Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last year Lexington had sales of $841,000 and paid taxes of $50,000. Because of the low interest rate environment , the firm also borrowed some

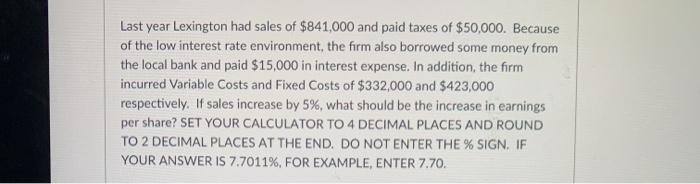

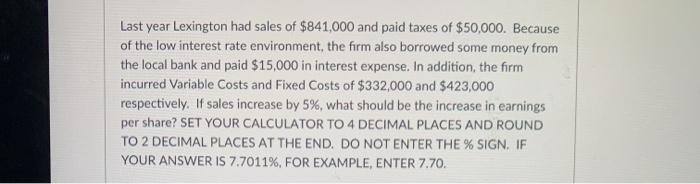

Last year Lexington had sales of $841,000 and paid taxes of $50,000. Because of the low interest rate environment , the firm also borrowed some money from the local bank and paid $15,000 in interest expense . In addition , the firm incurred Variable costs and Fixed Costs of $332,000 and $423,000 respectively . If sales increase by 5 %, what should be the increase in earnings per share ? SET YOUR CALCULATOR TO 4 DECIMAL PLACES AND ROUND TO 2 DECIMAL PLACES AT THE END . DO NOT ENTER THE % SIGN . IF YOUR ANSWER IS 7.7011 % , FOR EXAMPLE , ENTER 7.70 .

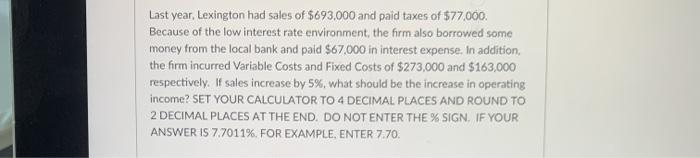

its 2 seperate questions please help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started