Answered step by step

Verified Expert Solution

Question

1 Approved Answer

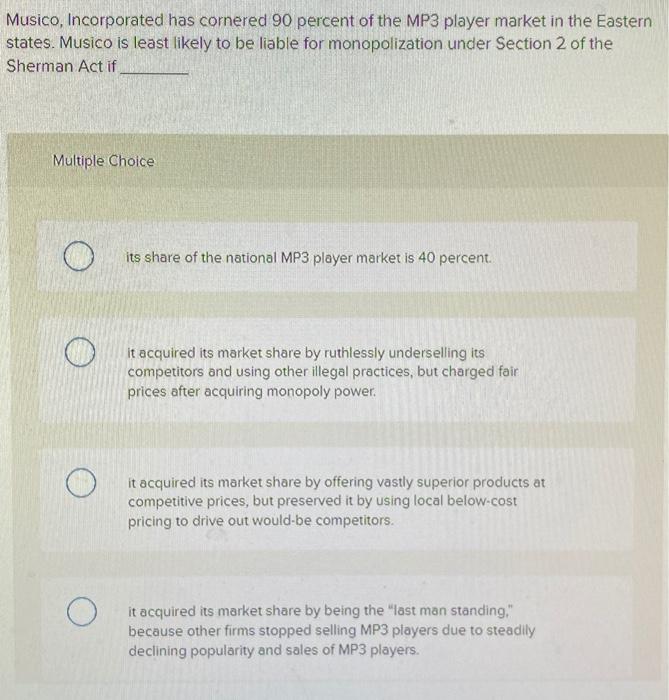

Law Musico, Incorporated has cornered 90 percent of the MP3 player market in the Eastern tates. Musico is least likely to be liable for monopolization

Law

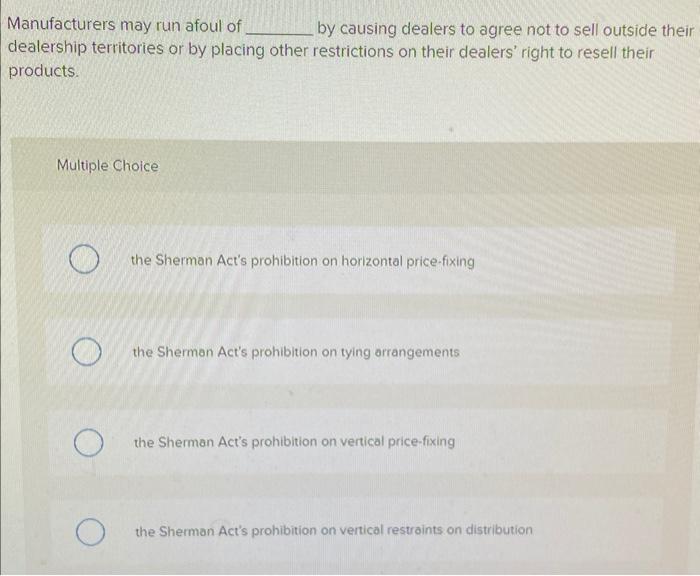

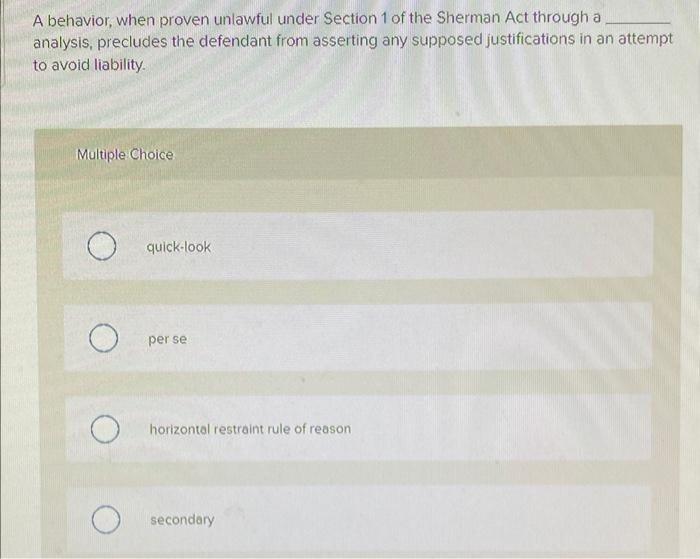

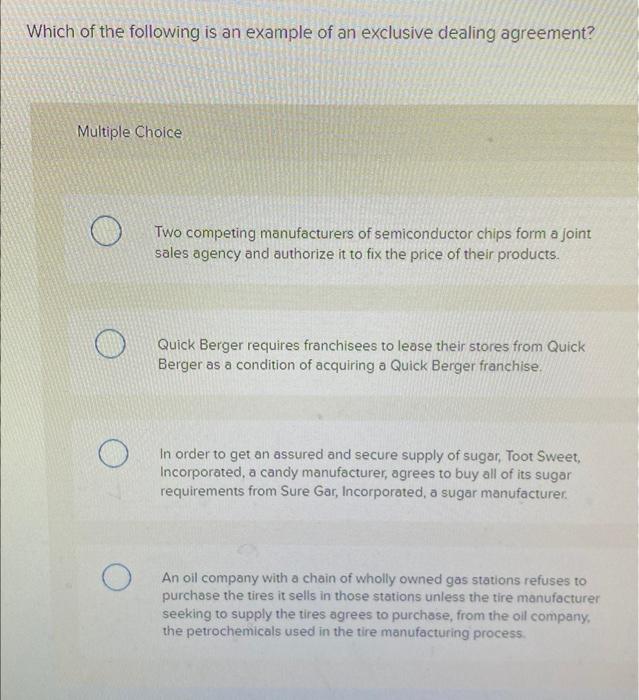

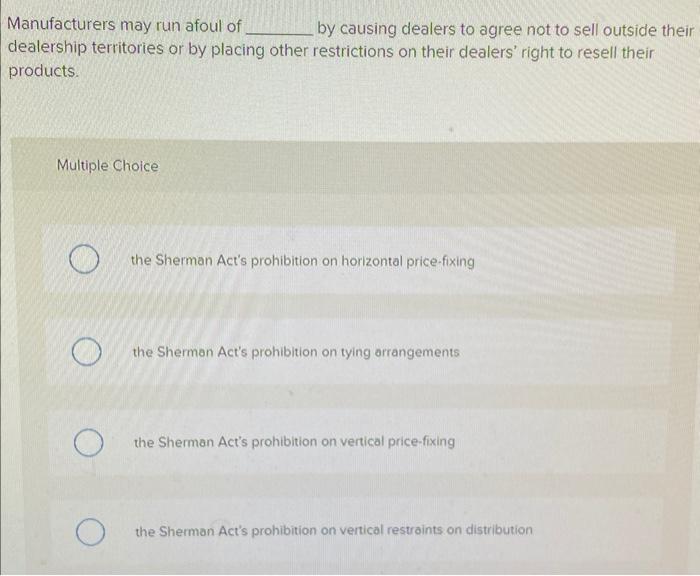

Musico, Incorporated has cornered 90 percent of the MP3 player market in the Eastern tates. Musico is least likely to be liable for monopolization under Section 2 of the herman Act if Multiple Choice its share of the national MP3 player market is 40 percent. It acquired its market share by ruthlessly underselling its competitors and using other illegal proctices, but charged fair prices after acquiring monopoly power. it acquired its market share by offering vastly superior products at competitive prices, but preserved it by using local below-cost pricing to drive out would-be competitors. it acquired its market share by being the "last man standing." because other firms stopped selling MP3 players due to steadily declining popularity and sales of MP3 players. A behavior, when proven unlawful under Section 1 of the Sherman Act through a analysis, precludes the defendant from asserting any supposed justifications in an attempt to avoid liability. Multiple Choice quick-100k per se horizontal restraint rule of reason secondary Possession of monopoly power is sufficient for a defendant to be held liable for monopolization under Section 2 of the Sherman Act. True or False For purposes of determining whether Section 1 of the Sherman Act has been violated, courts generally treat reciprocal dealing agreements in a fashion similar to the treatment of tying agreements. True or False Mathew Shaw and his friends are associates in the business of garment manufacturing. Their garment association agreed not to sell to retailers who sold clothing with designs pirated from original manufacturers. Typically, the courts will apply the Multiple Choice rule of reason to this case of vertical boycott. per se rule to this case of horizontal boycott. rule of reason to this case of horizontal boycott: perse rule to this case of vertical boycott. A,B, and C are foreign companies which make cashmere sweaters in various foreign countries. They reach an agreement for the purpose of raising prices of the sweaters. Collectively, they make substantial sales into the U.S., both in absolute numbers and relative to total consumption of sweaters in the U.S. Will these firms be subject to U.S. antitrust law and the jurisdiction of U.S. courts? Multiple Choice No, they do not have U.S. production facilities or U.S. subsidiaries. Yes, because these foreign firms have participated in U.S. commerce. No, because their participation in U.S. commerce is only by exporting sweaters. Yes, if they agree to set up a joint sales outlet in the U.S for selling the sweaters. Which of the following is an example of vertical price-fixing? Multiple Choice An agreement between three manufacturers to restrict the amount of a good to be sold. An agreement between a manufacturer and a dealer about the resale price of a product. An agreement between two manufacturers on the quantity of a product to be made. An agreement between two dealers to pay manufacturers a particular price for a product. Which of the following is an example of an exclusive dealing agreement? Multiple Choice Two competing manufacturers of semiconductor chips form a joint sales agency and authorize it to fix the price of their products. Quick Berger requires franchisees to lease their stores from Quick Berger as a condition of acquiring a Quick Berger franchise. In order to get an assured and secure supply of sugar, Toot Sweet, Incorporated, a candy manufacturer, agrees to buy all of its sugar requirements from Sure Gar, Incorporated, a sugar manufacturer. An oil company with a chain of wholly owned gas stations refuses to purchase the tires it sells in those stations unless the tire manufacturer seeking to supply the tires agrees to purchase, from the oil company, the petrochemicals used in the tire manufacturing process. Manufacturers may run afoul of by causing dealers to agree not to sell outside their dealership territories or by placing other restrictions on their dealers' right to resell their products. Multiple Choice the Sherman Act's prohibition on horizontal price-fixing the Sherman Act's prohibition on tying arrangements the Sherman Act's prohibition on vertical price-fixing the Sherman Act's prohibition on vertical restraints on distribution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started