Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last year, Lauren grossed $ 175,000 as a stockbroker on Wall Street. a. Determine how much he owes in federal taxes when he files

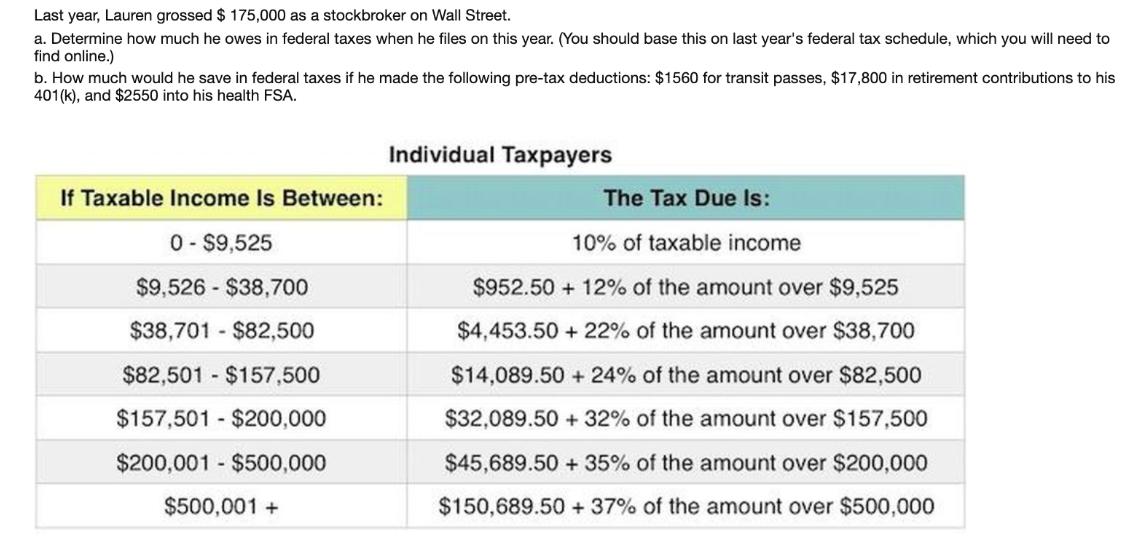

Last year, Lauren grossed $ 175,000 as a stockbroker on Wall Street. a. Determine how much he owes in federal taxes when he files on this year. (You should base this on last year's federal tax schedule, which you will need to find online.) b. How much would he save in federal taxes if he made the following pre-tax deductions: $1560 for transit passes, $17,800 in retirement contributions to his 401(k), and $2550 into his health FSA. If Taxable Income Is Between: 0 - $9,525 $9,526 $38,700 $38,701 - $82,500 $82,501 - $157,500 $157,501 $200,000 $200,001 - $500,000 $500,001 + Individual Taxpayers The Tax Due Is: 10% of taxable income $952.50 + 12% of the amount over $9,525 $4,453.50+22% of the amount over $38,700 $14,089.50 + 24% of the amount over $82,500 $32,089.50 + 32% of the amount over $157,500 $45,689.50 + 35% of the amount over $200,000 $150,689.50 + 37% of the amount over $500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

lets break down the calculations step by step and provide a detailed solution a Calculate Federal Ta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66421b120bc79_986250.pdf

180 KBs PDF File

66421b120bc79_986250.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started