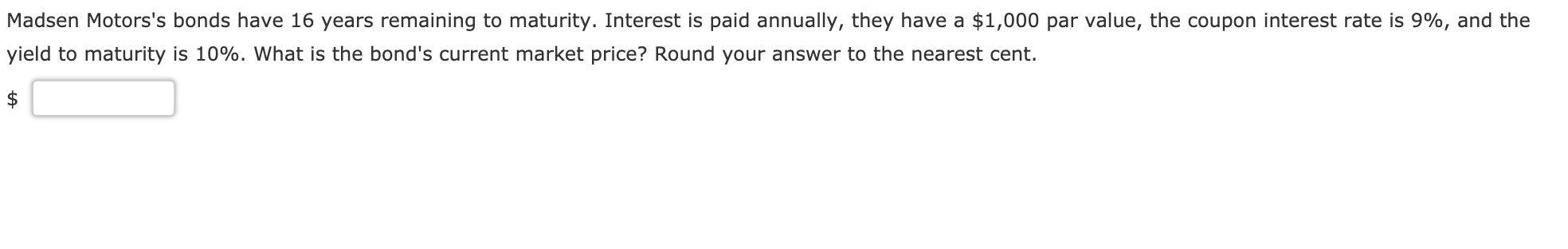

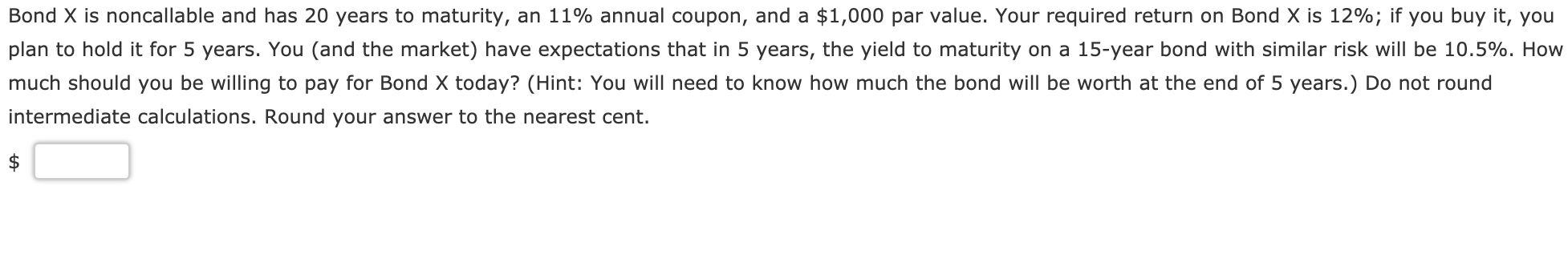

Last year Janet purchased a $1,000 face value corporate bond with a 12% annual coupon rate and a 30-year maturity. At the time of the purchase, it had an expected yield to maturity of 10.32%. If Janet sold the bond today for $1,087.04, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places. % Harrimon Industries bonds have 4 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 10%. a. What is the yield to maturity at a current market price of 1. $892? Round your answer to two decimal places. % 2. $1,167? Round your answer to two decimal places. % b. Would you pay $892 for each bond if you thought that a "fair" market interest rate for such bonds was 13%that is, if ra = 13%? I. You would buy the bond as long as the yield to maturity at this price equals your required rate of return. II. You would not buy the bond as long as the yield to maturity at this price is greater than your required rate of return. III. You would not buy the bond as long as the yield to maturity at this price is less than the coupon rate on the bond. IV. You would buy the bond as long as the yield to maturity at this price is greater than your required rate of return. V. You would buy the bond as long as the yield to maturity at this price is less than your required rate of return. -Select- Madsen Motors's bonds have 16 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 9%, and the yield to maturity is 10%. What is the bond's current market price? Round your answer to the nearest cent. $ Bond X is noncallable and has 20 years to maturity, an 11% annual coupon, and a $1,000 par value. Your required return on Bond X is 12%; if you buy it, you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 10.5%. How much should you be willing to pay for Bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.) Do not round intermediate calculations. Round your answer to the nearest cent. $