Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last year Nina's salary was $36,400. She had a taxable benefit amount for Life insurance of $12.50 per pay and AD&D $4.30 per pay.

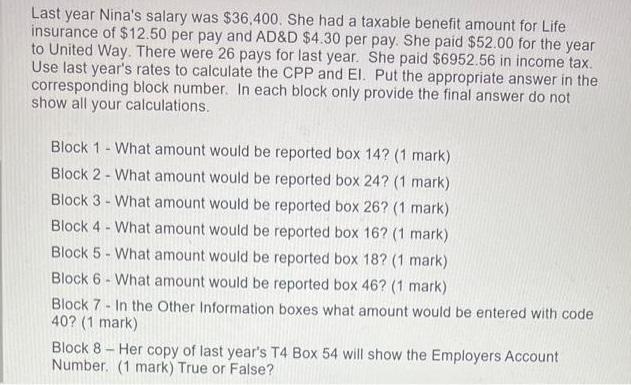

Last year Nina's salary was $36,400. She had a taxable benefit amount for Life insurance of $12.50 per pay and AD&D $4.30 per pay. She paid $52.00 for the year to United Way. There were 26 pays for last year. She paid $6952.56 in income tax. Use last year's rates to calculate the CPP and El. Put the appropriate answer in the corresponding block number. In each block only provide the final answer do not show all your calculations. Block 1 What amount would be reported box 14? (1 mark) Block 2 - What amount would be reported box 24? (1 mark) - Block 3 What amount would be reported box 26? (1 mark) Block 4 What amount would be reported box 16? (1 mark) Block 5 What amount would be reported box 18? (1 mark) Block 6 What amount would be reported box 46? (1 mark) . Block 7- In the Other Information boxes what amount would be entered with code 40? (1 mark) Her copy of last year's T4 Box 54 will show the Employers Account Number. (1 mark) True or False? Block 8 -

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Block 1 What amount would be reported box 14 1 mark ANSWER 5200 EXPLANATION 5200 is the amount that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started