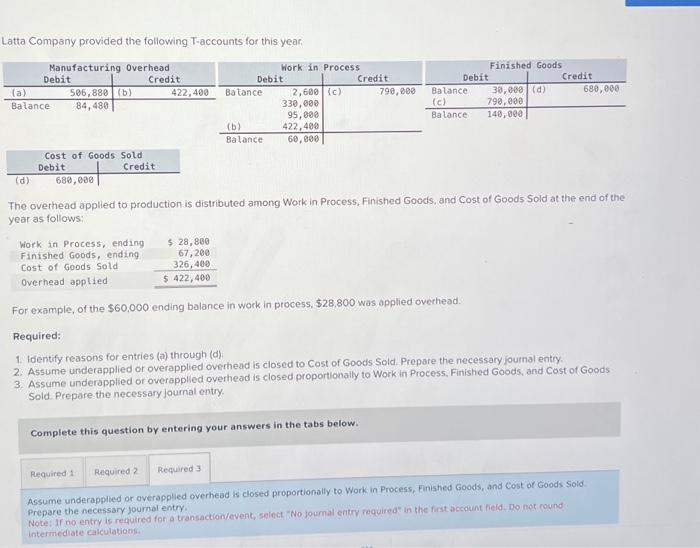

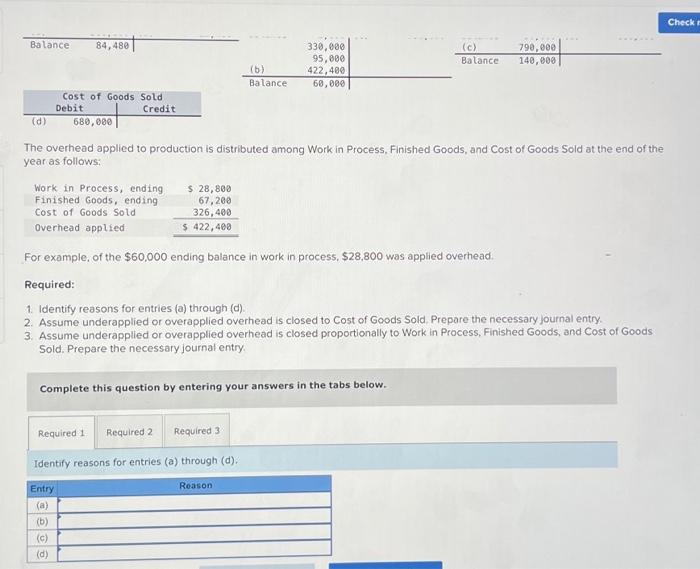

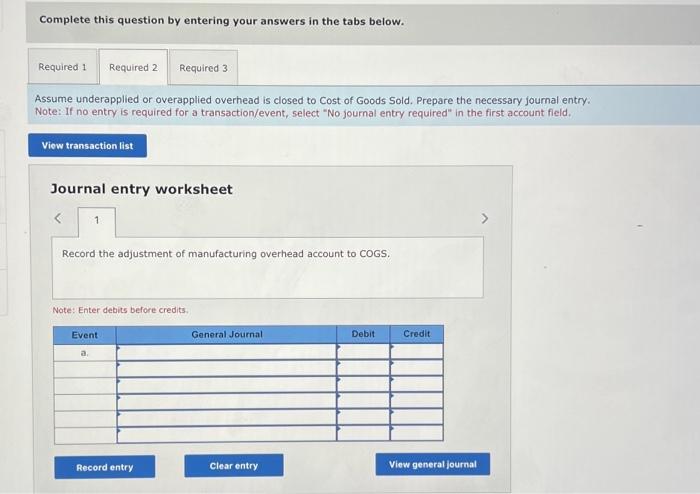

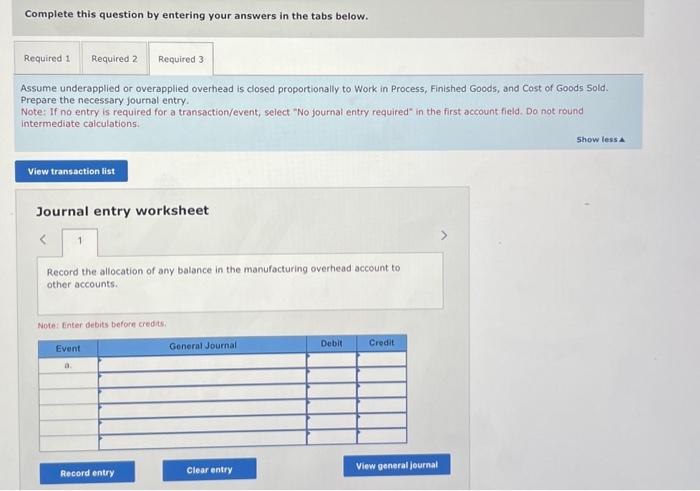

Latta Company provided the following T-accounts for this year: The overhead applied to production is distributed among Work in Process, Finished Goods, and Cost of Goods Sold at the end of the year as follows: For example, of the $60,000 ending balance in work in process, $28,800 was applied overhead. Required: 1. Identify reasons for entries (a) through (d) 2. Assume underapplied or overapplied overhead is closed to Cost of Goods Sold. Prepore the necessary journal entry; 3. Assume underapplied or overapplied overhead is closed proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the necessary journal entry. Complete this question by entering your answers in the tabs below. Assume underapplied or overapplied overhead is closed proportionally to Work in Process, Finished Goods, and Cost of Goods Sold Prepare the necessary journal entry. Note: if no entry is required fon a tranisacton/event, select "No joumal entry required" in the first account field. Do not round intemedate calculations. The overhead applied to production is distributed among Work in Process, Finished Goods, and Cost of Goods Sold at the end of the year as follows: For example, of the $60,000 ending balance in work in process, $28,800 was applied overhead. Required: 1. Identify reasons for entries (a) through (d). 2. Assume underapplied or overapplied overhead is closed to Cost of Goods Sold. Prepare the necessary journal entry. 3. Assume underapplied or overapplied overhead is closed proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the necessary journal entry. Complete this question by entering your answers in the tabs below. Identify reasons for entries (a) through (d). Complete this question by entering your answers in the tabs below. Assume underapplied or overapplied overhead is closed to Cost of Goods Sold. Prepare the necessary journal entry. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the adjustment of manufacturing overhead account to COGS. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Assume underapplied or overapplied overhead is closed proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the necessary journal entry. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Journal entry worksheet Record the allocation of any balance in the manufacturing overhead account to other accounts. Note: Enter debits before credits