Question

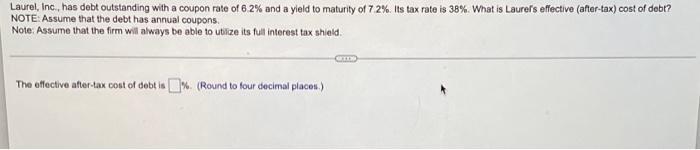

Laurel, Inc., has debt outstanding with a coupon rate of 6.2% and a yield to maturity of 7.2%. Its tax rate is 38%. What

Laurel, Inc., has debt outstanding with a coupon rate of 6.2% and a yield to maturity of 7.2%. Its tax rate is 38%. What is Laurer's effective (after-tax) cost of debt? NOTE: Assume that the debt has annual coupons. Note: Assume that the firm will always be able to utilize its full interest tax shield. The effective after-tax cost of debt is %. (Round to four decimal places.)

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the effective aftertax cost of debt for Laurel Inc we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

5th Global Edition

1292437154, 978-1292437156

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App