Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Laura Lamont is the Swiss divisional manager of the electric appliance multinational ElectroMarket. She is given a budget of CHF 10 million to expand

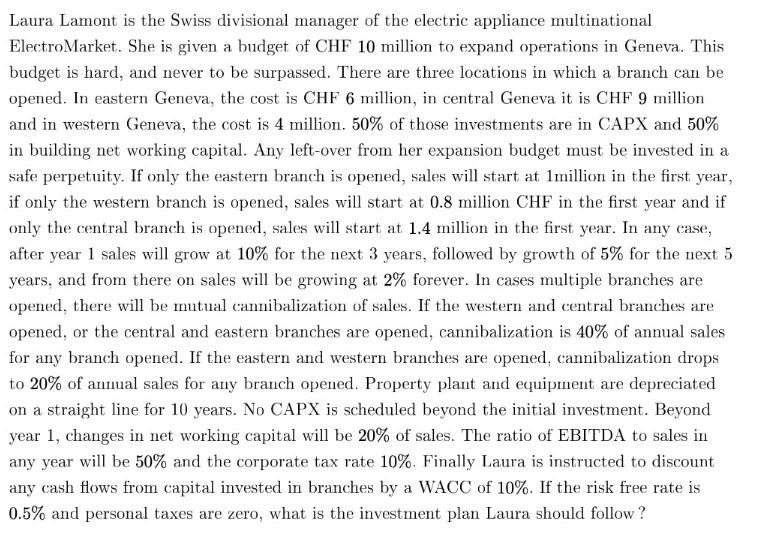

Laura Lamont is the Swiss divisional manager of the electric appliance multinational ElectroMarket. She is given a budget of CHF 10 million to expand operations in Geneva. This budget is hard, and never to be surpassed. There are three locations in which a branch can be opened. In eastern Geneva, the cost is CHF 6 million, in central Geneva it is CHF 9 million and in western Geneva, the cost is 4 million. 50% of those investments are in CAPX and 50% in building net working capital. Any left-over from her expansion budget must be invested in a safe perpetuity. If only the eastern branch is opened, sales will start at 1million in the first year, if only the western branch is opened, sales will start at 0.8 million CHF in the first year and if only the central branch is opened, sales will start at 1.4 million in the first year. In any case, after year 1 sales will grow at 10% for the next 3 years, followed by growth of 5% for the next 5 years, and from there on sales will be growing at 2% forever. In cases multiple branches are opened, there will be mutual cannibalization of sales. If the western and central branches are opened, or the central and eastern branches are opened, cannibalization is 40% of annual sales for any branch opened. If the eastern and western branches are opened, cannibalization drops to 20% of annual sales for any branch opened. Property plant and equipment are depreciated on a straight line for 10 years. No CAPX is scheduled beyond the initial investment. Beyond year 1, changes in net working capital will be 20% of sales. The ratio of EBITDA to sales in any year will be 50% and the corporate tax rate 10%. Finally Laura is instructed to discount any cash flows from capital invested in branches by a WACC of 10%. If the risk free rate is 0.5% and personal taxes are zero, what is the investment plan Laura should follow?

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the investment plan Laura should follow we need to calculate the cash flows and net present value NPV for each option Option 1 O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started