Answered step by step

Verified Expert Solution

Question

1 Approved Answer

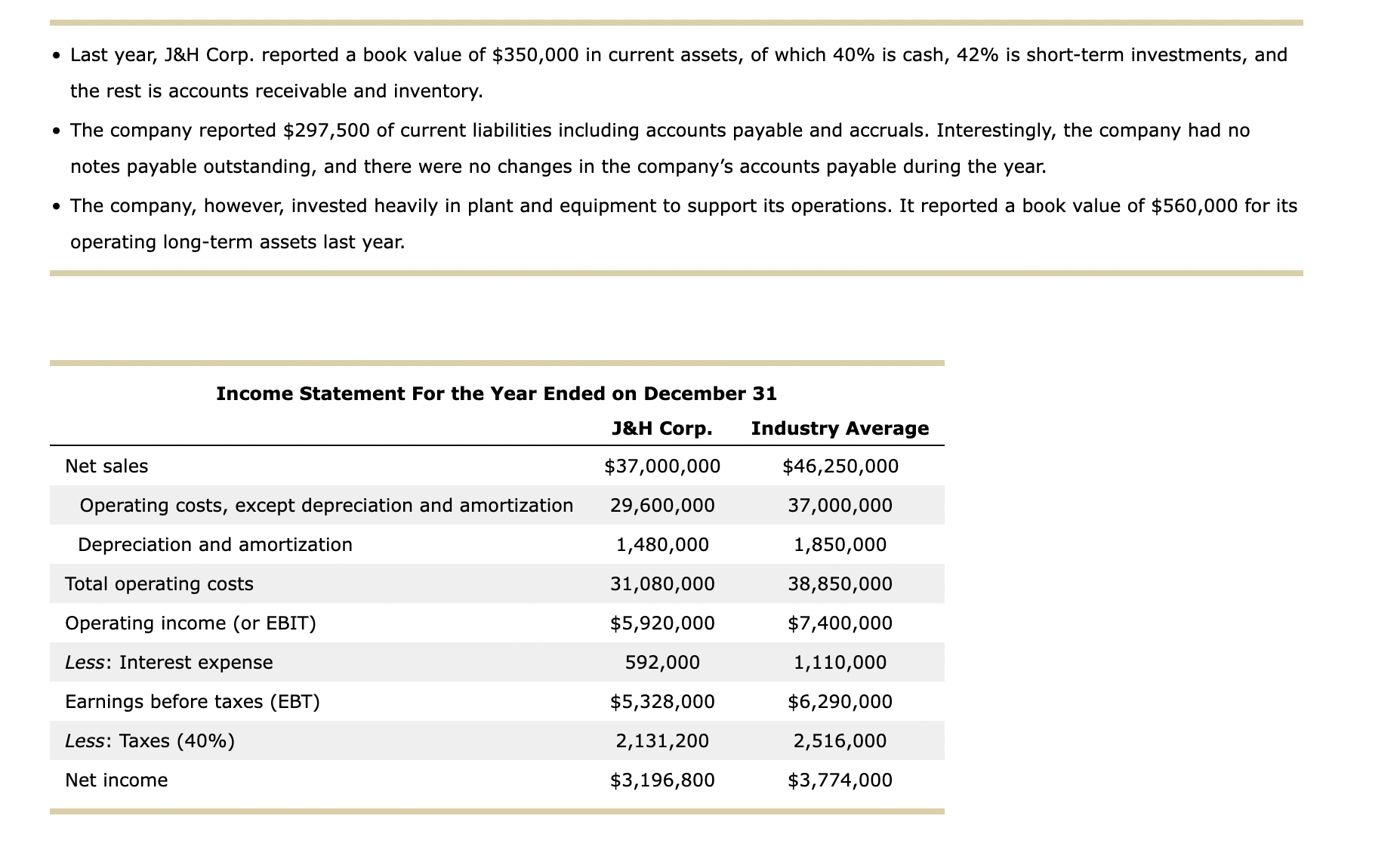

- Last year, J&H Corp. reported a book value of $350,000 in current assets, of which 40% is cash, 42% is short-term investments, and the

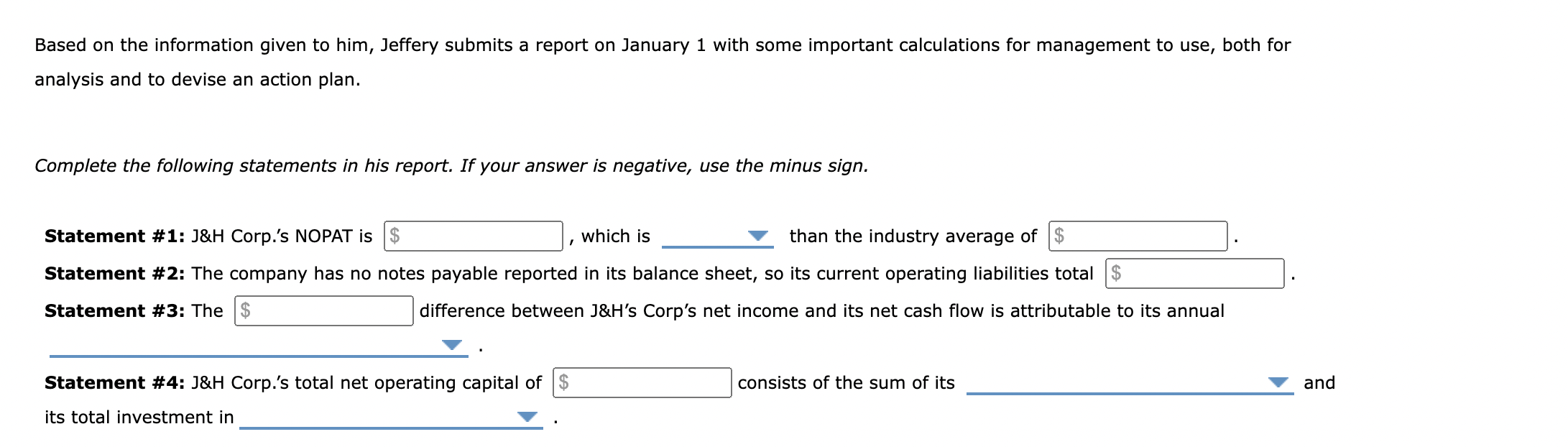

- Last year, J\&H Corp. reported a book value of $350,000 in current assets, of which 40% is cash, 42% is short-term investments, and the rest is accounts receivable and inventory. - The company reported $297,500 of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable outstanding, and there were no changes in the company's accounts payable during the year. - The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $560,000 for its operating long-term assets last year. Based on the information given to him, Jeffery submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Complete the following statements in his report. If your answer is negative, use the minus sign. Statement \# 1: J\&H Corp.'s NOPAT is , which is than the industry average of Statement \#2: The company has no notes payable reported in its balance sheet, so its current operating liabilities total Statement \#3: The difference between J\&H's Corp's net income and its net cash flow is attributable to its annual Statement \#4: J\&H Corp.'s total net operating capital of consists of the sum of its and its total investment in

- Last year, J\&H Corp. reported a book value of $350,000 in current assets, of which 40% is cash, 42% is short-term investments, and the rest is accounts receivable and inventory. - The company reported $297,500 of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable outstanding, and there were no changes in the company's accounts payable during the year. - The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $560,000 for its operating long-term assets last year. Based on the information given to him, Jeffery submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Complete the following statements in his report. If your answer is negative, use the minus sign. Statement \# 1: J\&H Corp.'s NOPAT is , which is than the industry average of Statement \#2: The company has no notes payable reported in its balance sheet, so its current operating liabilities total Statement \#3: The difference between J\&H's Corp's net income and its net cash flow is attributable to its annual Statement \#4: J\&H Corp.'s total net operating capital of consists of the sum of its and its total investment in Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started