Question

Laura's Cosmetics uses a normal cost system and has the following balances at the end of its first year's operations. WIP inventory $ 166,000

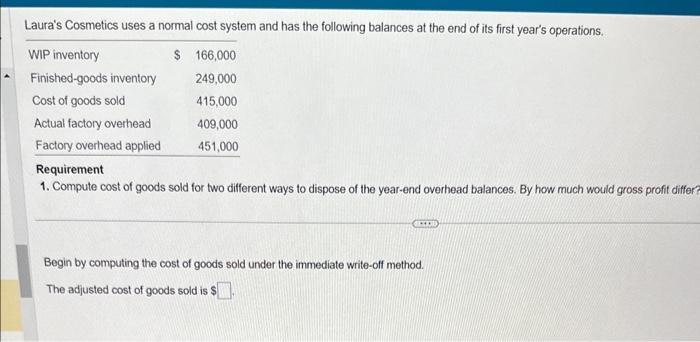

Laura's Cosmetics uses a normal cost system and has the following balances at the end of its first year's operations. WIP inventory $ 166,000 Finished-goods inventory 249,000 Cost of goods sold 415,000 Actual factory overhead 409,000 Factory overhead applied 451,000 Requirement 1. Compute cost of goods sold for two different ways to dispose of the year-end overhead balances. By how much would gross profit differ? Begin by computing the cost of goods sold under the immediate write-off method. The adjusted cost of goods sold is $

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Computation of the cost of goods sold under the immediate write off method To compute overhead appli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu

6th Canadian edition

013257084X, 1846589207, 978-0132570848

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App