Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Laurenburg precision engineering Case study involving Bonds. Please help answering the 4 questions using this information in entirety. Thanks! Laurinburg Precision Engineering Oliver MacKinnon and

Laurenburg precision engineering Case study involving Bonds. Please help answering the 4 questions using this information in entirety. Thanks!

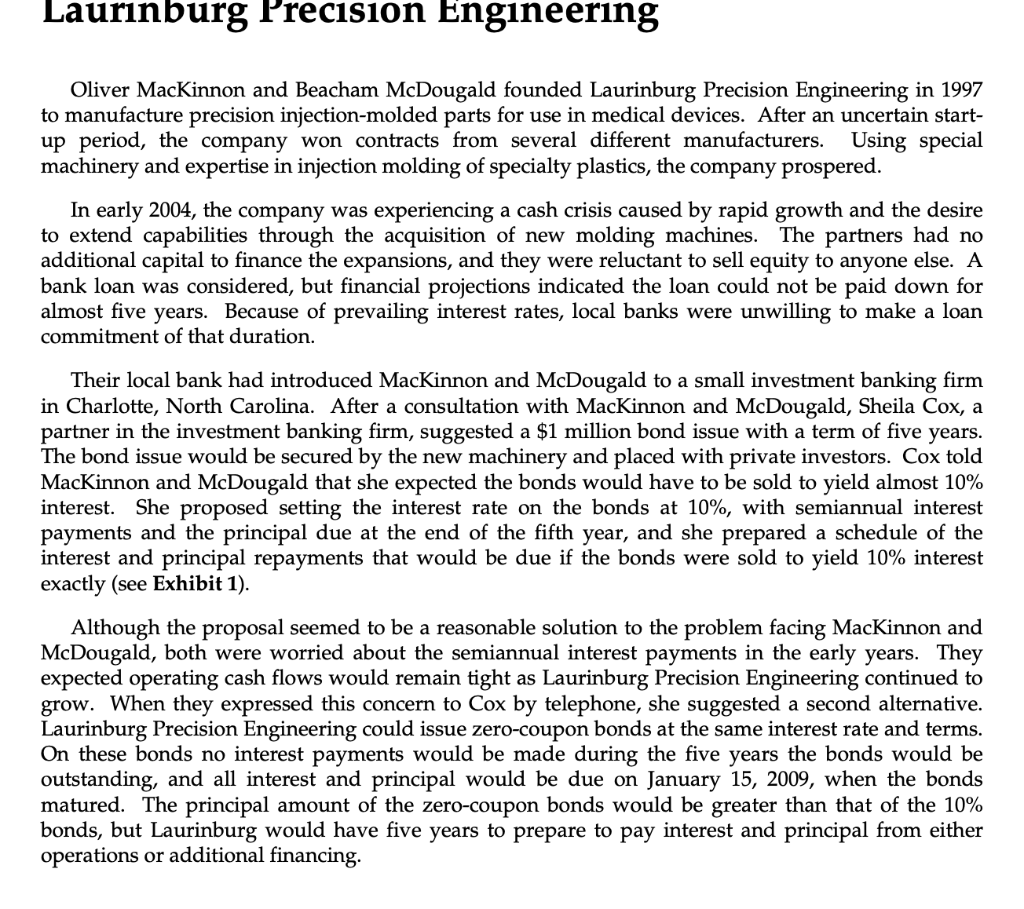

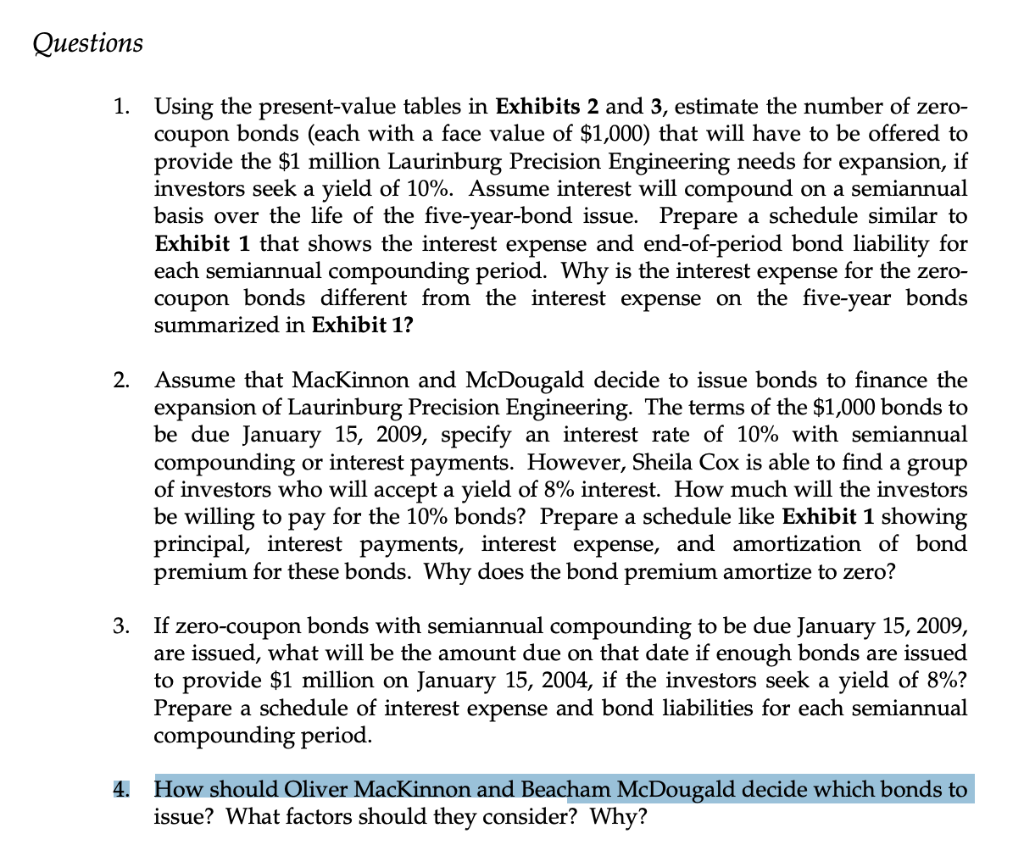

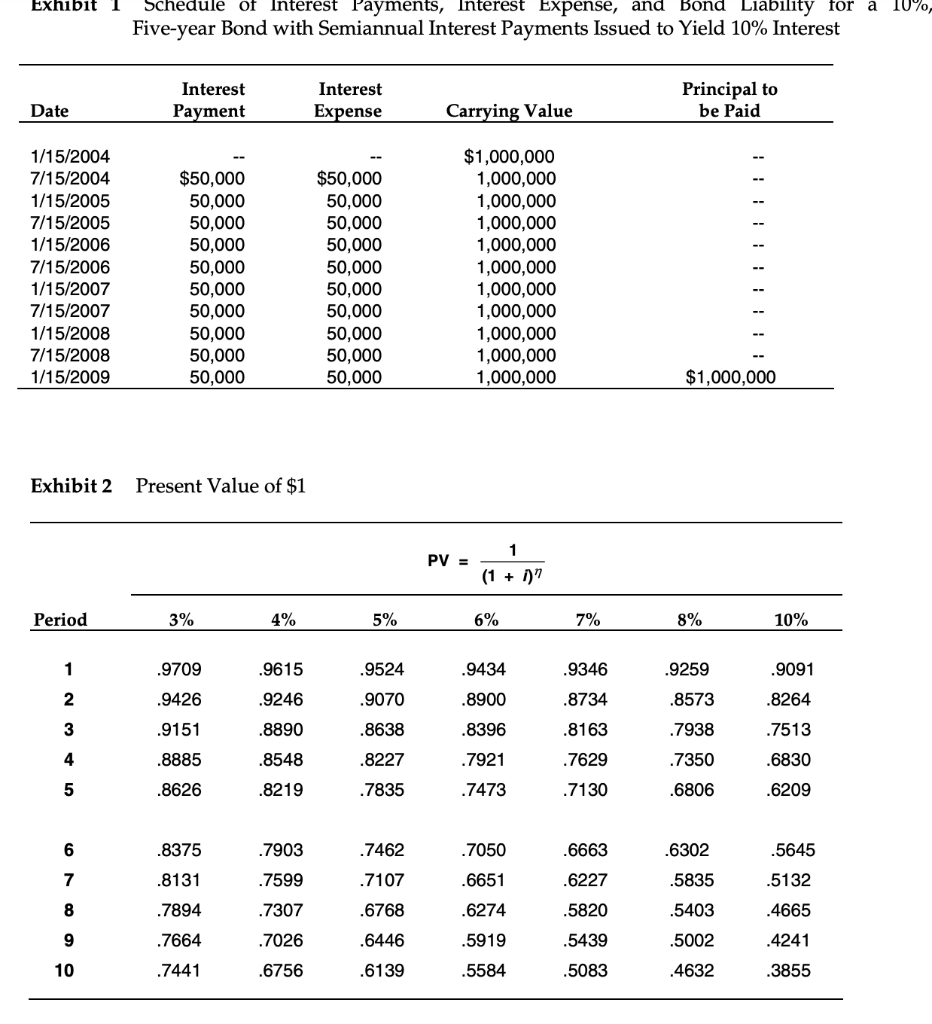

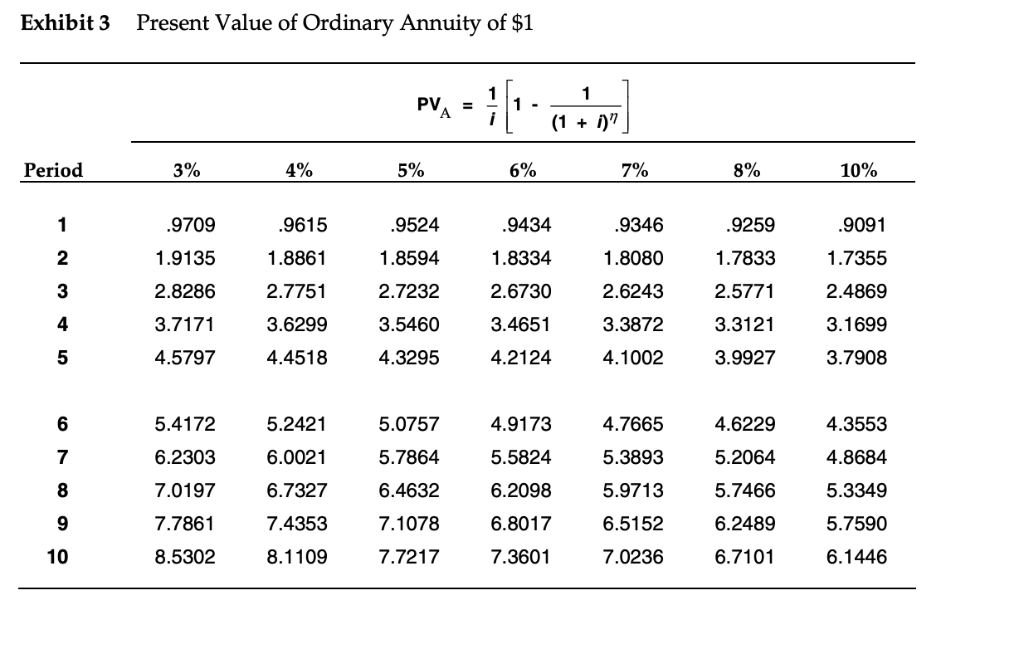

Laurinburg Precision Engineering Oliver MacKinnon and Beacham McDougald founded Laurinburg Precision Engineering in 1997 to manufacture precision injection-molded parts for use in medical devices. After an uncertain start up period, the company won contracts from several different manufacturers. Using special machinery and expertise in injection molding of specialty plastics, the company prospered In early 2004, the company was experiencing a cash crisis caused by rapid growth and the desire to extend capabilities through the acquisition of new molding machines. The partners had no additional capital to finance the expansions, and they were reluctant to sell equity to anyone else. A bank loan was considered, but financial projections indicated the loan could not be paid down for almost five years. Because of prevailing interest rates, local banks were unwilling to make a loan commitment of that duration Their local bank had introduced MacKinnon and McDougald to a small investment banking firm in Charlotte, North Carolina. After a consultation with MacKinnon and McDougald, Sheila Cox, a partner in the investment banking firm, suggested a $1 million bond issue with a term of five years The bond issue would be secured by the new machinery and placed with private investors. Cox told MacKinnon and McDougald that she expected the bonds would have to be sold to yield almost 10% interest. She proposed setting the interest rate on the bonds at 10%, with semiannual interest payments and the principal due at the end of the fifth year, and she prepared a schedule of the interest and principal repayments that would be due if the bonds were sold to yield 10% interest exactly (see Exhibit 1) Although the proposal seemed to be a reasonable solution to the problem facing MacKinnon and McDougald, both were worried about the semiannual interest payments in the early years. They expected operating cash flows would remain tight as Laurinburg Precision Engineering continued to row. When they expressed this concern to Cox by telephone, she suggested a second alternative. Laurinburg Precision Engineering could issue zero-coupon bonds at the same interest rate and terms On these bonds no interest payments would be made during the five years the bonds would be outstanding, and all interest and principal would be due on January 15, 2009, when the bonds matured. The principal amount of the zero-coupon bonds would be greater than that of the 10% bonds, but Laurinburg would have five years to prepare to pay interest and principal from either operations or additional financing Questions 1. Using the present-value tables in Exhibits 2 and 3, estimate the number of zero- coupon bonds (each with a face value of $1,000) that will have to be offered to provide the $1 million Laurinburg Precision Engineering needs for expansion, if investors seek a yield of 10%. Assume interest will compound on a semiannual basisover the life of the five-vear-bond issue. Prepare a schedule similar to Exhibit 1 that shows the interest expense and end-of-period bond liability for each semiannual compounding period. W coupon bonds different from the interest expense on the five-year bonds summarized in Exhibit 1? hy is the interest expense for the zero- 2. Assume that MacKinnon and McDougald decide to issue bonds to finance the expansion of Laurinburg Precision Engineering. The terms of the $1,000 bonds to be due January 15, 2009, specify an interest rate of 10% with semiannual compounding or interest payments. However, Sheila Cox is able to find a group of investors who will accept a yield of 8% interest. How much will the investors be willing to pay for the 10% bonds? Prepare a schedule like Exhibit 1 showing principal, interest payments, interest expense, and amortization of bond premium for these bonds. Why does the bond premium amortize to zero? 3. If zero-coupon bonds with semiannual compounding to be due January 15, 2009, are issued, what will be the amount due on that date if enough bonds are issued to provide $1 million on January 15, 2004, if the investors seek a yield of 8%? Prepare a schedule of interest expense and bond liabilities for each semiannual compounding period 4. How should Oliver MacKinnon and Beacham McDougald decide which bonds to issue? What factors should thev consider? Why? Exhibit 1 Schedule of Interest Payments, Interest Expense, and Bond Liability for a 10% Five-year Bond with Semiannual Interest Payments Issued to Yield 10% Interest Interest Interest Principal to $1,000,000 1/15/2005 7/15/2005 1/15/2006 7/15/2006 1/15/2007 7/15/2007 1/15/2008 7/15/2008 1/15/2009 1,000,000 50,000 50,000 1,000,000 1,000,000 1,000,000 50,000 $1,000,000 Exhibit 2 Present Value of $1 Period 0 7 2 2 .7921 .7629 3 .8626 7835 7462 .7050 5645 0 2 .7894 -7664 .7026 Exhibit 3 Present Value of Ordinary Annuity of $1 Period 3% 4% 5% 6% 8% 10% 0 9709 1.9135 2.8286 9615 1.8861 2.7751 3.6299 4.4518 9524 1.8594 2.7232 3.5460 4.3295 9434 1.8334 2.6730 3.4651 4.2124 9346 1.8080 2.6243 3.3872 4.1002 9259 1.7833 2.5771 3.3121 3.9927 9091 1.7355 2.4869 3.1699 3.7908 2 4 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 5.2421 6.0021 6.7327 7.4353 8.1109 5.0757 5.7864 6.4632 7.1078 7.7217 4.9173 5.5824 6.2098 6.8017 7.3601 4.7665 5.3893 5.9713 6.5152 7.0236 4.6229 5.2064 5.7466 6.2489 6.7101 4.3553 4.8684 5.3349 5.7590 6.1446 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started