Answered step by step

Verified Expert Solution

Question

1 Approved Answer

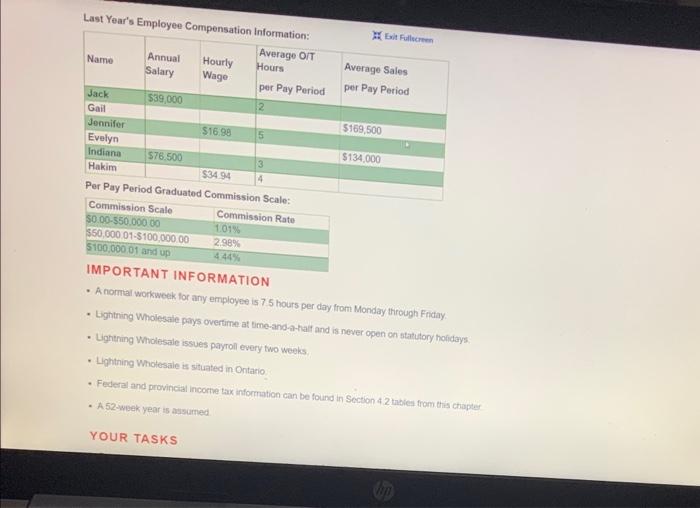

Last Year's Employee Compensation Information: Average O/T Hours Name Jack Gail Annual Salary $39,000 Jennifer Evelyn Indiana $76.500 Hakim $50,000.01-$100,000.00 $100,000 01 and up

Last Year's Employee Compensation Information: Average O/T Hours Name Jack Gail Annual Salary $39,000 Jennifer Evelyn Indiana $76.500 Hakim $50,000.01-$100,000.00 $100,000 01 and up Hourly Wage . $16.98 per Pay Period 2 $34.94 Per Pay Period Graduated Commission Scale: Commission Scale Commission Rate $0.00-$50,000.00 1.01% 2.98% 4.44% 5 3 4 Average Sales per Pay Period $169,500 Exit Fullscreen $134,000 IMPORTANT INFORMATION A normal workweek for any employee is 7.5 hours per day from Monday through Friday Lightning Wholesale pays overtime at time-and-a-half and is never open on statutory holidays Lightning Wholesale issues payroll every two weeks. Lightning Wholesale is situated in Ontario . Federal and provincial income tax information can be found in Section 4.2 tables from this chapter -A 52-week year is assumed YOUR TASKS IMPORTANT INFORMATION A normal workweek for any employee is 7.5 hours per day from Monday through Friday Lightning Wholesale pays overtime at time-and-a-half and is never open on statutory holidays. Lightning Wholesale issues payroll every two weeks. Lightning Wholesale is situated in Ontario Federal and provincial income tax information can be found in Section 4.2 tables from this chapter .A 52-week year is assumed. YOUR TASKS 1. Create a report on each employee and summarize the information in a table. a. Calculate the annual regular earnings b. Calculate the annual overtime earnings. c. Calculate the annual gross earnings d. Calculate the annual federal income taxes e. Calculate the annual provincial income taxes. 1. Calculate the employee's take-home pay after deducting taxes: g. Calculate the totals of all of the above.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER EMPLOYEE REPORT Calculate Your Yearly Regular Wage Regular Earnings per pay period for Jack are calculated as follows Hourly Pay x 75 hours x 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started