Answered step by step

Verified Expert Solution

Question

1 Approved Answer

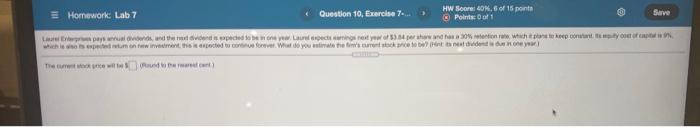

Laurel Enterprises pays annual dividends, and the next dividend is expected to be in one year. Laurel expects to earnings next year of $3.84 per

Laurel Enterprises pays annual dividends, and the next dividend is expected to be in one year. Laurel expects to earnings next year of $3.84 per share and has 30% retention rate, which it plans to keep constant. Its equity cost of capital is 9%, which is also its expected return on new investement; this is expected to continue forever. What do yoy estimate the firm's current stock price to be? (hint; its next dividend is due in one year)

Lauris pulvidends, and the nativitend pored to be on yo. Les mig ned year of 30 which was which is to its expectmon with pred to contine foreverWhat do you the file denone The current stock price webe) Cound to w nawet cont> HW Score: 10,1 Porto Save Homework Lab 7 Question 10, Exercise www Help me solve Venewal Get more Homework: Lab 7 Question 10, Exercise 7. HW Score: 40M, 6 of 15 point Points of 1 Save Lepas was there and speed one. La croyo 53.34 wwwsche keep on your which is now invented forever. Wat you the best to do near Red Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started