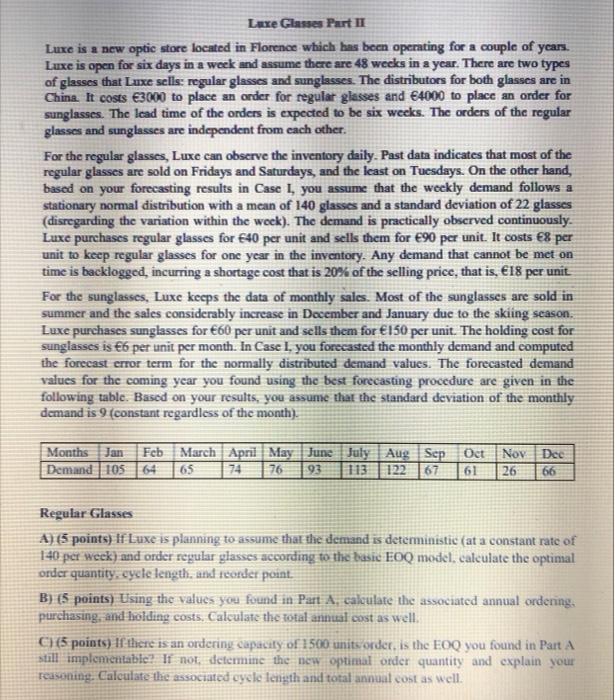

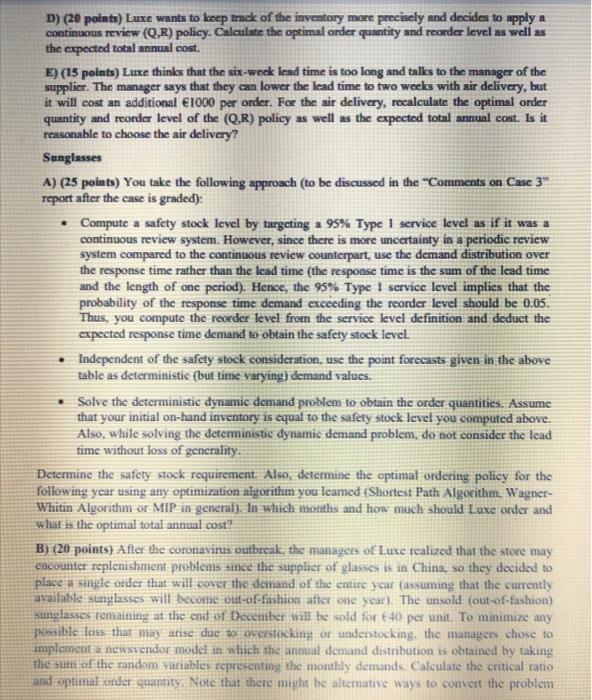

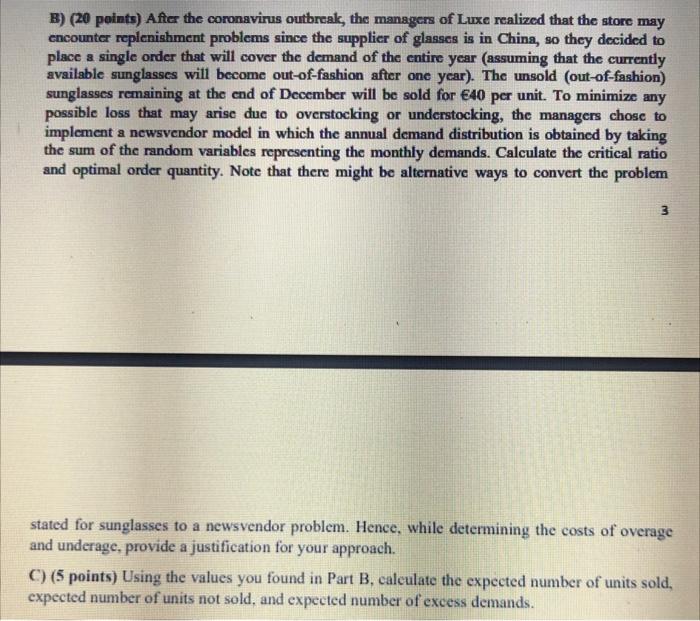

Laxe Giasses Part II Luxe is a new optic store located in Florence which has been operating for a couple of years. Luxe is open for six days in a week and assume there are 48 wecks in a year. There are two types of glasses that Luxe sells: regular glasses and sunglasses. The distributors for both glasses are in China. It costs 3000 to place an order for regular glasses and 64000 to place an order for sunglasses. The lead time of the onders is expected to be six weeks. The orders of the regular glasses and sunglasses are independent from each other. For the regular glasses, Luxe can observe the inventory daily. Past data indicates that most of the regular glasses are sold on Fridays and Saturdays, and the least on Tuesdays. On the other hand, based on your forecasting results in Case I, you assume that the weekly demand follows a stationary normal distribution with a mean of 140 glasses and a standard deviation of 22 glasses (disregarding the variation within the week). The demand is practically observed continuously. Luxe purchases regular glasses for 640 per unit and sells them for 90 per unit. It costs 68 per unit to keep regular glasses for one year in the inventory. Any demand that cannot be met on time is backlogged, incurring a shortage cost that is 20% of the selling price, that is, 18 per unit. For the sunglasses, Luxe keeps the data of monthly sales. Most of the sunglasses are sold in summer and the sales considerably increase in December and January due to the skiing season. Luxe purchases sunglasses for 60 per unit and sells them for 150 per unit. The holding cost for sunglasses is 66 per unit per month. In Case I, you forecasted the monthly demand and computed the forecast error term for the normally distributed demand values. The forecasted demand values for the coming year you found using the best forecasting procedure are given in the following table. Based on your results, you assume that the standard deviation of the monthly demand is 9 (constant regardless of the month). Regular Glasses A) (5 points) If Luxe is planning to assume that the demand is deteministic (at a constant rate of 140 per week) and order regular glasses according to the basic EOQ model, calculate the optimal order quantity. cyste length, and teorder point. B) (5 points) Using the values you found in Part A, calculate the associated annual ordening. purchasing, and holding costs. Calculate the total annual cost as well. C) (5 points) If there is an ordering capacaty of 1500 unitworder, is the EOQ you found in Part A still implementable? If nor determine the new optimal otder quantity and explain your reavoning. Calculate the assoctated cyshe length and total annual cost as well. D) (20 points) Luxe wants to keep track of the inveatory more precisely and decides to apply a continuous review (Q,R ) policy. Caleulate the optimal onder quantity and reorder level as well as the expected total annual cost. E) (15 points) Luxe thinks that the six-wock lead time is too long and talics to the manager of the supplier. The manager says that they can lower the lead time to two weeks with air delivery, but it will cost an additional 1000 per order. For the air delivery, recalculate the optimal order quantity and reorder level of the (Q,R) policy as well as the expected total annual cost. Is it reasonable to choose the air delivery? Sunglasses A) (25 points) You take the following approach (to be discussed in the "Comments on Case 3" report after the case is graded): - Compute a safety stock level by targeting a 95% Type 1 service level as if it was a continuous review system. However, since there is more uncertainty in a periodic review system compared to the continuous review counterpart, use the demand distribution over the response time rather than the lead time (the response time is the sum of the lead time and the length of one period). Hence, the 95% Type 1 service level implies that the probability of the response time demand exceeding the reorder level should be 0.05. Thus, you compute the reorder level from the service level definition and deduct the expected response time demand to obtain the safety stock level. - Independent of the safety stock consideration, use the point forecasts given in the above table as deterministic (but lime varying) demand values. - Solve the deterministic dynamic demand problem to obtain the order quantities. Assume that your initial on-hand inventory is equal to the safety stock level you computed above. Also, while solving the deterministic dynamic demand problem, do not consider the lead time withoul loss of generality. Determine the safety stock requirement. Also, determine the optimal ordering policy for the following year using any optimization algorithm you leamed (Shortest Path Algocithm. WagnerWhitin Algorithm or MIP in general). In which moaths and how much should Luxe order and What is the optimal total annual cost? B) (20 points) After the coronavirus outbreak, the managers of Luxe realized that the store may encounter replenishment problems stnce the suppher of glasses is in China, so they decided to place a single order that will cover the demand of the entire y car fassuming that the currently available stanglasses will become out-of-fishion after one year). The unsold (out-of-fashion) punglasses remaining at the end of December will be sold for (40) per unit. To minimize any possible loss that maiy arise due to overstosking of understocking. the managers chose to implement a newsvendor model in which the annual demand distribution is obtained by taking the stim of the random variables reprecenting the monthly demands. Calculate the critical ratio and optimal order quantity. Note that there might be altemative ways to convert the problem B) (20 points) After the coronavirus outbreak, the managers of Luxe realized that the store may encounter replenishment problems since the supplier of glasses is in China, so they decided to place a single order that will cover the demand of the entire year (assuming that the currently available sunglasses will become out-of-fashion after one year). The unsold (out-of-fashion) sunglasses remaining at the end of December will be sold for 40 per unit. To minimize any possible loss that may arise due to overstocking or understocking, the managers chose to implement a newsvendor model in which the annual demand distribution is obtained by taking the sum of the random variables representing the monthly demands. Calculate the critical ratio and optimal order quantity. Note that there might be alternative ways to convert the problem 3 stated for sunglasses to a newsvendor problem. Hence, while determining the costs of overage and underage, provide a justification for your approach. C) (5 points) Using the values you found in Part B, calculate the expected number of units sold, expected number of units not sold, and expected number of excess demands