1. Suppose you have a portfolio of stocks which you want to hedge using S&P500 index futures. You regress weekly changes of the portfolio

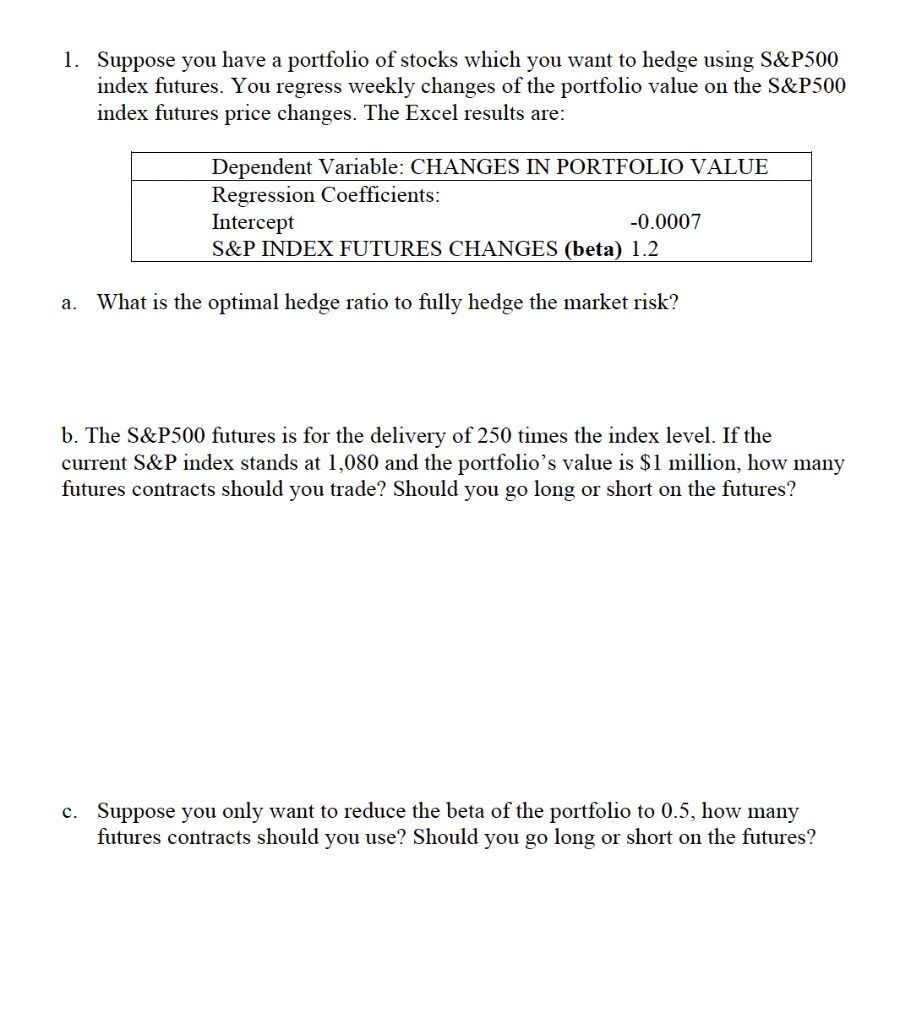

1. Suppose you have a portfolio of stocks which you want to hedge using S&P500 index futures. You regress weekly changes of the portfolio value on the S&P500 index futures price changes. The Excel results are: Dependent Variable: CHANGES IN PORTFOLIO VALUE Regression Coefficients: Intercept -0.0007 S&P INDEX FUTURES CHANGES (beta) 1.2 a. What is the optimal hedge ratio to fully hedge the market risk? b. The S&P500 futures is for the delivery of 250 times the index level. If the current S&P index stands at 1,080 and portfolio's value is $1 million, how many futures contracts should you trade? Should you go long or short on the futures? c. Suppose you only want to reduce the beta of the portfolio to 0.5, how many futures contracts should you use? Should you go long or short on the futures?

Step by Step Solution

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a The optimal hedge ratio also known as the beta is given by the regression coefficient of the SP500 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started