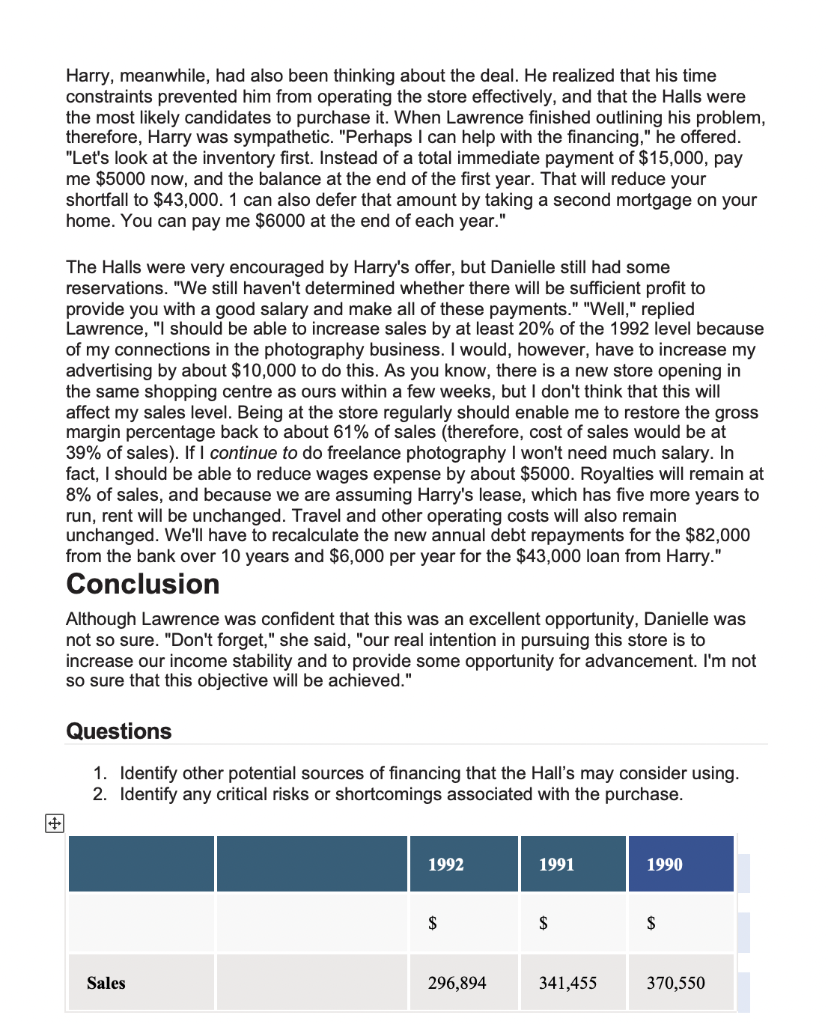

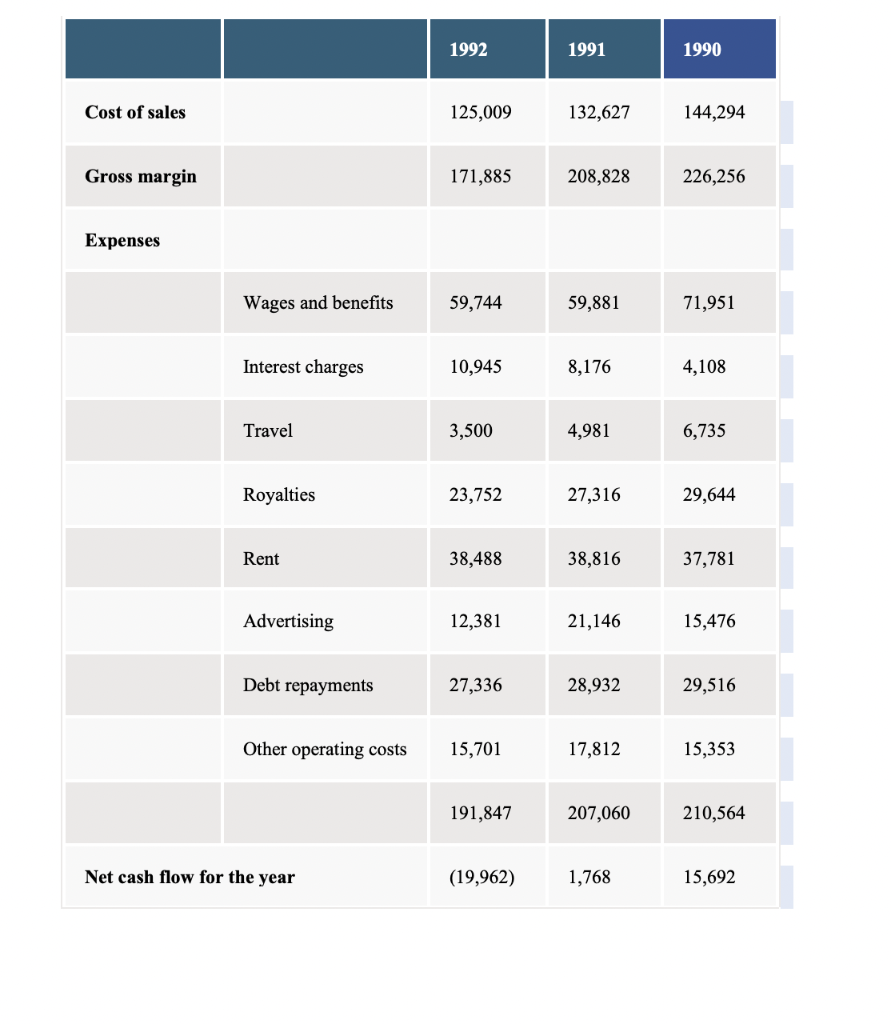

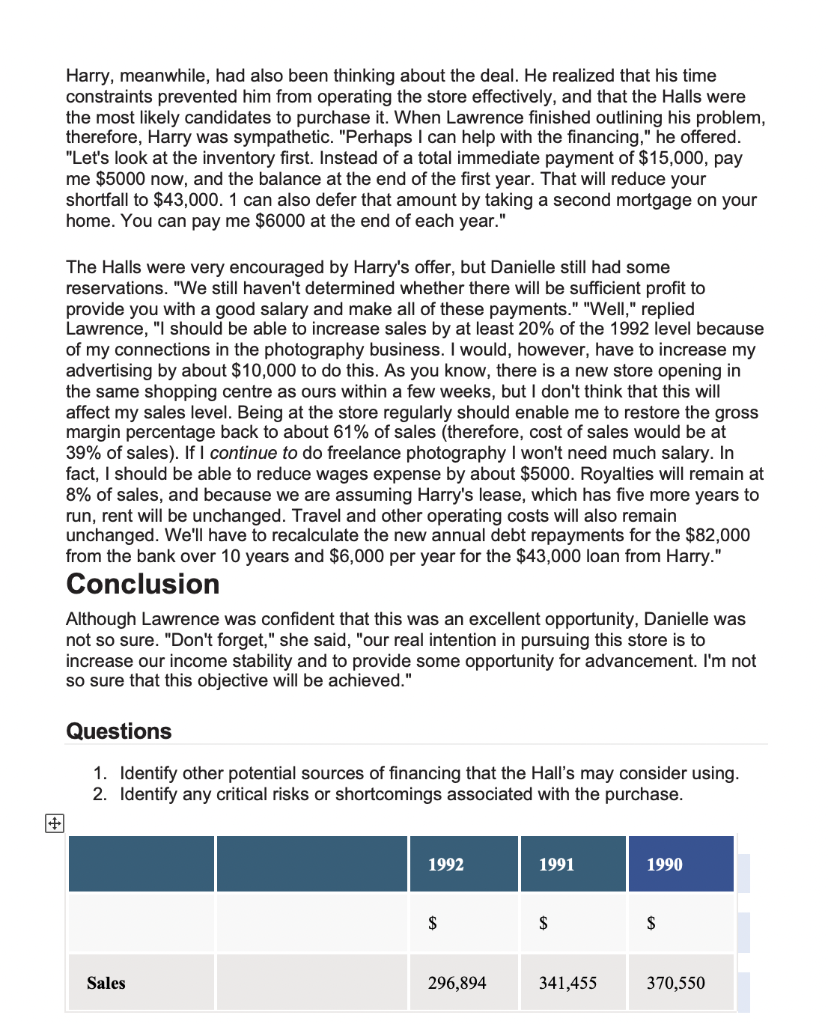

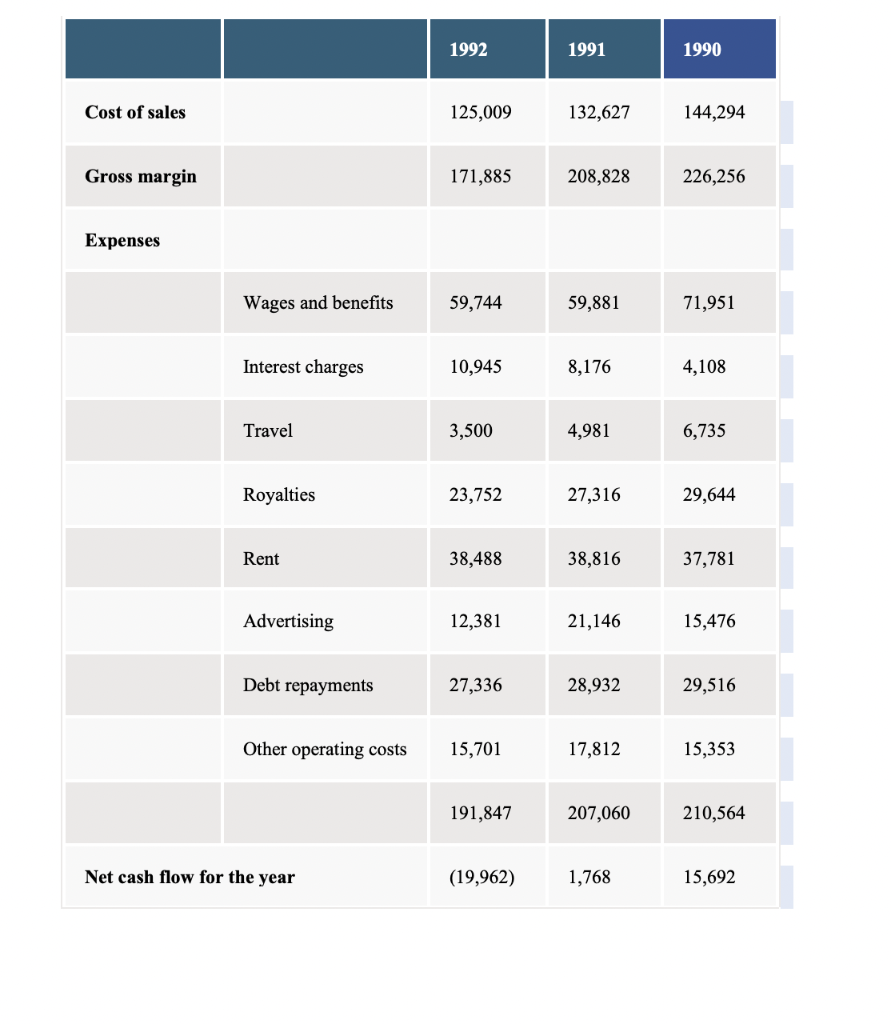

Lawrence Hall "I guess it's decision time," said Lawrence Hall to his wife, Danielle. By March 2, 1992, the Halls had spent two months investigating the purchase of Good Fotos Limited, a combination photographic supply store and film processor located in a shopping mall in Halifax, Nova Scotia. "I think you're right," replied Danielle. "We've probably received the best offer that the present owner, Harry Mitchell, is going to make. We must now carefully review our personal financial situation, reexamine the company's financial information provided by Mr. Mitchell, and reassess our personal goals in order to confirm this is what we really want. After the commitment is made, it will be too late to change our decision." Background Information Lawrence Hall was a self-employed photographer living in Dartmouth, Nova Scotia. His wife, Danielle, was a dental hygienist, working with a local dental practice. Lawrence had become a freelance photographer five years ago, following his marriage. Prior to that, he had been a deep-sea diver. It was his interest in underwater photography, as well as a desire to find a less risky line of work, that prompted his career change. Lawrence found that freelance photography was a competitive business, with periods of intense activity alternating with slower periods. The family often had to rely on Danielle's income to carry them through these slower periods. It was because of this that Lawrence, who had always enjoyed working for himself, decided to consider the purchase of a photographic store. Good Fotos Limited was a franchised photo finisher/ retailer, owned by Harry Mitchell. Mr. Mitchell, a well-known local entrepreneur, was involved in several successful small businesses in the Halifax area. He had begun Good Fotos Limited about four years previously, mainly as a project for his wife, Roberta, to operate. Roberta had now decided that she was no longer interested in the store, and Harry, because of his other business commitments, did not have sufficient time to properly operate it. As a result, the store's financial performance had declined over the past several years. (See Exhibit 1) When the Halls first approached Mr. Mitchell about acquiring the store, he agreed the total selling price for the inventory, equipment and other assets of the company would be as follows: . Inventory$ 15,000 Equipment123,750 Other assets 96,250 . . Total$235,000 The Halls spent about three weeks reviewing and discussing this offer. Finally, they decided to meet with Harry. Lawrence began the negotiations. "We feel that the price of $235,000 is just too high. We've examined the equipment and found that it needs some repair work. Also, the store needs painting and minor changes. We are prepared to offer $180,000 plus the value of the inventory. Don't forget, the store is generating less cash each year, to the point in 1992 where it is spending more than it takes in." "I agree that the store and equipment need some work done on them," responded Harry. "However, $180,000 plus inventories does not even return book value of the assets." After some additional discussion, both parties agreed that a price of $190,000 plus inventories would be acceptable. The Halls left the meeting satisfied with the deal they had negotiated, and made an appointment with their bank manager for the following morning. The revised values were: Inventory$ 15,000 Equipment103,000 Other assets 87,000 . Total$205,000 The Problem Ralph Welsh, manager of the Royal Bank of Canada's Dartmouth Shopping Center Branch, removed his glasses and looked thoughtfully across his desk at the Halls. "What you've just told me about the opportunity is certainly interesting," he said. "There are, however, some points that need clarification and some things about the bank's lending policies which you should understand. We would normally be prepared to lend 80% of the value of the equipment which are part of this package. One of the most important things to clarify is whether this company can support the debt you are taking on and still provide an income for you. You've stated, for example, that you feel sales can be increased because you, Lawrence, will be working at the store and because of your contacts among professional photographers. I think that from your point of view, you should check on the competition from similar operations before making that type of assumption. I'll need a forecast statement of net cash flow for the next year reflecting the acquisition and the changes you plan to make before I can proceed any further. In addition, you would repay the loan in equal payments over ten years." Lawrence and Danielle were somewhat disappointed after they left the bank. "I didn't think that the bank would lend us all the money we needed," said Danielle, "but I thought they would provide more than that. It appears that we can borrow only $82,000." Lawrence and Danielle determined that one alternative for acquiring more money was to borrow $50,000 as an add-on mortgage on their home. They also had about $20,000 available which could be borrowed from their life insurance policies. "This win still leave us $53,000 short," said Lawrence. "I'll have to tell Harry that we can't finance the deal." Harry, meanwhile, had also been thinking about the deal. He realized that his time constraints prevented him from operating the store effectively, and that the Halls were the most likely candidates to purchase it. When Lawrence finished outlining his problem, therefore, Harry was sympathetic. "Perhaps I can help with the financing," he offered. "Let's look at the inventory first. Instead of a total immediate payment of $15,000, pay me $5000 now, and the balance at the end of the first year. That will reduce your shortfall to $43,000. 1 can also defer that amount by taking a second mortgage on your home. You can pay me $6000 at the end of each year." The Halls were very encouraged by Harry's offer, but Danielle still had some reservations. "We still haven't determined whether there will be sufficient profit to provide you with a good salary and make all of these payments." "Well," replied Lawrence, "I should be able to increase sales by at least 20% of the 1992 level because of my connections in the photography business. I would, however, have to increase my advertising by about $10,000 to do this. As you know, there is a new store opening in the same shopping centre as ours within a few weeks, but I don't think that this will affect my sales level. Being at the store regularly should enable me to restore the gross margin percentage back to about 61% of sales (therefore, cost of sales would be at 39% of sales). If I continue to do freelance photography I won't need much salary. In fact, I should be able to reduce wages expense by about $5000. Royalties will remain at 8% of sales, and because we are assuming Harry's lease, which has five more years to run, rent will be unchanged. Travel and other operating costs will also remain unchanged. We'll have to recalculate the new annual debt repayments for the $82,000 from the bank over 10 years and $6,000 per year for the $43,000 loan from Harry." Conclusion Although Lawrence was confident that this was an excellent opportunity, Danielle was not so sure. "Don't forget," she said, "our real intention in pursuing this store is to increase our income stability and to provide some opportunity for advancement. I'm not so sure that this objective will be achieved." Questions 1. Identify other potential sources of financing that the Hall's may consider using. 2. Identify any critical risks or shortcomings associated with the purchase. 1992 1991 1990 $ $ $ Sales 296,894 341,455 370,550 1992 1991 1990 Cost of sales 125,009 132,627 144,294 Gross margin 171,885 208,828 226,256 Expenses Wages and benefits 59,744 59,881 71,951 Interest charges 10,945 8,176 4,108 Travel 3,500 4,981 6,735 Royalties 23,752 27,316 29,644 Rent 38,488 38,816 37,781 Advertising 12,381 21,146 15,476 Debt repayments 27,336 28,932 29,516 Other operating costs 15,701 17,812 15,353 191,847 207,060 210,564 Net cash flow for the year (19,962) 1,768 15,692 1992 1991 1990 Exhibit 1 Good Fotos Limited Statement of Net Cash Flow For the Years Ended January 31 O This case was adapted from a case prepared by Professor Wayne King for tile Atlantic Entrepreneurial Institute as a basis for classroom discussion, and is not meant to illustrate either effective or ineffective management. Material in this case has been disguised. Copyright 1993, the Atlantic Entrepreneurial Institute. Reproduction of this case is allowed without permission for educational purposes, but all such reproduction must acknowledge the copyright. This permission does not include publication. Lawrence Hall "I guess it's decision time," said Lawrence Hall to his wife, Danielle. By March 2, 1992, the Halls had spent two months investigating the purchase of Good Fotos Limited, a combination photographic supply store and film processor located in a shopping mall in Halifax, Nova Scotia. "I think you're right," replied Danielle. "We've probably received the best offer that the present owner, Harry Mitchell, is going to make. We must now carefully review our personal financial situation, reexamine the company's financial information provided by Mr. Mitchell, and reassess our personal goals in order to confirm this is what we really want. After the commitment is made, it will be too late to change our decision." Background Information Lawrence Hall was a self-employed photographer living in Dartmouth, Nova Scotia. His wife, Danielle, was a dental hygienist, working with a local dental practice. Lawrence had become a freelance photographer five years ago, following his marriage. Prior to that, he had been a deep-sea diver. It was his interest in underwater photography, as well as a desire to find a less risky line of work, that prompted his career change. Lawrence found that freelance photography was a competitive business, with periods of intense activity alternating with slower periods. The family often had to rely on Danielle's income to carry them through these slower periods. It was because of this that Lawrence, who had always enjoyed working for himself, decided to consider the purchase of a photographic store. Good Fotos Limited was a franchised photo finisher/ retailer, owned by Harry Mitchell. Mr. Mitchell, a well-known local entrepreneur, was involved in several successful small businesses in the Halifax area. He had begun Good Fotos Limited about four years previously, mainly as a project for his wife, Roberta, to operate. Roberta had now decided that she was no longer interested in the store, and Harry, because of his other business commitments, did not have sufficient time to properly operate it. As a result, the store's financial performance had declined over the past several years. (See Exhibit 1) When the Halls first approached Mr. Mitchell about acquiring the store, he agreed the total selling price for the inventory, equipment and other assets of the company would be as follows: . Inventory$ 15,000 Equipment123,750 Other assets 96,250 . . Total$235,000 The Halls spent about three weeks reviewing and discussing this offer. Finally, they decided to meet with Harry. Lawrence began the negotiations. "We feel that the price of $235,000 is just too high. We've examined the equipment and found that it needs some repair work. Also, the store needs painting and minor changes. We are prepared to offer $180,000 plus the value of the inventory. Don't forget, the store is generating less cash each year, to the point in 1992 where it is spending more than it takes in." "I agree that the store and equipment need some work done on them," responded Harry. "However, $180,000 plus inventories does not even return book value of the assets." After some additional discussion, both parties agreed that a price of $190,000 plus inventories would be acceptable. The Halls left the meeting satisfied with the deal they had negotiated, and made an appointment with their bank manager for the following morning. The revised values were: Inventory$ 15,000 Equipment103,000 Other assets 87,000 . Total$205,000 The Problem Ralph Welsh, manager of the Royal Bank of Canada's Dartmouth Shopping Center Branch, removed his glasses and looked thoughtfully across his desk at the Halls. "What you've just told me about the opportunity is certainly interesting," he said. "There are, however, some points that need clarification and some things about the bank's lending policies which you should understand. We would normally be prepared to lend 80% of the value of the equipment which are part of this package. One of the most important things to clarify is whether this company can support the debt you are taking on and still provide an income for you. You've stated, for example, that you feel sales can be increased because you, Lawrence, will be working at the store and because of your contacts among professional photographers. I think that from your point of view, you should check on the competition from similar operations before making that type of assumption. I'll need a forecast statement of net cash flow for the next year reflecting the acquisition and the changes you plan to make before I can proceed any further. In addition, you would repay the loan in equal payments over ten years." Lawrence and Danielle were somewhat disappointed after they left the bank. "I didn't think that the bank would lend us all the money we needed," said Danielle, "but I thought they would provide more than that. It appears that we can borrow only $82,000." Lawrence and Danielle determined that one alternative for acquiring more money was to borrow $50,000 as an add-on mortgage on their home. They also had about $20,000 available which could be borrowed from their life insurance policies. "This win still leave us $53,000 short," said Lawrence. "I'll have to tell Harry that we can't finance the deal." Harry, meanwhile, had also been thinking about the deal. He realized that his time constraints prevented him from operating the store effectively, and that the Halls were the most likely candidates to purchase it. When Lawrence finished outlining his problem, therefore, Harry was sympathetic. "Perhaps I can help with the financing," he offered. "Let's look at the inventory first. Instead of a total immediate payment of $15,000, pay me $5000 now, and the balance at the end of the first year. That will reduce your shortfall to $43,000. 1 can also defer that amount by taking a second mortgage on your home. You can pay me $6000 at the end of each year." The Halls were very encouraged by Harry's offer, but Danielle still had some reservations. "We still haven't determined whether there will be sufficient profit to provide you with a good salary and make all of these payments." "Well," replied Lawrence, "I should be able to increase sales by at least 20% of the 1992 level because of my connections in the photography business. I would, however, have to increase my advertising by about $10,000 to do this. As you know, there is a new store opening in the same shopping centre as ours within a few weeks, but I don't think that this will affect my sales level. Being at the store regularly should enable me to restore the gross margin percentage back to about 61% of sales (therefore, cost of sales would be at 39% of sales). If I continue to do freelance photography I won't need much salary. In fact, I should be able to reduce wages expense by about $5000. Royalties will remain at 8% of sales, and because we are assuming Harry's lease, which has five more years to run, rent will be unchanged. Travel and other operating costs will also remain unchanged. We'll have to recalculate the new annual debt repayments for the $82,000 from the bank over 10 years and $6,000 per year for the $43,000 loan from Harry." Conclusion Although Lawrence was confident that this was an excellent opportunity, Danielle was not so sure. "Don't forget," she said, "our real intention in pursuing this store is to increase our income stability and to provide some opportunity for advancement. I'm not so sure that this objective will be achieved." Questions 1. Identify other potential sources of financing that the Hall's may consider using. 2. Identify any critical risks or shortcomings associated with the purchase. 1992 1991 1990 $ $ $ Sales 296,894 341,455 370,550 1992 1991 1990 Cost of sales 125,009 132,627 144,294 Gross margin 171,885 208,828 226,256 Expenses Wages and benefits 59,744 59,881 71,951 Interest charges 10,945 8,176 4,108 Travel 3,500 4,981 6,735 Royalties 23,752 27,316 29,644 Rent 38,488 38,816 37,781 Advertising 12,381 21,146 15,476 Debt repayments 27,336 28,932 29,516 Other operating costs 15,701 17,812 15,353 191,847 207,060 210,564 Net cash flow for the year (19,962) 1,768 15,692 1992 1991 1990 Exhibit 1 Good Fotos Limited Statement of Net Cash Flow For the Years Ended January 31 O This case was adapted from a case prepared by Professor Wayne King for tile Atlantic Entrepreneurial Institute as a basis for classroom discussion, and is not meant to illustrate either effective or ineffective management. Material in this case has been disguised. Copyright 1993, the Atlantic Entrepreneurial Institute. Reproduction of this case is allowed without permission for educational purposes, but all such reproduction must acknowledge the copyright. This permission does not include publication