Question

Latest Industry Averages Liquidty Profitability Net working capital N/A h. Net profit margin 9.26% Current ratio 2.46 i. Return on assets 27.2% Receivables turnover 5.45

| Latest Industry Averages | |||

| Liquidty |

| Profitability |

|

| Net working capital | N/A | h. Net profit margin | 9.26% |

| Current ratio | 2.46 | i. Return on assets | 27.2% |

| Receivables turnover | 5.45 | j. Return on equity | 50.4% |

| Inventory turnover | 3.85 | Common-Stock Ratios |

|

| Fixed asset turnover | 0.75 | k. Earnings per share | $3.00 |

| Leverage |

| l. Price-to-earnings ratio | 20.0 |

| Debt-equity ratio | 1.25 | m. Dividends per share | $1.00 |

| Times interest earned | 3.70 | n. Dividend yield | 2.5% |

|

|

| o. Payout ratio | 33.3% |

|

|

| p. Book value per share | $6.25 |

|

|

| q. Price-to-book-value | 6.4 |

1.Construct a common size income statement and common size balance sheet. Why are common size financial statements useful?

2. Compute the following ratios and comment on whether the ratio is a strength or a weakness for the firm.

a.Debt equity ratio

b.Quick ratio

c.Current ratio

d.Inventory turnover

e.Receivables turnover

f.Fixed asset turnover

g.Net profit margin

h.Times interest earned

i.ROA

3.Decompose ROE using the DuPont equation. Why do we want to decompose ROE?

4.What is free cash flow? What are the five uses of FCF?

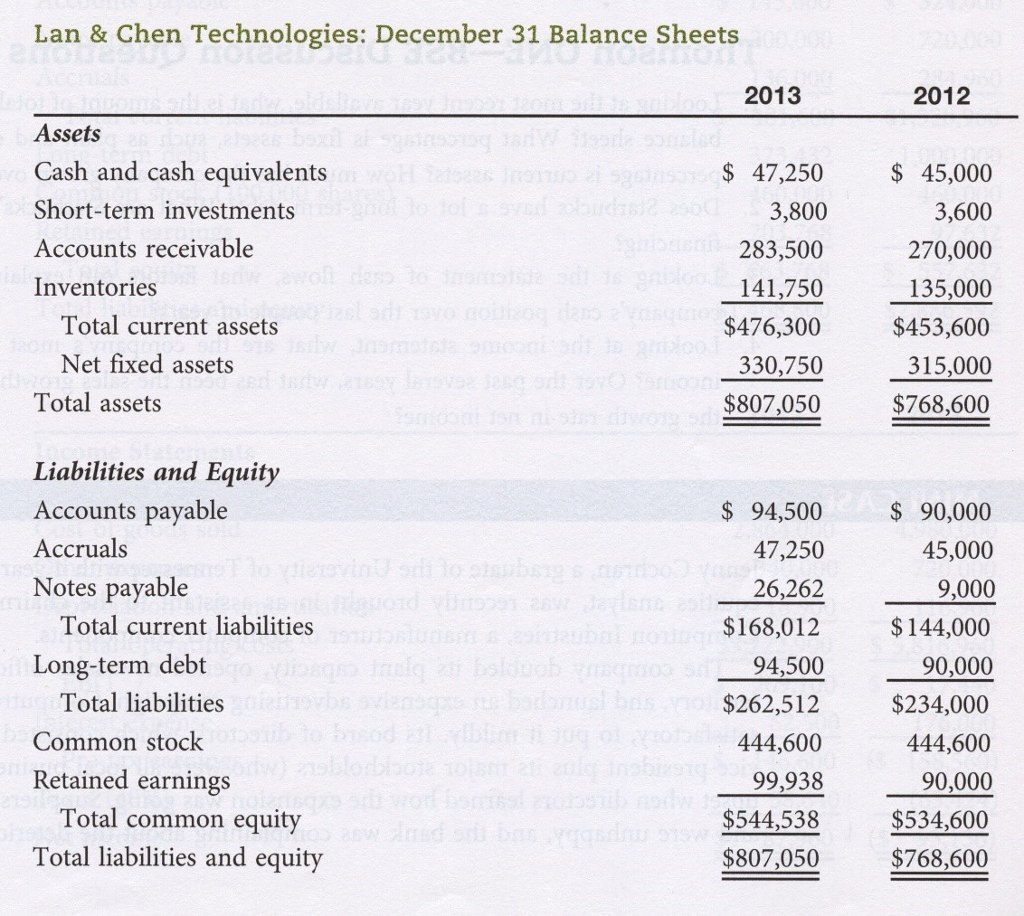

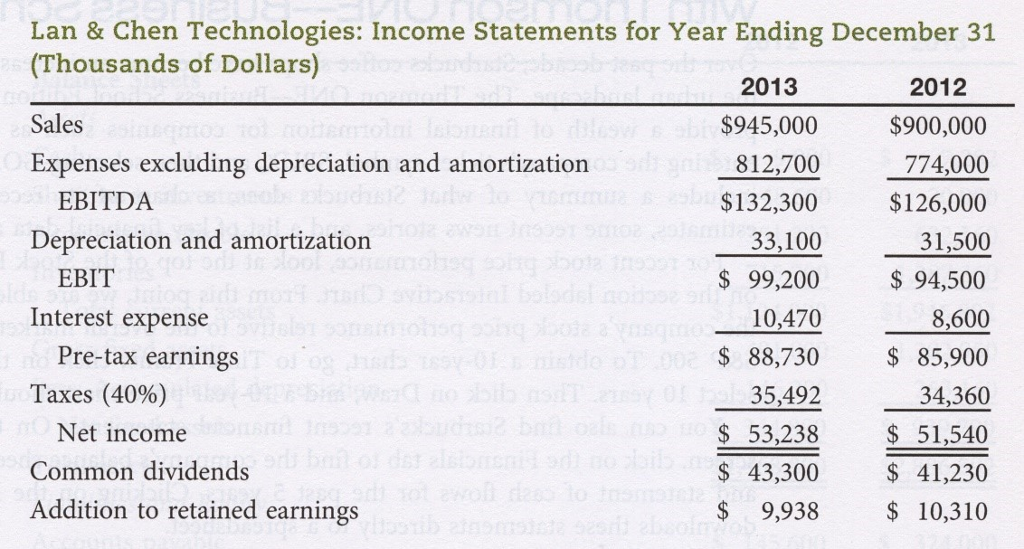

Lan & Chen Technologies: December 31 Balance Sheets 2013 2012 Assets Cash and cash equivalents Short-term investments Accounts receivable Inventories $ 47,250 3,800 283,500 141,750 $476,300 330,750 $807,050 $45,000 3,600 270,000 135,000 $453,600 315,000 $768,600 Total current assets Net fixed assets Total assets Liabilities and Equity Accounts payable Accruals Notes payable 94,500 47,250 26,262 $168,012 94,500 $262,512 444,600 99,938 $544,538 $807,050 $ 90,000 45,000 9,000 $144,000 90,000 $234,000 444,600 90,000 $534,600 $768,600 Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started