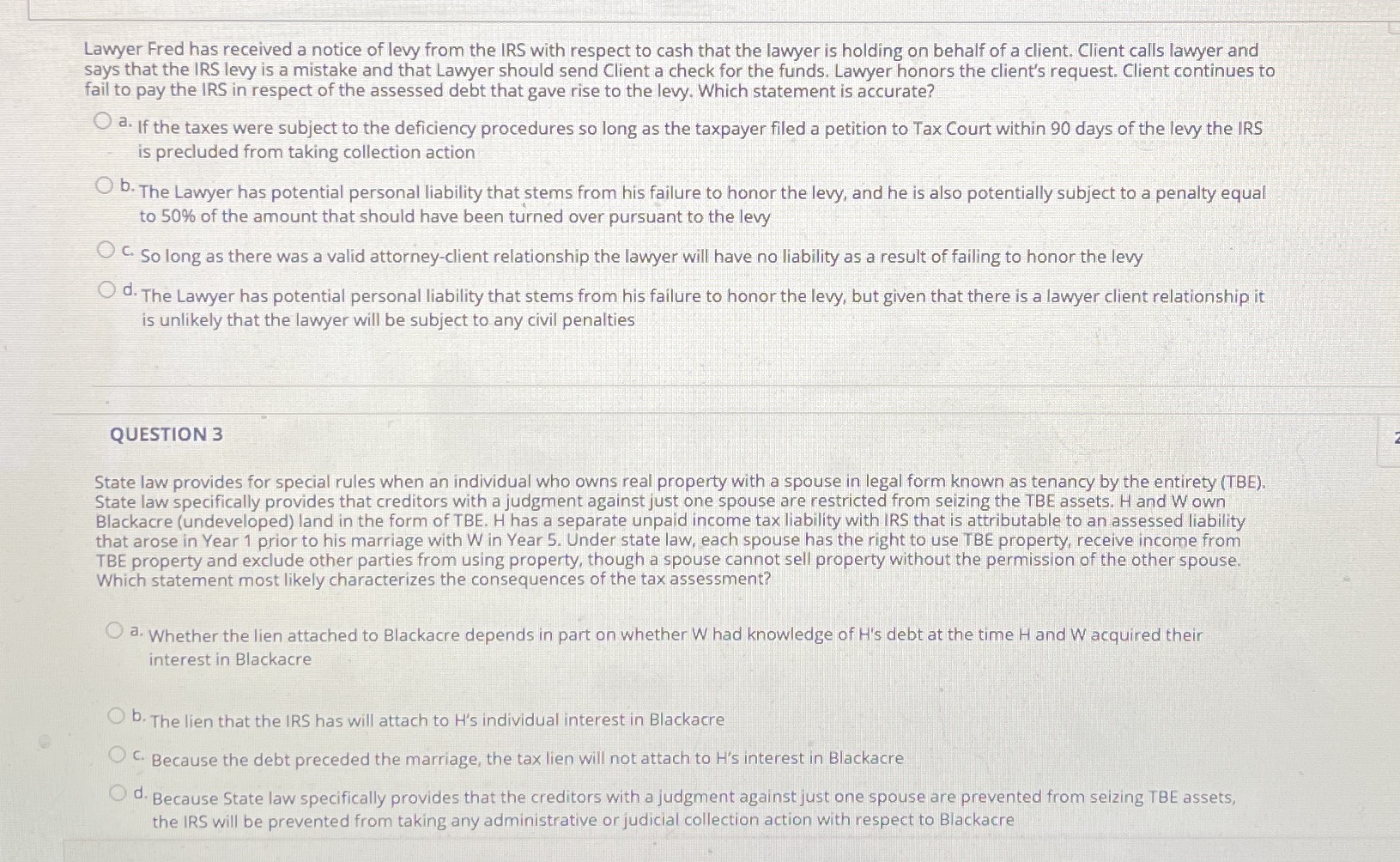

Lawyer Fred has received a notice of levy from the IRS with respect to cash that the lawyer is holding on behalf of a client. Client calls lawyer and says that the IRS levy is a mistake and that Lawyer should send Client a check for the funds. Lawyer honors the client's request. Client continues to fail to pay the IRS in respect of the assessed debt that gave rise to the levy. Which statement is accurate? a. If the taxes were subject to the deficiency procedures so long as the taxpayer filed a petition to Tax Court within 90 days of the levy the IRS is precluded from taking collection action O b. The Lawyer has potential personal liability that stems from his failure to honor the levy, and he is also potentially subject to a penalty equal to 50% of the amount that should have been turned over pursuant to the levy C. So long as there was a valid attorney-client relationship the lawyer will have no liability as a result of failing to honor the levy O d. The Lawyer has potential personal liability that stems from his failure to honor the levy, but given that there is a lawyer client relationship it is unlikely that the lawyer will be subject to any civil penalties QUESTION 3 State law provides for special rules when an individual who owns real property with a spouse in legal form known as tenancy by the entirety (TBE). State law specifically provides that creditors with a judgment against just one spouse are restricted from seizing the TBE assets. H and Wown Blackacre (undeveloped) land in the form of TBE. H has a separate unpaid income tax liability with IRS that is attributable to an assessed liability that arose in Year 1 prior to his marriage with W in Year 5. Under state law, each spouse has the right to use TBE property, receive income from TBE property and exclude other parties from using property, though a spouse cannot sell property without the permission of the other spouse. Which statement most likely characterizes the consequences of the tax assessment? a. Whether the lien attached to Blackacre depends in part on whether W had knowledge of H's debt at the time H and W acquired their interest in Blackacre O b. The lien that the IRS has will attach to H's individual interest in Blackacre C. Because the debt preceded the marriage, the tax lien will not attach to H's interest in Blackacre d. Because State law specifically provides that the creditors with a judgment against just one spouse are prevented from seizing TBE assets, the IRS will be prevented from taking any administrative or judicial collection action with respect to Blackacre