Question

Lazard Corporation has experienced cash flow problems and decides to improve its current cash position by factoring 30% of its receivables, without recourse, and assigning

Lazard Corporation has experienced cash flow problems and decides to improve its current cash position by factoring 30% of its receivables, without recourse, and assigning the remainder with the same finance company. The factored receivables meet the conditions for a sale while the assigned receivables do not. The agreement with the finance company stipulates that a 10% commission will be assessed on factored accounts, no service charge is assessed on the assigned accounts, and 15% annual interest will be charged on the outstanding note payable balance related to the assigned accounts. Additionally, the finance company will advance only 80% of the factored and assigned accounts, and Lazard must continue the collection responsibilities on the assigned accounts. At the beginning of the last month of the companys fiscal year, the accounts receivable transferred to the finance company amounted to $187,000. During the month, collections on factored accounts were $46,000, and collections on assigned accounts amounted to $84,000. All collections on assigned accounts plus accrued interest were remitted to the finance company at the end of the month. The remaining amounts owed will be remitted within these months.

| Required: | |

| 1. | Prepare all journal entries to record the preceding information on Lazards books. |

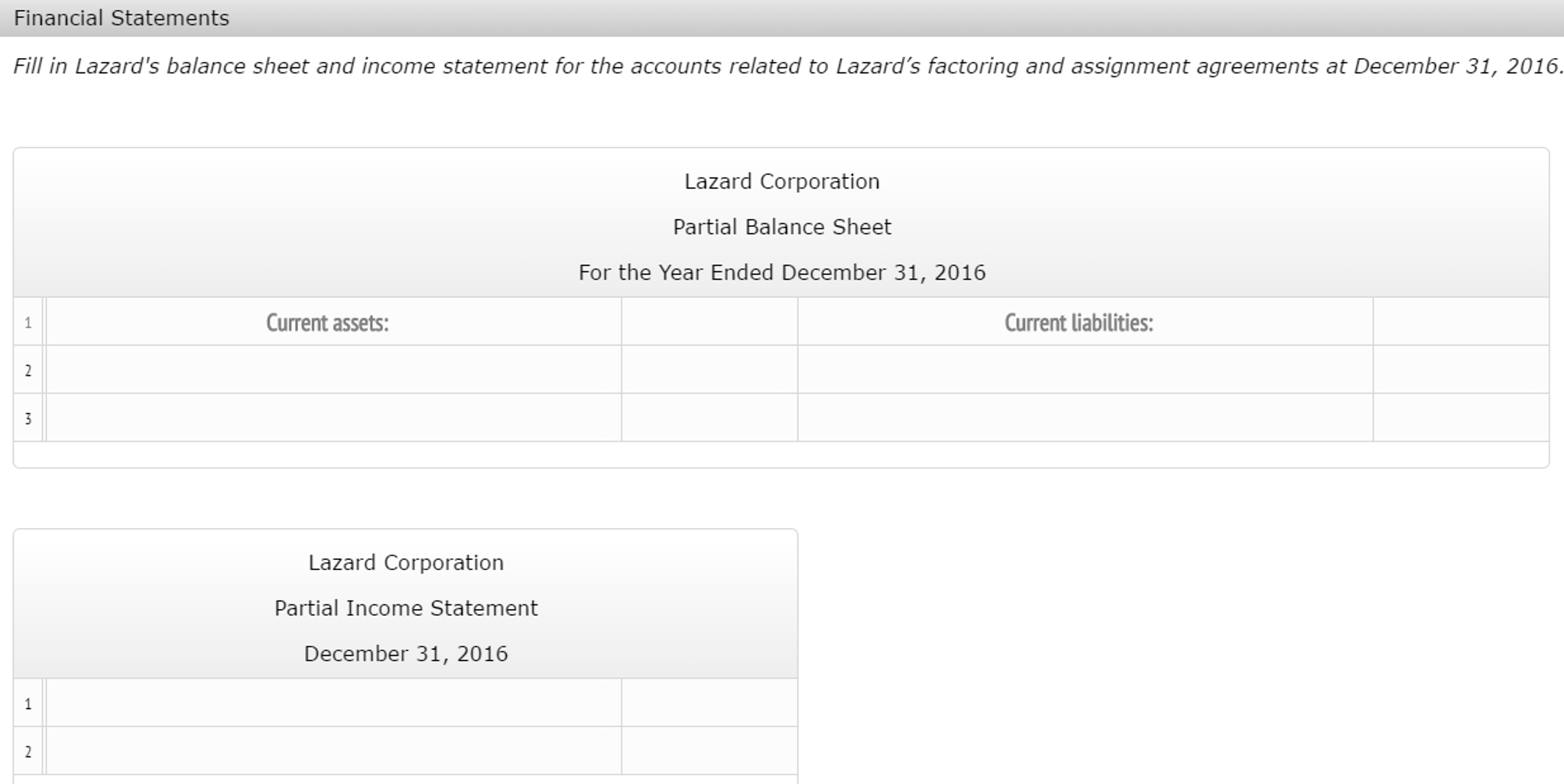

| 2. | How would the accounts related to Lazards factoring and assignment agreements be reported on Lazards year-end financial statements? |

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lazard Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started