Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last year, J&H Corp. reported a book value of exist450 million in current assets, of which 35% is cash, 37% is short-term investments, and the

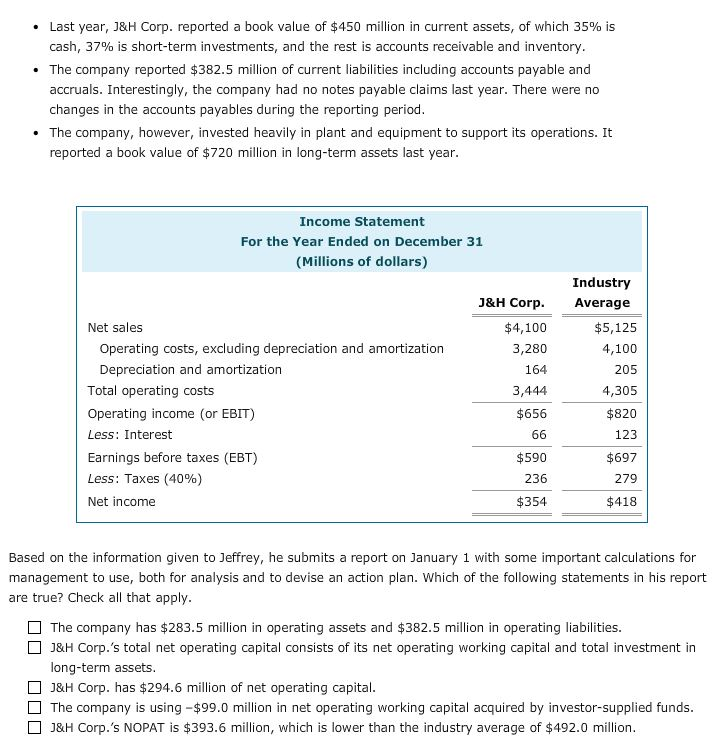

Last year, J&H Corp. reported a book value of exist450 million in current assets, of which 35% is cash, 37% is short-term investments, and the rest is accounts receivable and inventory. The company reported exist382.5 million of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period. The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of exist720 million in long-term assets last year. Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply The company has exist283.5 million in operating assets and exist382.5 million in operating liabilities. J&H Corp.'s total net operating capital consists of its net operating working capital and total investment in long-term assets J&H Corp. has exist294.6 million of net operating capital. The company is using-exist99.0 million in net operating working capital acquired by investor-supplied funds. J&H Corp.'s NOPAT is exist393.6 million, which is lower than the industry average of exist492.0 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started