Laura is a CPA employed by a regional firm a tax manager. In her spare time, she operates a custom drapery business out of

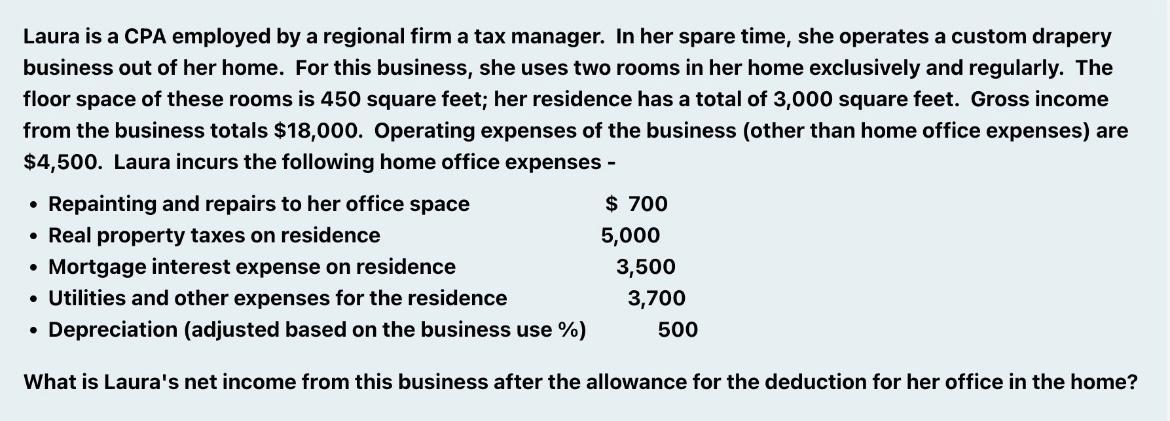

Laura is a CPA employed by a regional firm a tax manager. In her spare time, she operates a custom drapery business out of her home. For this business, she uses two rooms in her home exclusively and regularly. The floor space of these rooms is 450 square feet; her residence has a total of 3,000 square feet. Gross income from the business totals $18,000. Operating expenses of the business (other than home office expenses) are $4,500. Laura incurs the following home office expenses - Repainting and repairs to her office space Real property taxes on residence Mortgage interest expense on residence Utilities and other expenses for the residence Depreciation (adjusted based on the business use %) $ 700 5,000 3,500 3,700 500 What is Laura's net income from this business after the allowance for the deduction for her office in the home?

Step by Step Solution

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Lauras net income from the business after the allowance for the deduction for her offic...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started