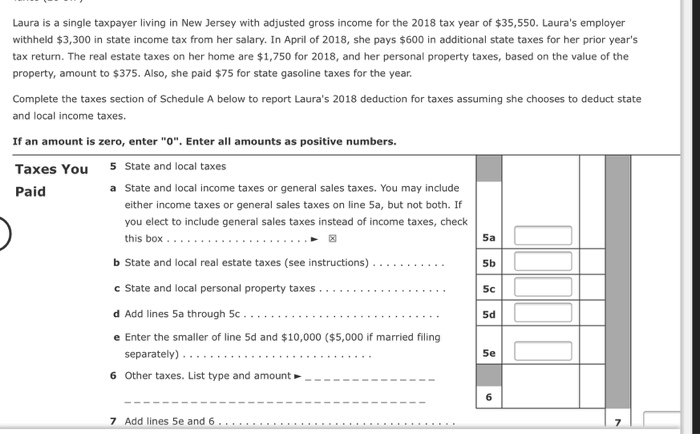

Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2018 tax year of $35,550. Laura's employer withheld $3,300 in state income tax from her salary. In April of 2018, she pays $600 in additional state taxes for her prior year's tax return. The real estate taxes on her home are $1,750 for 2018, and her personal property taxes, based on the value of the property, amount to $375. Also, she paid $75 for state gasoline taxes for the year. Complete the taxes section of Schedule A below to report Laura's 2018 deduction for taxes assuming she chooses to deduct state and local income taxes. If an amount is zero, enter "O". Enter all amounts as positive numbers. Taxes You 5 State and local taxes Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) .......... c State and local personal property taxes . . . . . . . . . . . . . . . . . . d Add lines 5a through 5c .... e Enter the smaller of line 5d and $10,000 ($5,000 if married filing separately). .................... 6 Other taxes. List type and amount --- 7 Add lines 5e and 6 .......... Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2018 tax year of $35,550. Laura's employer withheld $3,300 in state income tax from her salary. In April of 2018, she pays $600 in additional state taxes for her prior year's tax return. The real estate taxes on her home are $1,750 for 2018, and her personal property taxes, based on the value of the property, amount to $375. Also, she paid $75 for state gasoline taxes for the year. Complete the taxes section of Schedule A below to report Laura's 2018 deduction for taxes assuming she chooses to deduct state and local income taxes. If an amount is zero, enter "O". Enter all amounts as positive numbers. Taxes You 5 State and local taxes Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) .......... c State and local personal property taxes . . . . . . . . . . . . . . . . . . d Add lines 5a through 5c .... e Enter the smaller of line 5d and $10,000 ($5,000 if married filing separately). .................... 6 Other taxes. List type and amount --- 7 Add lines 5e and 6