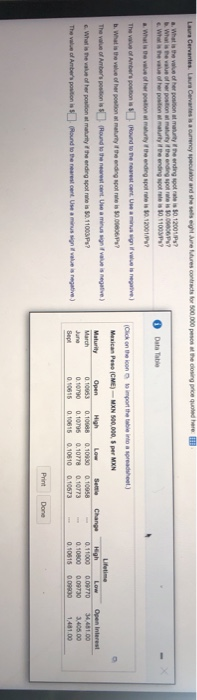

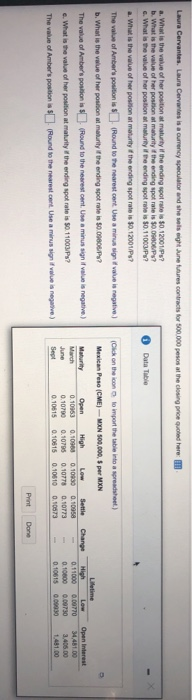

Laura Cervantes, Laure Cervantes is a currency speculator and she was tres contracts for 500.000 pesos at the closing price Quote What is the other position at the ending sports 30.12001? We of her position matury the ending spot is 1000PX? c. What is the other position muy it the ending Not rate is 1011001? Data Table What is the of her poston marty the ending sport is 10.12001/2 The value of Amber's pois Rond to the recent a les negative) (Click on the conto import the White aret) b. What is the value of her position at matury the ending sport is 1000 Mexican Peso CME) - MXN 500.000 per MXN The value of Amber's positionist (Round to the nearest cont. Uw a minus in value is negative) Maturity Open High Settle 6. What is the other position at maturity the ending spot rate is 0.11003? 0.10053 0.10088 0.10930 0.10958 June 0.10730 0.10795 0.10778 0.10773 The value of Amber's position is Round to the recent Use aus in value is negative) Sep 0.10015 0.10615 0.10510 0.10573 Change Log High 0.11000 0 09770 0.10800 0.09730 0.10015 0.09800 Open Interest 34.48100 3.405.00 1.401.00 Print Done Laura Cervantes. Laura Cervantes is a currency speculator and she was eight June futures contracts for 500.000 pesos at the closing price quoted here a. What is the value of her position at maturity of the ending spot rate is $0.12001/PS? b. What is the value of her position at maturity the ending spot rate is 10.000VP? c. What is the value of her position at maturity of the ending spot role is $0.11000VP? Data Table a. What is the value of her position at maturity the ending spot rate is 10.12001/P? The value of Amber's position is Round to the nearest cent. Use a minua sign value in negative) Click on the conto import the table into a spreadsheet.) b. What is the value of her position at maturity the ending spot rate is $0.0980P? Mexican Peso (CME) - MXN 500,000, per MXN The value of Amber's portion is $(Round to the nearest cent. Use a minus sign if value is negative) Maturity Open High Low Settle e. What is the value of her position at maturity the ending spot rate is $0.14003/P? March 0.10953 0.10930 0.10950 0.10958 June 0.10790 0.10795 0.10778 0.10773 The value of Amber's position is $. Round to the nearest cent. Use a mission value in negative) Sept 0.10615 0.10815 0.10010 0.10573 Change Lifetime High Low 011000 0.00770 O TODO 0.00730 0.10615 0.00030 Open Interest 34,481 00 3.405.00 1.481.00 Print Done Vatic Capital Cachita Haynes works as a currency speculator for Vale Capital of Los Angeles. Her latest speculative position is to prolt from her expectation that the U.S. dowiecarly against the Japanese yen The current spot rate is 121.00/5. She must choose between the following 1-day options on the Japanese yen: m a. Should Cachita buy a put on yen or a call on yon? b. What is Cach's breakeven price on the option purchased in parte? 6. Using your answer from porta, what is has gross proft and not proft (including premium I the spot rate at the end of days is W140.00$? Should Cachia buy a put on yen ora calon yan? (Select the best choice below) O A Cachna should buy a calon yen to profit from the tal of the dollar theme of the you) OB Cach should buy a put on yen to profit from the rise of the dollar (the fol of the you) OC Cach should buy a call on yon to proft from the rise of the color the fall of the you) OD. Cachta should buy a put on yon to profit from the fall of the dollar (the rise of the yon). b. What is Cacha's breakeven price on the option purchased in part Cachita's breakeven price on her option choices (Enter as US dollars and round to five decimal places) c. Using your answer from part, what is Cachita's gros profit and neprofit including premium the spot rate at the end of 90 days is 140.00/5? Cachas gros prolt, the ending spot rate is 140.00/5, is Erter as US dollars and round to five decimal places) Cachas not proft, if the ending spot rate is 120.005, Enter as US doors and round to five decimal places) Laura Cervantes, Laure Cervantes is a currency speculator and she was tres contracts for 500.000 pesos at the closing price Quote What is the other position at the ending sports 30.12001? We of her position matury the ending spot is 1000PX? c. What is the other position muy it the ending Not rate is 1011001? Data Table What is the of her poston marty the ending sport is 10.12001/2 The value of Amber's pois Rond to the recent a les negative) (Click on the conto import the White aret) b. What is the value of her position at matury the ending sport is 1000 Mexican Peso CME) - MXN 500.000 per MXN The value of Amber's positionist (Round to the nearest cont. Uw a minus in value is negative) Maturity Open High Settle 6. What is the other position at maturity the ending spot rate is 0.11003? 0.10053 0.10088 0.10930 0.10958 June 0.10730 0.10795 0.10778 0.10773 The value of Amber's position is Round to the recent Use aus in value is negative) Sep 0.10015 0.10615 0.10510 0.10573 Change Log High 0.11000 0 09770 0.10800 0.09730 0.10015 0.09800 Open Interest 34.48100 3.405.00 1.401.00 Print Done Laura Cervantes. Laura Cervantes is a currency speculator and she was eight June futures contracts for 500.000 pesos at the closing price quoted here a. What is the value of her position at maturity of the ending spot rate is $0.12001/PS? b. What is the value of her position at maturity the ending spot rate is 10.000VP? c. What is the value of her position at maturity of the ending spot role is $0.11000VP? Data Table a. What is the value of her position at maturity the ending spot rate is 10.12001/P? The value of Amber's position is Round to the nearest cent. Use a minua sign value in negative) Click on the conto import the table into a spreadsheet.) b. What is the value of her position at maturity the ending spot rate is $0.0980P? Mexican Peso (CME) - MXN 500,000, per MXN The value of Amber's portion is $(Round to the nearest cent. Use a minus sign if value is negative) Maturity Open High Low Settle e. What is the value of her position at maturity the ending spot rate is $0.14003/P? March 0.10953 0.10930 0.10950 0.10958 June 0.10790 0.10795 0.10778 0.10773 The value of Amber's position is $. Round to the nearest cent. Use a mission value in negative) Sept 0.10615 0.10815 0.10010 0.10573 Change Lifetime High Low 011000 0.00770 O TODO 0.00730 0.10615 0.00030 Open Interest 34,481 00 3.405.00 1.481.00 Print Done Vatic Capital Cachita Haynes works as a currency speculator for Vale Capital of Los Angeles. Her latest speculative position is to prolt from her expectation that the U.S. dowiecarly against the Japanese yen The current spot rate is 121.00/5. She must choose between the following 1-day options on the Japanese yen: m a. Should Cachita buy a put on yen or a call on yon? b. What is Cach's breakeven price on the option purchased in parte? 6. Using your answer from porta, what is has gross proft and not proft (including premium I the spot rate at the end of days is W140.00$? Should Cachia buy a put on yen ora calon yan? (Select the best choice below) O A Cachna should buy a calon yen to profit from the tal of the dollar theme of the you) OB Cach should buy a put on yen to profit from the rise of the dollar (the fol of the you) OC Cach should buy a call on yon to proft from the rise of the color the fall of the you) OD. Cachta should buy a put on yon to profit from the fall of the dollar (the rise of the yon). b. What is Cacha's breakeven price on the option purchased in part Cachita's breakeven price on her option choices (Enter as US dollars and round to five decimal places) c. Using your answer from part, what is Cachita's gros profit and neprofit including premium the spot rate at the end of 90 days is 140.00/5? Cachas gros prolt, the ending spot rate is 140.00/5, is Erter as US dollars and round to five decimal places) Cachas not proft, if the ending spot rate is 120.005, Enter as US doors and round to five decimal places)