Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rextesla Industrial is a company which wants to raise 4 billion CHF by means of equity issuance. Using the last available financial statements, its

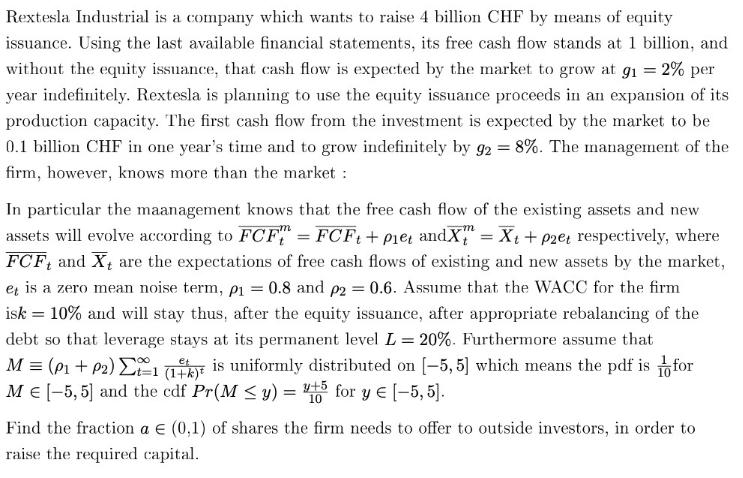

Rextesla Industrial is a company which wants to raise 4 billion CHF by means of equity issuance. Using the last available financial statements, its free cash flow stands at 1 billion, and without the equity issuance, that cash flow is expected by the market to grow at g = 2% per year indefinitely. Rextesla is planning to use the equity issuance proceeds in an expansion of its production capacity. The first cash flow from the investment is expected by the market to be 0.1 billion CHF in one year's time and to grow indefinitely by 92 = = 8%. The management of the firm, however, knows more than the market : In particular the maanagement knows that the free cash flow of the existing assets and new assets will evolve according to FCF = FCFt + piet andX = X + p2et respectively, where FCF, and X, are the expectations of free cash flows of existing and new assets by the market, et is a zero mean noise term, p1 = 0.8 and p2 = 0.6. Assume that the WACC for the firm isk= 10% and will stay thus, after the equity issuance, after appropriate rebalancing of the debt so that leverage stays at its permanent level L = 20%. Furthermore assume that M = (0 + 02) et 1 (1 k) is uniformly distributed on [-5,5] which means the pdf is for M [-5,5] and the cdf Pr(M y) = 5 for y [-5,5]. 10 Find the fraction a (0,1) of shares the firm needs to offer to outside investors, in order to raise the required capital.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To determine the fraction of shares that Rextesla Industrial needs to offer to outside investors we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started