Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Laura has just received $7,000 from her aunt as her birthday gift. She has decided to invest the money. As her best friend and financial

- Laura has just received $7,000 from her aunt as her birthday gift. She has decided to invest the money. As her best friend and financial advisor, you have conducted a careful fundamental analysis and discovered an undervalued stock, MYS, which is currently selling at $35 per share. The possible cash investment strategies for Sophie are either to buy the stock directly at $35 per share or buy the stock call option selling at $7 per share (that is, the option premium or cost) in an option contract with a strike price of $37 per share. Explain to Laura which strategy is better by comparing these two strategies in terms of % rate of return under these two scenarios: the stock price at call option expiration is (a) $50 and (2) $30.

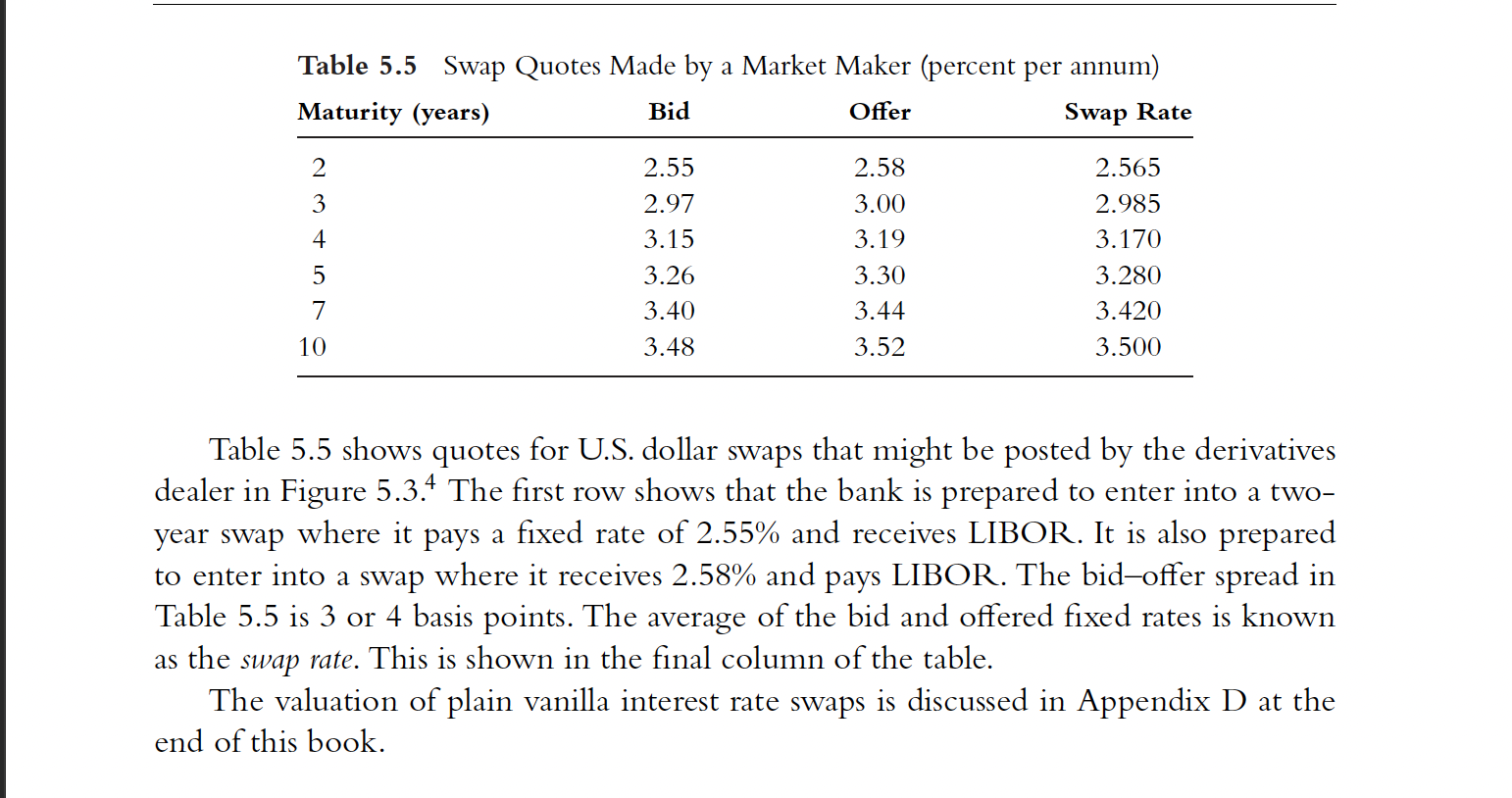

- (10 marks) FANG Fund Inc. has a 7-year floating-rate investment at an annual rate of LIBOR - 0.5%. Concerned with the counterparty risk, FANG has decided to an interest rate swap with the market maker whose swap quotes are those in Table 5.5 on p.110. a) Explain how FANG can use the quotes in Table 5.5 to lock in its return at a fixed rate and illustrate your answer with a diagram in which you need to indicate FANG's initial situation (that is, paying or earning a fixed-rate or a floating-rate); b) In a proposed/possible interest rate swap, which rate FANG receives and which rate it pays; c) As a result of this swap, what is the net rate FANG will earn/pay from now on. d) Under what circumstance, that is, how much LIBOR should be, will FANG gain by entering into the swap?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started