Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last year Mountain Top, Inc. purchased coal mine at a cost of $900,000. The salvage value has been estimated at 5100, 000 coal mine has

Last year Mountain Top, Inc. purchased coal mine at a cost of $900,000. The salvage value has been estimated at 5100, 000 coal mine has an estimated 200, 000 tons of avaliable coal. A total of 20, 000 tons were mined and sold during the current you The

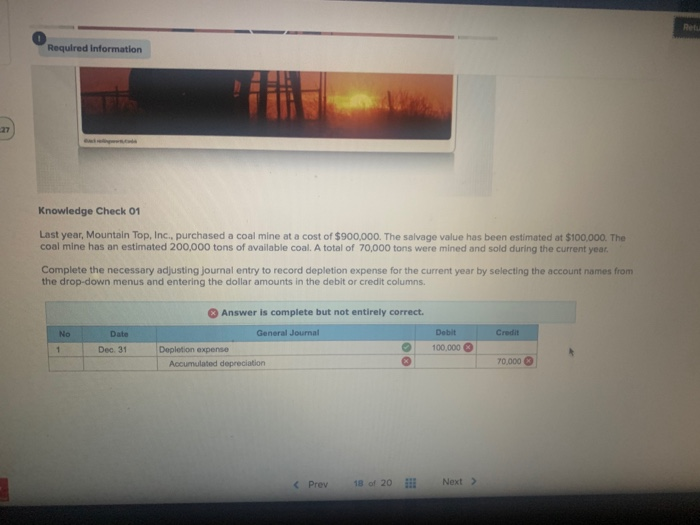

Required information Knowledge Check 01 Last year, Mountain Top, Inc., purchased a coal mine at a cost of $900,000. The salvage value has been estimated at $100,000. The coal mine has an estimated 200,000 tons of available coal. A total of 70,000 tons were mined and sold during the current year. Complete the necessary adjusting journal entry to record depletion expense for the current year by selecting the account names from the drop-down menus and entering the dollar amounts in the debitor credit columns Answer is complete but not entirely correct. No Date General Journal Credit Debit 100,000 Dec 31 Depletion expense Accumulated depreciation 70,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started